Occidental Petroleum 2002 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2002 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THUMS

Occidental purchased THUMS, the field contractor of the Long Beach Unit, an

oil and gas production unit offshore Long Beach, California, in 2000. It is part

of the Wilmington field, which is the fourth largest oil field in the

continental U.S. At year-end 2002, net production from the THUMS oil property

was averaging 26,000 barrels per day.

Occidental completed construction of a 45-megawatt gas-fired power plant

and began generating electricity in December 2002. Previously, the oil field's

operations depended on the local utility for power to operate electric pumps

critical to production. The electricity supply from the utility was

interruptible, meaning that when power was in short supply, service could be

temporarily discontinued. Electricity is the largest component of operating

costs for this field and by securing a reliable source of electricity, it will

be possible to reduce overall field production costs.

GULF OF MEXICO

In July 2000, Occidental completed agreements with respect to two

transactions involving its interests on the Continental Shelf in the Gulf of

Mexico (GOM) and the proceeds were used to reduce debt.

Occidental has a one-third interest in the deep water Horn Mountain oil

field, which is its primary asset in the GOM. BP p.l.c. (BP) is the operator.

The discovery well, which was drilled to a depth of nearly 14,000 feet, is

located about 60 miles off the Louisiana-Mississippi coast in 5,400 feet of

water.

Development work was completed on time and under budget and the field began

production in November 2002, with a year-end exit rate of approximately 9,000

net BOE per day. Net proved reserves are approximately 36 million BOE.

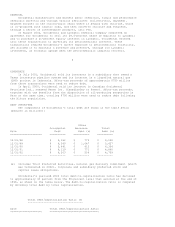

HUGOTON

Occidental owns a large concentration of gas reserves, production interests

and royalty interests in the Hugoton area of Kansas and Oklahoma. The Hugoton

field is the largest natural gas field discovered to date in North America.

Occidental's Hugoton operations produced 148,000 Mcf of natural gas and 3,000

barrels of oil per day in 2002.

MIDDLE EAST

DOLPHIN PROJECT

In 2002, Occidental purchased a 24.5-percent interest in Dolphin Energy

Limited (DEL), the operator of the Dolphin Project. The Dolphin Project, which

is expected to cost its owners $3.5 billion in total, consists of two parts: (1)

a development and production sharing agreement with Qatar to develop and produce

natural gas and condensate in Qatar's North Field; and (2) the rights for DEL to

build, own and operate a 260-mile-long, 48-inch export pipeline to transport 2

billion cubic feet per day of dry natural gas from Qatar to markets in the UAE

for a period of 25 years. The pipeline will have capacity to transport up to 3.2

billion cubic feet per day, which will allow for additional business development

projects. DEL is currently negotiating contracts to market the gas with users in

the UAE. Construction on the upstream production and processing facilities and

the pipeline is expected to begin in 2003 and production is scheduled to begin

in early 2006. The Dolphin partners anticipate securing project financing.

Occidental has not recorded any revenue or production costs for this project and

no oil and gas reserves have been included in its 2002 proved oil and gas

reserves.

OMAN

Occidental's Oman business centers on its 300-million barrel discovery in

Block 9, in which it has a 65-percent working interest. Occidental has produced

more than 150 million gross barrels from the Block, most of it from the Safah

field.

Net production to Occidental averaged 13,000 barrels of oil per day in the

fourth quarter.

Occidental uses multi-lateral horizontal wells to increase production and

recovery rates and to minimize the number of wells needed. Today, 60 percent of

Occidental's production in Oman relies on horizontal wells. A new waterflood

program is currently under way at Safah that will enhance production and improve