Occidental Petroleum 2002 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2002 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.12/31/98 66%

12/31/99 61%

12/31/00 57%

12/31/01 46%

12/31/02 43%

-------------------- -------------------------------

BUSINESS REVIEW - OIL AND GAS

Occidental's overall performance during the past several years reflects the

successful implementation of its oil and gas business strategy, beginning with

the 1998 $3.5 billion acquisition of the Elk Hills oil and gas field in

California. The Elk Hills acquisition was followed in April 2000 by the

purchases of both Altura Energy in Texas for $3.6 billion and the THUMS property

in Long Beach, California for $68 million.

At the end of 2002, these three assets made up 69 percent of Occidental's

worldwide proven oil reserves and 55 percent of its proven gas reserves. On a

barrel of oil equivalent (BOE) basis, they accounted for 67 percent of

Occidental's worldwide reserves. In 2002, the combined production from these

assets averaged approximately 290,000 BOE per day, which represents 56 percent

of Occidental's total worldwide production. These businesses also contributed

approximately 60 percent of oil and gas segment earnings and 85 percent of oil

and gas segment free cash flow.

ELK HILLS

Occidental operates the Elk Hills oil and gas field in the southern portion

of California's San Joaquin Valley with an approximate 78-percent interest. The

field reserves are among the top ten in the lower 48 United States and the field

is the largest producer of gas in California. Production increased in 2002 to

approximately 101,000 BOE per day from approximately 99,000 BOE per day in 2001.

Elk Hills has generated total net cash flow, after subtracting $696 million of

capital expenditures, of approximately $2.8 billion since Occidental acquired

the asset in early 1998.

Since the date of acquisition, Occidental has replaced 109 percent of its

total Elk Hills oil and gas production of 173 million BOE. At the end of 2002,

the property still had an estimated 440 million BOE of proved reserves, compared

to the 425 million BOE that were recorded at the time of the acquisition.

PERMIAN BASIN

Occidental integrated the Altura properties with its previously existing

Permian Basin properties in Southwest Texas and Southeast New Mexico. Since the

acquisition, the former Altura properties have generated more than $1.8 billion

in total net cash flow, after subtracting capital expenditures of approximately

$400 million.

One element of Occidental's strategy in the Permian Basin is to acquire

producing properties at attractive prices that offer synergies with its existing

operations. In 2002, Occidental made a number of small acquisitions in the

Permian Basin for a total purchase price of $73 million. These acquisitions

accounted for total proven reserve additions of 53.3 million BOE for an average

cost of $1.36 per BOE.

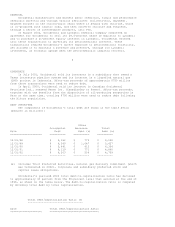

Total Permian oil and gas production averaged 164,000 BOE per day in 2002

compared to 162,000 BOE per day in 2001. Net Permian oil production averaged

142,000 barrels per day in 2002 compared to 137,000 barrels per day in 2001.

Occidental is the largest oil producer in Texas.

Approximately 50 percent of Occidental's Permian Basin production is

reliant upon the application of carbon dioxide (CO2) flood technology, an

enhanced oil recovery technique, a portion of which is supplied by the Bravo

Dome CO2 unit. This involves injecting CO2 into oil reservoirs where it acts as

a solvent, causing the oil to flow more freely so it can be pumped to the

surface. The size of these CO2 flood operations makes Occidental a world leader

in the development and application of this technology. In 2002, Occidental

implemented two large CO2 projects, one in the Cogdell field in West Texas and

the other in Hobbs, New Mexico. When these two projects become fully

operational, they are expected to add approximately 10,000 BOE per day to

Occidental's production.

10