Occidental Petroleum 2002 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2002 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CHEMICAL

Occidental manufactures and markets basic chemicals, vinyls and performance

chemicals directly and through various affiliates (collectively, OxyChem).

OxyChem focuses on the chlorovinyls chain where it begins with chlorine, which

is co-produced with caustic soda, and then converts chlorine and ethylene,

through a series of intermediate products, into PVC.

In August 2002, Occidental and Lyondell Chemical Company completed an

agreement for Occidental to sell its 29.5-percent share of Equistar to Lyondell

and to purchase a 21-percent equity interest in Lyondell. Occidental entered

into these transactions to diversify its petrochemicals interest. These

transactions reduced Occidental's direct exposure to petrochemicals volatility,

yet allowed it to maintain a presence and preserve, through its Lyondell

investment, an economic upside when the petrochemicals industry recovers.

9

CORPORATE

In July 2001, Occidental sold its interests in a subsidiary that owned a

Texas intrastate pipeline system and its interest in a liquefied natural gas

(LNG) project in Indonesia. After-tax proceeds of approximately $750 million

from these transactions were used to reduce debt.

In April 2000, Occidental sold its interest in Canadian Occidental

Petroleum Ltd., renamed Nexen Inc. (CanadianOxy or Nexen). After-tax proceeds,

together with tax benefits from the disposition of oil-producing properties in

Peru at the same time, totaling $700 million were used to reduce debt following

the Altura acquisition.

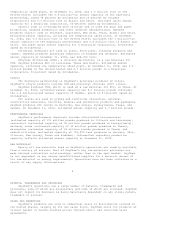

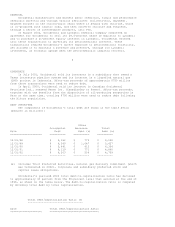

DEBT STRUCTURE

The components of Occidental's total debt are shown in the table below

(amounts in millions):

Other

Occidental Recourse Total

Date Debt Debt (a) Debt (a)

==================== ========== ========== ==========

12/31/98 $ 5,382 $ 776 $ 6,158

12/31/99 $ 4,380 $ 1,047 $ 5,427

12/31/00 $ 5,441 $ 913 $ 6,354

12/31/01 $ 4,119 $ 771 $ 4,890

12/31/02 $ 4,203 $ 556 $ 4,759

-------------------- ---------- ---------- ----------

(a) Includes Trust Preferred Securities, natural gas delivery commitment (which

was terminated in 2002), corporate and subsidiary preferred stock and

capital lease obligations.

Occidental's year-end 2002 total debt-to-capitalization ratio has declined

to approximately 43 percent from the 66-percent level that existed at the end of

1998, as shown in the table below. The debt-to-capitalization ratio is computed

by dividing total debt by total capitalization.

Total Debt/Capitalization Ratio (%)

-----------------------------------

Date Total Debt/Capitalization Ratio

==================== ===============================