Occidental Petroleum 2002 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2002 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEGMENT OPERATIONS

The following discussion of Occidental's two operating segments and

corporate items should be read in conjunction with Note 15 to the Consolidated

Financial Statements.

Segment earnings exclude interest income, interest expense, unallocated

corporate expenses, discontinued operations and cumulative effect of changes in

accounting principles, but include gains and losses from dispositions of segment

assets and results from equity investments.

Foreign income and other taxes and certain state taxes are included in

segment earnings based on their operating results. U.S. federal income taxes are

not allocated to segments except for amounts in lieu thereof that represent the

tax effect of operating charges resulting from purchase accounting adjustments,

and the tax effects resulting from major, infrequently occurring transactions,

such as asset dispositions and legal settlements that relate to segment results.

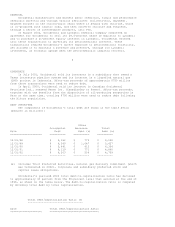

The following table sets forth the sales and earnings of each operating

segment and corporate items:

SEGMENT OPERATIONS

In millions

For the years ended December 31, 2002 2001 2000

================================ ======== ======== ========

SALES

Oil and Gas $ 4,634 $ 5,134 $ 4,875

Chemical 2,704 2,968 3,629

-------- -------- --------

$ 7,338 $ 8,102 $ 8,504

================================ ======== ======== ========

EARNINGS(LOSS)

Oil and Gas (a) $ 1,707 $ 2,845 $ 2,417

Chemical (a) 275 (399) 141

-------- -------- --------

1,982 2,446 2,558

Unallocated corporate items

Interest expense, net (b) (253) (272) (372)

Income taxes (c) (364) (359) (853)

Trust preferred distributions

and other (47) (56) (67)

Other (c, d) (155) (580) 291

-------- -------- --------

Income from continuing

operations 1,163 1,179 1,557

Discontinued operations, net (79) (1) 13

Cumulative effect of changes in

accounting principles, net (95) (24) --

-------- -------- --------

Net Income $ 989 $ 1,154 $ 1,570

================================ ======== ======== ========

(a) Segment earnings in 2002 were affected by $402 million of net credits

allocated, comprising $1 million of charges and $403 million of credits in

oil and gas and chemical, respectively. The chemical amount includes a $392

million credit for the sale of the Equistar investment. Segment earnings in

2001 were affected by $14 million of net charges allocated, comprising $56

million of charges and $42 million of credits in oil and gas and chemical,

respectively. The oil and gas amount includes a charge for the sale of the

Indonesian Tangguh LNG project. The chemical amount includes credits for

the sale of certain chemical operations. Segment earnings in 2000 were

affected by $25 million from net charges allocated, comprising $32 million

of charges and $7 million in credits in oil and gas and chemical,

respectively. The oil and gas amount includes a charge for the GOM