Occidental Petroleum 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

[X] Annual Report Pursuant to Section 13 or 15(d) [ ] Transition Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934 of the Securities Exchange Act of 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2002 FOR THE TRANSITION PERIOD FROM ____ TO ____

COMMISSION FILE NUMBER 1-9210

OCCIDENTAL PETROLEUM CORPORATION

(Exact name of registrant as specified in its charter)

State or other jurisdiction of incorporation or organization Delaware

I.R.S. Employer Identification No. 95-4035997

Address of principal executive offices 10889 Wilshire Blvd., Los Angeles, CA

Zip Code 90024

Registrant's telephone number, including area code (310) 208-8800

Securities registered pursuant to Section 12(b) of the Act:

TITLE OF EACH CLASS NAME OF EACH EXCHANGE ON WHICH REGISTERED

10 1/8% Senior Debentures due 2009 New York Stock Exchange

9 1/4% Senior Debentures due 2019 New York Stock Exchange

Oxy Capital Trust I 8.16% Trust Originated Preferred Securities New York Stock Exchange

Common Stock New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant (1) has filed all reports required

to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

[X] YES [ ] NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405

of Regulation S-K is not contained herein, and will not be contained, to the

best of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. [X]

Indicate by check mark whether the registrant is an accelerated filer (as

defined in Exchange Act Rule 12b-2). [X] YES [ ] NO

The aggregate market value of the voting stock held by nonaffiliates of the

registrant was approximately $11.3 billion, computed by reference to the closing

price on the New York Stock Exchange composite tape of $29.99 per share of

Common Stock on June 28, 2002. Shares of Common Stock held by each executive

officer and director have been excluded from this computation in that such

persons may be deemed to be affiliates. This determination of affiliate status

is not a conclusive determination for other purposes.

At January 31, 2003, there were approximately 377,933,436 shares of Common Stock

outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Table of contents

-

Page 1

... or organization No. offices including area code Delaware 95-4035997 10889 Wilshire Blvd., Los Angeles, CA 90024 (310) 208-8800 Securities registered pursuant to Section 12(b) of the Act: TITLE OF EACH CLASS 10 1/8% Senior Debentures due 2009 9 1/4% Senior Debentures due 2019 Oxy Capital Trust... -

Page 2

...'s definitive Proxy Statement, filed in connection with its April 25, 2003, Annual Meeting of Stockholders, are incorporated by reference into Part III. TABLE OF CONTENTS PAGE PART I ITEMS 1 AND 2 Business and Properties...General...Developments...Oil and Gas Operations...Chemical Operations... -

Page 3

... (subsidiaries). Occidental's executive offices are located at 10889 Wilshire Boulevard, Los Angeles, California 90024; telephone (310) 208-8800. GENERAL Occidental's principal businesses constitute two industry segments. The oil and gas segment explores for, develops, produces and markets crude oil... -

Page 4

... through enhanced oil recovery projects and making strategic acquisitions. Occidental focuses in its core areas of the United States, the Middle East and Latin America. CHEMICAL OPERATIONS GENERAL Occidental manufactures and markets basic chemicals, vinyls and performance chemicals directly and... -

Page 5

... gross annual capacity for a Brazilian corporation, 50-percent owned by Occidental). Caustic soda is co-produced with chlorine and is used for pulp and paper production, alumina production and other chemical manufacturing. OxyChem produces caustic soda in Delaware, Louisiana, New York, Texas, Brazil... -

Page 6

...SEC; Other SEC filings, including Forms 3, 4 and 5; and Corporate-governance information, including its corporate-governance guidelines, board-committee charters and Code of Business Conduct. ITEM 3 LEGAL PROCEEDINGS For information regarding lawsuits, claims, commitments, contingencies and related... -

Page 7

... Vice President - Corporate Development. Executive Vice President, General Counsel and Secretary since 1993. Executive Vice President - Human Resources since 1994. Executive Vice President since 1984; 1988-2002, Director; President and Chief Executive Officer of Occidental Chemical Corporation... -

Page 8

... 10, 2002, a dividend of $.26 per share was declared on the common stock, payable on April 15, 2003 to stockholders of record on March 10, 2003. The declaration of future cash dividends is a business decision made by the Board of Directors from time to time, and will depend on Occidental's financial... -

Page 9

... this report, the term "Occidental" refers to Occidental Petroleum Corporation and/or one or more entities in which it owns a majority voting interest (subsidiaries). Occidental is divided into two segments: oil and gas and chemical. 2002 BUSINESS ENVIRONMENT OIL AND NATURAL GAS INDUSTRY Oil and gas... -

Page 10

...gas operations are located in California, Kansas, Oklahoma, New Mexico and Texas domestically and in Colombia, Ecuador, Oman, Pakistan, Qatar, Russia, United Arab Emirates and Yemen internationally. Occidental also has interests in several other countries. The asset mix within each of the core areas... -

Page 11

... from these transactions were used to reduce debt. In April 2000, Occidental sold its interest in Canadian Occidental Petroleum Ltd., renamed Nexen Inc. (CanadianOxy or Nexen). After-tax proceeds, together with tax benefits from the disposition of oil-producing properties in Peru at the same time... -

Page 12

... of Occidental's total worldwide production. These businesses also contributed approximately 60 percent of oil and gas segment earnings and 85 percent of oil and gas segment free cash flow. ELK HILLS Occidental operates the Elk Hills oil and gas field in the southern portion of California's San... -

Page 13

... Beach, California, in 2000. It is part of the Wilmington field, which is the fourth largest oil field in the continental U.S. At year-end 2002, net production from the THUMS oil property was averaging 26,000 barrels per day. Occidental completed construction of a 45-megawatt gas-fired power plant... -

Page 14

... Core Venture Two consortium, which is proposing to invest in the Red Sea area to help the Kingdom identify and develop new natural gas reserves for the domestic market. An initial agreement was signed with the Kingdom on June 3, 2001. OTHER EASTERN HEMISPHERE PAKISTAN Occidental holds oil and gas... -

Page 15

... In Russia, Occidental owns 50 percent of a joint venture company, Vanyoganneft, that operates in the western Siberian oil basin. Production for 2002 was approximately 27,000 BOE per day, net to Occidental. LATIN AMERICA COLOMBIA Occidental has a 35-percent net share of production and is operator of... -

Page 16

... the steam and electric power requirements for the Taft, Louisiana chlor-alkali plant at a lower cost than if the plant were to generate its own steam and purchase electricity from a public utility. It sells excess power in the merchant market. VINYLS 2002 saw improvement in North American PVC resin... -

Page 17

...-driven drilling activity, giving rise to expectations of steeper production decline rates in 2003. Robust prices in 2003 could lead to a new upsurge in gas-related drilling to address longer-term supply uncertainties. 13 CHEMICAL The performance of the chemical business is difficult to forecast... -

Page 18

... dispositions and legal settlements that relate to segment results. The following table sets forth the sales and earnings of each operating segment and corporate items: SEGMENT OPERATIONS In millions For the years ended December 31 SALES Oil and Gas Chemical 2002 ======== 2001 ======== 2000... -

Page 19

... Other Total Natural Gas (MMCF) California Hugoton Permian U.S. Other Total LATIN AMERICA Crude oil & condensate (MBBL) Colombia Ecuador Total MIDDLE EAST AND OTHER EASTERN HEMISPHERE Crude oil & condensate (MBBL) Oman Pakistan Qatar Yemen Total Natural Gas (MMCF) Pakistan Total 2002 4,634 1,707... -

Page 20

... SUBSIDIARIES (MBOE) Less: Colombia-minority interest Add: Russia-Occidental net interest Add: Yemen-Occidental net interest TOTAL WORLDWIDE PRODUCTION AVERAGE SALES PRICES CRUDE OIL PRICES ($ per barrel) U.S. Latin America Middle East and Other Eastern Hemisphere (e) Total consolidated subsidiaries... -

Page 21

... is meant to provide useful information to investors interested in comparing Occidental's earnings performance between periods. Core earnings is not considered to be an alternative to operating income in accordance with generally accepted accounting principles. Product volumes produced at former... -

Page 22

... investment, the pre-tax gain of $61 million on the partial sale of the Gulf of Mexico assets, the pre-tax gain of $63 million on the receipt of contingency payments related to a prior-year sale of a Dutch North Sea subsidiary and the pre-tax gain of $34 million on the sale of the Durez business. -

Page 23

... the write-down of certain oil and gas investments and the chemical intermediate businesses. Exploration expense in 2002 includes a $33 million write-off for Lost Hills leases and a $25 million write-off for the Thunderball deep gas well, both in California. Exploration expense in 2001 includes... -

Page 24

...the three years also includes charges for employee benefit plans and other items. INVESTING ACTIVITIES In millions 2002 1,696) 2001 651) 2000 3,044) NET CASH USED The 2002 amount includes approximately $349 million for a 24.5-percent interest in DEL, the operator of the Dolphin Project. The... -

Page 25

... majeure, upstream expropriation events, bankruptcy of the pipeline company or its parent company, abandonment of the project, termination of an investment guarantee agreement with Ecuador, or certain defaults by Occidental. This advance tariff would be used by the pipeline company to service or... -

Page 26

... project the 2002. As will debt. ELK HILLS POWER Occidental and Sempra Energy (Sempra) each has a 50-percent interest in Elk Hills Power LLC, a limited liability company that is currently constructing a gas-fired, power-generation plant in California. Occidental accounts for this investment using... -

Page 27

... meet certain criteria to qualify for the program. Under this program, Occidental serves as the collection agent with respect to the receivables sold. An interest in new receivables is sold as collections are made from customers. Fees and expenses under this program are included in selling, general... -

Page 28

... $360 million receivable sale amount is reflected in the 2006-2007 year column since Occidental could finance the amount with its committed credit line, which becomes due in 2006, if the program is terminated. COMMITMENTS At December 31, 2002, commitments for major capital expenditures during 2003... -

Page 29

... 2001, reflects higher product prices during the fourth quarter of 2002 versus 2001. The increase in receivables from joint ventures, partnerships and other is due to higher mark-to-market adjustments on derivative financial instruments in the marketing and trading group. The increase in inventories... -

Page 30

... of preferred stock to a financial institution. Occidental retains all common shares of the subsidiary and elects the majority of the directors. The subsidiary is the holding company for a number of international subsidiaries of Occidental. In the event that the subsidiary fails to pay preferred... -

Page 31

... two blocks from the government of Pakistan for approximately $72 million. DISPOSITION OF CHROME AND VULCAN In the fourth quarter of 2002, Occidental sold its chrome business at Castle Hayne, North Carolina for $25 million and its calendering operations (Vulcan) for a $6 million note receivable. In... -

Page 32

...acquisition of THUMS, the field contractor of the Long Beach Unit, an oil and gas production unit, for approximately $68 million. ALTURA ACQUISITION On April 19, 2000, Occidental completed its acquisition of all of the common interest in Altura, the largest oil producer in Texas. The acquisition was... -

Page 33

... cash from operations and proceeds from existing credit facilities as necessary. DERIVATIVE ACTIVITIES AND MARKET RISK GENERAL Occidental's market risk exposures relate primarily to commodity prices and, to a lesser extent, interest rates and foreign currency exchange rates. Occidental periodically... -

Page 34

... periodically uses different types of derivative instruments to achieve the best prices for oil and gas. Derivatives are also used by Occidental to reduce its exposure to price volatility and mitigate fluctuations in commodity-related cash flows. Occidental enters into low-risk marketing and trading... -

Page 35

.... COMMODITY HEDGES On a limited basis, Occidental uses cash-flow hedges for the sale of crude oil and natural gas. Crude oil cash-flow hedges were executed for approximately 20 percent and 29 percent of total U.S. oil production in 2002 and 2001, respectively. Natural gas cash-flow hedges were... -

Page 36

...levels necessary for operating purposes. Generally, 24 international crude oil sales are denominated in U.S. dollars. Additionally, all of Occidental's oil and gas foreign entities have the U.S. dollar as the functional currency. However, in one foreign chemical subsidiary where the local currency... -

Page 37

... changes in how revenue from energy trading is recorded. Occidental has two major types of oil and gas revenues: (1) Revenues from its equity production; and (2) revenues from the sale of oil and gas produced by other companies, but purchased and resold by Occidental, referred to as revenue from... -

Page 38

... AND RELATED MATTERS Occidental Petroleum Corporation (OPC) and certain of its subsidiaries have been named in a substantial number of lawsuits, claims and other legal proceedings. These actions seek, among other things, compensation for alleged personal injury, breach of contract, property damage... -

Page 39

... and Elk Hills Power, the guarantees on debt and other commitments relating to the Ecuador pipeline and the residual value guarantee of the LaPorte, Texas VCM plant operating lease. The remaining $100 million relates to various indemnities and guarantees provided to third parties. Occidental has... -

Page 40

... in some cases, compensation for alleged property damage, punitive damages and civil penalties. Occidental manages its environmental remediation efforts through a wholly owned subsidiary, Glenn Springs Holdings, Inc. (GSH), which reports its results directly to Occidental's corporate management. The... -

Page 41

...-- certain oil and gas properties in the southwestern United States, a chemical plant in Louisiana, and a phosphorous recovery operation in Tennessee -- account for 62 percent of the reserves associated with these facilities. CLOSED OR SOLD FACILITIES There are 44 sites formerly owned or operated by... -

Page 42

..., and a former chemical plant in West Virginia. ENVIRONMENTAL COSTS Occidental's costs, some of which may include estimates, relating to compliance with environmental laws and regulations, are shown below for each segment: In millions OPERATING EXPENSES Oil and Gas Chemical 2002 ======== 2001... -

Page 43

... of Occidental's management. OIL AND GAS PROPERTIES Occidental uses the successful efforts method to account for its oil and gas properties. Under this method, costs of acquiring properties, costs of drilling successful exploration wells and development costs are capitalized. Annual lease rentals... -

Page 44

... change the estimated useful lives of Occidental's chemical plants include higher or lower product prices, feedstock costs, energy prices, environmental regulations, competition and technological changes. Occidental is required to perform impairment tests on its assets whenever events or changes in... -

Page 45

... with negotiated or prescribed allocations; Category 2: Oil and gas joint ventures wherein each joint venture partner pays its proportionate share of remedial cost; and Category 3: Contractual arrangements typically relating to purchases and sales of property wherein the parties to the transaction... -

Page 46

... based on new information, changes in laws or regulations, changes in management's plans or intentions, the outcome of legal proceedings, settlements or other factors. 30 ADDITIONAL ACCOUNTING CHANGES Listed below are additional changes in accounting principles applicable to Occidental. FIN NO... -

Page 47

... future abandonment and removal costs of offshore production platforms, net of salvage value, over their operating lives. For onshore oil and gas production, Occidental estimates that the salvage value of the oil and 31 gas properties generally will approximate the dismantlement, restoration and... -

Page 48

... included in cost of sales on Occidental's Statements of Operations totaled $245 million in 2000. SFAS NO. 140 In the fourth quarter of 2000, Occidental adopted the disclosure provisions of SFAS No. 140, "Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities... -

Page 49

... to publicly update or revise any forward-looking statements, whether as a result of new information or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed might not occur. REPORT OF MANAGEMENT The management of Occidental Petroleum Corporation is... -

Page 50

..., the financial position of Occidental Petroleum Corporation and subsidiaries as of December 31, 2002 and 2001, and the results of their operations and their cash flows for each of the years in the three-year period ended December 31, 2002, in conformity with accounting principles generally accepted... -

Page 51

... share amounts Occidental Petroleum Corporation and Subsidiaries Assets at December 31 CURRENT ASSETS Cash and cash equivalents Trade receivables, net of reserves of $28 in 2002 and $35 in 2001 Receivables from joint ventures, partnerships and other Inventories Assets held for sale Income tax... -

Page 52

... share amounts Occidental Petroleum Corporation and Subsidiaries Liabilities and Equity at December 31 CURRENT LIABILITIES Current maturities of long-term debt and capital lease liabilities Notes payable Accounts payable Accrued liabilities Dividends payable Obligation under natural gas delivery... -

Page 53

...are an integral part of these financial statements. 38 CONSOLIDATED STATEMENTS OF CASH FLOWS In millions Occidental Petroleum Corporation and Subsidiaries For the years ended December 31 CASH FLOW FROM OPERATING ACTIVITIES Income from continuing operations Adjustments to reconcile income to net... -

Page 54

... financial statements include the accounts of Occidental Petroleum Corporation, entities where it owns a majority voting interest and its undivided interests in oil and gas exploration and production ventures. In these Notes, the term "Occidental" or "the Company" refers to Occidental Petroleum... -

Page 55

... groups. Occidental attempts to conduct its financial affairs so as to mitigate its exposure against such risks and would expect to receive compensation in the event of nationalization. Since Occidental's major products are commodities, significant changes in the prices of oil and gas and chemical... -

Page 56

... the related assets (see Note 16). Occidental uses the successful efforts method to account for its oil and gas properties. Under this method, costs of acquiring properties, costs of drilling successful exploration wells and development costs are capitalized. Annual lease rentals, exploration costs... -

Page 57

... the estimated useful lives of Occidental's chemical plants include higher or lower product prices, feedstock costs, energy prices, environmental regulations, competition and technological changes. Occidental is required to perform impairment tests on its chemical assets whenever events or changes... -

Page 58

... with negotiated or prescribed allocations; Category 2: Oil and gas joint ventures wherein each joint venture partner pays its proportionate share of remedial cost; and Category 3: Contractual arrangements typically relating to purchases and sales of property wherein the parties to the transaction... -

Page 59

... operating lives. Such costs are calculated at unit-of-production rates based upon estimated proved recoverable reserves and are taken into account in determining depreciation, depletion and amortization. For onshore production, Occidental assumes that the salvage value of the oil and gas property... -

Page 60

... DERIVATIVES GENERAL Occidental's results are sensitive to fluctuations in crude oil and natural gas prices. MARKETING AND TRADING OPERATIONS Occidental periodically uses different types of derivative instruments to achieve the best prices for oil and gas. Derivatives are also used by Occidental to... -

Page 61

... at levels necessary for operating purposes. Generally, international crude oil sales are denominated in U.S. dollars. Additionally, all of Occidental's oil and gas foreign entities have the U.S. dollar as the functional currency. However, in one foreign chemical subsidiary where the local currency... -

Page 62

... with Qatar to develop and produce natural gas and condensate in Qatar's North Field; and (2) the rights for DEL to build, own and operate a 260-mile-long, 48-inch export pipeline to transport 2 billion cubic feet per day of dry natural gas from Qatar to markets in the UAE for a period of 25 years... -

Page 63

... interests in these two blocks from the government of Pakistan for approximately $72 million. In the fourth quarter of 2002, Occidental sold its chrome business at Castle Hayne, North Carolina for $25 million and its calendering operations (Vulcan) for a $6 million note receivable. In the third... -

Page 64

... the acquisition of THUMS, the field contractor of the Long Beach Unit, an oil and gas production unit, for approximately $68 million. On April 19, 2000, Occidental completed its acquisition of all of the common interest in Altura, the largest oil producer in Texas. The acquisition was valued at... -

Page 65

...percent interests in joint businesses of approximately equal value, resulting in Occidental owning 100 percent of an oil and gas operation in Ecuador and CanadianOxy owning 100 percent of sodium chlorate operations in Canada and Louisiana. NOTE 4 ASSET WRITE-DOWNS AND ACCOUNTING CHANGES ASSET WRITE... -

Page 66

...has two major types of oil and gas revenues: (1) Revenues from its equity production; and (2) revenues from the sale of oil and gas produced by other companies, but purchased and resold by Occidental, referred to as revenue from trading activities. Both types of sales involve physical deliveries and... -

Page 67

... future abandonment and removal costs of offshore production platforms, net of salvage value, over their operating lives. For onshore oil and gas production, Occidental estimates that the salvage value of the oil and gas properties generally will approximate the dismantlement, restoration and... -

Page 68

...attributed to these reporting units. Occidental now has no remaining goodwill on its financial statements. SFAS NO. 141 In June 2001, the FASB issued SFAS No. 141, "Business Combinations." SFAS No. 141 establishes new standards for accounting and reporting business combinations including eliminating... -

Page 69

... process Finished goods 2002 54 125 -319 ---------498 (7 491 ========== 2001 53 119 -252 ---------424 (10 414 ========== LIFO reserve TOTAL NOTE 6 LONG-TERM DEBT Long-term debt consisted of the following (in millions): Balance at December 31 OCCIDENTAL PETROLEUM CORPORATION 6.75% senior... -

Page 70

... facilities, office space, railcars and tanks, frequently include renewal and/or purchase options and require Occidental to pay for utilities, taxes, insurance and maintenance expense. At December 31, 2002, future net minimum lease payments for capital and operating leases (excluding oil and gas and... -

Page 71

... is leasing a cogeneration facility which was completed in 2002. This facility supplies all the steam and electric power requirements for Occidental's Taft chlor-alkali plant at a lower cost than if the plant were to generate its own steam and purchase electricity from a public utility. An owner... -

Page 72

... in some cases, compensation for alleged property damage, punitive damages and civil penalties. Occidental manages its environmental remediation efforts through a wholly owned subsidiary, Glenn Springs Holdings, Inc. (GSH), which reports its results directly to Occidental's corporate management. The... -

Page 73

... - certain oil and gas properties in the southwestern United States, a chemical plant in Louisiana, and a phosphorous recovery operation in Tennessee -- account for 62 percent of the reserves associated with these facilities. There are 44 sites formerly owned or operated by certain subsidiaries of... -

Page 74

...cases, compensation for alleged property damage, punitive damages and civil penalties; however, Occidental is usually one of many companies in these proceedings and has to date been successful in sharing response costs with other financially-sound companies. With respect to all such lawsuits, claims... -

Page 75

... and Elk Hills Power, the guarantees on debt and other commitments relating to the Ecuador pipeline and the residual value guarantee of the LaPorte, Texas VCM plant operating lease. The remaining $100 million relates to various indemnities and guarantees provided to third parties. Occidental has... -

Page 76

... to Occidental's effective tax rate on income from continuing operations: For the years ended December 31 U.S. federal statutory tax rate Operations outside the United States (a) Benefit from sale of subsidiary stock State taxes, net of federal benefit Other Tax rate provided by Occidental 2002... -

Page 77

... primarily as a result of unremitted earnings of consolidated subsidiaries, as it is Occidental's intention, generally, to reinvest such earnings permanently. The discontinued operations include an income tax benefit of $18 million in 2002, income tax expense of $3 million in 2001 and income... -

Page 78

... the purposes of further grants upon the effective date of the 1995 Incentive Stock Plan. The 1995 Incentive Stock Plan, as amended, provided for the grant of awards in the form of options, SARs, performance stock or restricted stock to salaried employees of Occidental or persons who have agreed to... -

Page 79

.... In 2002, rights to receive 923,224 shares were awarded at a weighted-average grant-date value of $26.73. RESTRICTED STOCK AWARDS Pursuant to the 2001 Incentive Compensation Plan and the 1995 Incentive Stock Plan, certain executives have been awarded Occidental restricted common stock at the... -

Page 80

...; and expected lives of 3.5, 5 and 5 years. These grants have limitations on transferability. In the case of executive management, such options may not be exercised for approximately two months of each calendar quarter. The use of short-term volatility measures as a proxy for long-term volatility... -

Page 81

...to-market adjustments Minimum pension liability adjustments Unrealized gains on securities TOTAL 2002 56) (26) (10) 65 27) ========== 2001 61) (20) (5 86) ========== 60 NOTE 12 TRUST PREFERRED SECURITIES In January 1999, Oxy Capital Trust I, a wholly-owned subsidiary of Occidental, issued... -

Page 82

... 31, 2002, 18,716,554 Trust Preferred Securities and 649,485 Common Securities were outstanding. 61 NOTE 13 RETIREMENT PLANS AND POSTRETIREMENT BENEFITS Occidental has various defined benefit and defined contribution retirement plans for its salaried, domestic union and nonunion hourly, and... -

Page 83

...dental benefits and life insurance coverage for certain active, retired and disabled employees and their eligible dependents. The benefits generally are funded by Occidental as the benefits are paid during the year. The cost of providing these benefits is based on claims filed and insurance premiums... -

Page 84

... of 25 percent as of December 31, 2001. Occidental bases its discount rate for foreign pension plans on rates indicative of government and or investment grade corporate debt in the applicable country. The average rate of increase in future compensation levels ranged from a low of 3 percent to a high... -

Page 85

.... Occidental's sales to certain chemical partnerships at market-related prices, in which it has investments, were $105 million, $68 million and $217 million, in 2002, 2001 and 2000, respectively. The following table presents Occidental's proportional interest in the summarized financial information... -

Page 86

...Texas. The cogeneration facility supplies all of the steam and electric power requirements to Occidental's Ingleside chlor-alkali plant and OxyMar's VCM plant at less cost than if these facilities were to produce their own steam and purchase electric power from a public utility. At December 31, 2002... -

Page 87

... project debt. Occidental and Sempra Energy (Sempra) each has a 50-percent interest in Elk Hills Power LLC, a limited liability company that is currently constructing a gas-fired, power-generation plant in California. Occidental accounts for this investment using the equity method. In January 2002... -

Page 88

66 INDUSTRY SEGMENTS In millions YEAR ENDED DECEMBER 31, 2002 Net sales Oil and Gas =========== Chemical =========== Corporate =========== Total =========== $ 4,634 (a) $ 2,704 (b 2,181 (474 128) 403 $ 7,338 =========== Pretax operating profit(loss) (c) Income taxes Discontinued ... -

Page 89

... for the years ended December 31: Benefit (Charge) In millions CORPORATE Gain on sale of CanadianOxy investment Loss on sale of pipeline-owning entity (a) Discontinued operations, net (a) Settlement of state tax issue Tax effect of pre-tax items Changes in accounting principles, net (a 2002 79... -

Page 90

... interest of $12 million in 2002, $5 million in 2001 and $3 million in 2000. GEOGRAPHIC AREAS In millions For the years ended December 31 United States Qatar Yemen Colombia Oman Pakistan Canada Russia Ecuador United Arab Emirates Other Foreign Total Net sales (a 2002 2001 2000 5,198 566 422... -

Page 91

... of Occidental's oil and gas producing activities, which exclude oil and gas trading activities and items such as asset dispositions, corporate overhead and interest, were as follows (in millions): FOR THE YEAR ENDED DECEMBER 31, 2002 Consolidated Subsidiaries Middle East and Other United Latin... -

Page 92

... results of operations for equity investees in Russia and Yemen, partially offset by minority interest for a Colombian affiliate. 71 RESULTS PER UNIT OF PRODUCTION (Unaudited) Consolidated Subsidiaries Middle East and Other United Latin Eastern States America Hemisphere Total Other... -

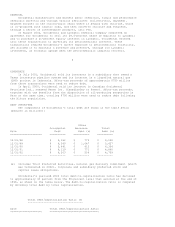

Page 93

... subject to volumetric production payments for the years 2002, 2001 and 2000, respectively. 72 2002 QUARTERLY FINANCIAL DATA (Unaudited) In millions, except per-share amounts Occidental Petroleum Corporation and Subsidiaries Three months ended Segment net sales Oil and gas Chemical MARCH 31... -

Page 94

... net of tax gain related to the sale of the investment in Equistar. 73 2001 QUARTERLY FINANCIAL DATA (Unaudited) In millions, except per-share amounts Occidental Petroleum Corporation and Subsidiaries Three months ended Segment net sales Oil and gas Chemical Net sales MARCH 31 ========== JUNE... -

Page 95

... discoveries Purchases of proved reserves Sales of proved reserves Production BALANCE AT DECEMBER 31, 2002 (B PROVED DEVELOPED RESERVES December 31, 1999 Consolidated Subsidiaries Middle East and Other United Latin Eastern States America Hemisphere Total Other Interests(a Total Worldwide... -

Page 96

...discoveries Purchases of proved reserves Sales of proved reserves Production (a BALANCE AT DECEMBER 31, 2002 PROVED DEVELOPED RESERVES December 31, 1999 Consolidated Subsidiaries Middle East and Other United Latin Eastern States America Hemisphere(c) Total Other Interests(b Total Worldwide... -

Page 97

... NET CASH FLOWS In millions AT DECEMBER 31, 2002 Future cash flows Future costs Production costs and other operating expenses Development costs (b) Consolidated Subsidiaries Middle East and Other United Latin Eastern States America Hemisphere Total Other Interests(a $ 46,806 $ 3,407... -

Page 98

... 31, 2002, Occidental's net productive and dry-exploratory and development wells completed. 2002 Oil -- Exploratory Development Gas -- Exploratory Development Dry -- Exploratory Development Consolidated Subsidiaries Middle East and Other United Latin Eastern States America Hemisphere Total... -

Page 99

... table sets forth, as of December 31, 2002, Occidental's participation in exploratory and development wells being drilled. Wells at December 31, 2002 Exploratory and development wells -- Gross Net Consolidated Subsidiaries Middle East and Other United Latin Eastern States America Hemisphere... -

Page 100

... Natural Gas (MMCF) California Hugoton Permian Other TOTAL Latin America Crude oil (MBL) Colombia Ecuador TOTAL Middle East and Other Eastern Hemisphere Crude oil (MBL) Oman Pakistan Qatar Yemen TOTAL Natural Gas (MMCF) Pakistan Barrels of Oil Equivalent (MBOE Consolidated subsidiaries Colombia... -

Page 101

...Occidental's directors appearing under the caption "Election of Directors" in Occidental's definitive proxy statement filed in connection with its April 25, 2003, Annual Meeting of Stockholders (the "2003 Proxy Statement"). See also the list of Occidental's executive officers and related information... -

Page 102

... Certain Beneficial Owners and Management" in the 2003 Proxy Statement. ITEM 13 CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS Not applicable. ITEM 14 CONTROLS AND PROCEDURES Within 90 days before filing this Annual Report, Occidental's Chief Executive Officer and Chief Financial Officer supervised... -

Page 103

...and certain executive officers (filed as Exhibit B to the Proxy Statement of Occidental for its May 21, 1987, Annual Meeting of Stockholders, File No. 1-9210). Occidental Petroleum Corporation Split Dollar Life Insurance Program and Related Documents (filed as Exhibit 10.2 to the Quarterly Report on... -

Page 104

... Occidental Petroleum Corporation Senior Executive Survivor Benefit Plan, dated February 28, 2002 (filed as Exhibit 10.2 to the Quarterly Report on Form 10-Q of Occidental for the quarterly period ended March 31, 2002, File No. 1-9210). Occidental Petroleum Corporation 1995 Incentive Stock Plan, as... -

Page 105

... fiscal year ended December 31, 1997, File No. 1-9210). Form of Nonqualified Stock Option Agreement under Occidental Petroleum Corporation 1995 Incentive Stock Plan (filed as Exhibit 10.3 to the Current Report on Form 8-K of Occidental, dated January 6, 1999 (date of earliest event reported), filed... -

Page 106

... Plan (December 2002 version). Occidental Petroleum Corporation Deferred Stock Program (filed as Exhibit 10.3 to the Quarterly Report on Form 10-Q of Occidental for the quarterly period ended September 30, 2002, File No. 1-9210). Occidental Petroleum Corporation Executive Incentive Compensation Plan... -

Page 107

... information under Item 9 shall not be deemed to be filed). 2. Current Report on Form 8-K dated November 26, 2002 (date of earliest event reported), filed on November 27, 2002, for the purpose of reporting, under Item 5, Occidental's Dolphin project acquisition and the Rule 10b5-1 plan of Dr. Irani... -

Page 108

... authorized. OCCIDENTAL PETROLEUM CORPORATION March 4, 2003 By: /s/ RAY R. IRANI Ray R. Irani Chairman of the Board of Directors and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf... -

Page 109

... Weisman TITLE ----Director DATE ---March 4, 2003 Director March 4, 2003 Director March 4, 2003 Director March 4, 2003 Director March 4, 2003 89 CERTIFICATIONS I, Ray R. Irani, certify that: 1. I have reviewed this annual report on Form 10-K of Occidental Petroleum Corporation; 2. Based... -

Page 110

...regard to significant deficiencies and material weaknesses. Date: March 4, 2003 /s/ RAY R. IRANI Ray R. Irani Chief Executive Officer 90 I, Stephen I. Chazen, certify that: 1. I have reviewed this annual report on Form 10-K of Occidental Petroleum Corporation; 2. Based on my statement of a the... -

Page 111

... audit committee of registrant's board of directors (or persons performing the equivalent functions): a) all significant deficiencies in the design or operation of internal controls which could adversely affect the registrant's ability to record, process, summarize and report financial data and have... -

Page 112

...the giving of the notice provided for in this Section 2 and on the record date for the determination of stocLholders entitled to vote at such Annual Teeting and (ii) who complies with the notice procedures set forth in this Section 2. In addition to any other applicable requirements, for business to... -

Page 113

... by the Board of Directors or the Chairman of the Board. Written notice of a Special Teeting stating the place, date and hour of the meeting and the purpose or purposes for which the meeting is called shall be given not less than ten nor more than sixty days before the date of the meeting to each... -

Page 114

... in person or by proxy but no proxy shall be voted on or after three years from its date, unless such proxy provides for a longer period. No vote at any meeting of stocLholders need be by written ballot unless the Board of Directors, in its discretion, or the officer of the Corporation presiding at... -

Page 115

... of business on the tenth (10th) day following the day on which such notice of the date of the meeting was mailed or such public disclosure was made, whichever first occurs. In no event shall the public announcement of an adjournment of an Annual Teeting commence a new time period for the giving of... -

Page 116

... person or by another person authorized in accordance with the General Corporation Law of the State of Delaware to act as proxy for the stocLholder, at the Annual Teeting to nominate the persons named in the stocLholder's notice, and (vi) any other information relating to the person that is required... -

Page 117

...of the Board of Directors in the management of the business and affairs of the Corporation. Teetings of any committee may be called by the Chairman of such committee, if there be one, or by any two members thereof other than such Chairman. Notice thereof stating -5- the place, date and hour of the... -

Page 118

.... ARTICLE IV OFFICERS SECTION 1. General. The officers of this Corporation shall be chosen by the Board of Directors and shall be a Chairman of the Board, who shall be the Chief Executive Officer, any number of Vice Chairmen, a President, a Senior Operating Officer, any number of Executive Vice... -

Page 119

...by these By-laws, by the Board of Directors or by the Chairman of the Board of Directors. SECTION 7. Senior Operating Officer. The Senior Operating Officer shall perform such duties and have such powers as are prescribed for Executive Vice Presidents and Vice Presidents under these By-laws and under... -

Page 120

... in the event of his disability or refusal to act, shall perform the duties of the Treasurer, and when so acting, shall have all the powers of and be subject to all the restrictions upon the Treasurer. If required by the Board of Directors, an Assistant Treasurer shall give the Corporation a bond in... -

Page 121

(i) by the Chairman of the Board of Directors, the President or a Vice President and (ii) by the Chief Financial Officer or the Treasurer or an Assistant Treasurer, or the Secretary or an Assistant Secretary of the Corporation, certifying the number of shares owned by him in the Corporation. SECTION... -

Page 122

... by Corporation. Powers of attorney, proxies, waivers of meeting, consents and other instruments relating to securities owned by the Corporation may be executed in the name and on behalf of the Corporation by the Chairman of the Board, or such other officer or officers as the Board of Directors or... -

Page 123

... of the director, officer, employee or agent is proper in the circumstances because he has met the applicable standard of conduct set forth in Section 1 or Section 2 of this Article VIII, as the case may be. Such determination shall be made (i) by the Board of Directors by a majority vote of... -

Page 124

... as a director, officer, employee or agent. The provisions of this Section 4 shall not be deemed to be exclusive or to limit in any way the circumstances in which a person may be deemed to have met the applicable standard of conduct set forth in Sections 1 or 2 of this Article VIII, as the case may... -

Page 125

...officers, and employees or agents, so that any person who is or was a director, officer, employee or agent of such constituent corporation, or is or was serving at the request of such constituent corporation as a director, officer, employee or agent of another corporation, partnership, joint venture... -

Page 126

... of the Plan is to provide a tax-deferred opportunity for key management and highly compensated employees of the Occidental Petroleum Corporation and its Affiliates (as defined below) to accumulate additional retirement income through deferrals of compensation. ARTICLE II DEFINITIONS Whenever the... -

Page 127

...Plan pursuant to Article III. Company. "Company" means Occidental Petroleum Corporation, or any successor thereto, and any Affiliates. Company Management. "Company Management" means the Chairman of the Board, President or any Executive Vice President of Occidental Petroleum Corporation. Compensation... -

Page 128

... of each annual installment by dividing the value of the Participant's Deferral Accounts as of the end of the month preceding the payment date by the number of annual installments remaining to be paid. 1988 DCP. "1988 DCP" means the Occidental Petroleum Corporation 1988 Deferred Compensation Plan. -

Page 129

... Contribution. "Savings Plan Restoration Contribution" means the amount credited to a Participant's Savings Plan Restoration Account pursuant to Section 4.6. SEDCP. "SEDCP" means the Occidental Petroleum Corporation Senior Executive Deferred Compensation Plan under which certain Company executives... -

Page 130

...the Executive Compensation and Human Resources Committee of the Board deems such an event to not be a Termination Event for the purposes of this Plan. Years of Service. "Years of Service" means the number of full years credited to a Participant under the Retirement Plan for vesting purposes. ARTICLE... -

Page 131

...matter which relates solely to such member's interest in the Plan as a Participant. 6 ARTICLE IV PARTICIPATION 4.1 Election to Participate. (a) Deferral Elections. An Eligible Employee may elect to participate in the Plan and elect to defer annual Base Salary and/or Bonus under the Plan by filing... -

Page 132

... paid upon the Participant's termination of employment as set forth in Section 5.1 or 5.2, as the case may be. A Participant may terminate an election for an Early Payment Benefit with respect to Compensation deferred in any future Plan Year by filing a new Deferral Election Form with the Committee... -

Page 133

... for each Plan Year at the same time as the Company contribution for such Plan Year is made to the Savings Plan. A Participant's interest in any credit to his Savings Plan Restoration Account and earnings thereon shall vest at the same rate and at the same time as would have been the case had such... -

Page 134

... sum shall be payable and instead, the Company shall pay to the Participant an annual amount for a period not to exceed three (3) years, determined using the Fractional Method. (d) Disability. If a Participant's employment with the Company terminates prior to Retirement due to a Disability, then the... -

Page 135

...described in the preceding sentence. In comparing the present value of these two alternative benefits, the Committee shall use in each case a discount factor of 8%. (b) If a Participant dies while employed by the Company after becoming eligible for Retirement, the Company will pay to the Participant... -

Page 136

...and any amounts remaining credited to the Participant's Early Payment Date Subaccount(s) shall be paid, together with the other amounts credited to the Participant's Deferral Account, as set forth in Section 5.1 or 5.2, as the case may be. 5.5 Emergency Benefit. In the event that the Committee, upon... -

Page 137

... amount of salary, bonus or other payment otherwise payable in cash to the Participant the amount of any taxes that the Company may be required to withhold with respect to interest or other amounts that the Company credits to a Participant's Deferral Accounts. 5.10 Termination of Employment. For the... -

Page 138

... Participant's probate estate. ARTICLE VII CLAIMS PROCEDURE All applications for benefits under the Plan shall be submitted to: Occidental Petroleum Corporation, Attention: Deferred Compensation Plan Committee, 10889 Wilshire Blvd., Los Angeles, CA 90024. Applications for benefits must be in writing... -

Page 139

...a rate that is less than the lesser of: (i) Moodys Plus Three (as defined in Article II and calculated as of the last day of the month preceding the date such amendment is adopted), or (ii) the highest yield on any unsecured debt or preferred stock of the Company that was outstanding on the last day... -

Page 140

... benefit under Section 5.3, (c) change the definition of the Declared Rate set forth in Article II to a rate or to a formula that, as of the last day of the month preceding the date of the Termination Event, produces a rate that is less than Moodys Plus Three (as defined in Article II and calculated... -

Page 141

... by the Employee Retirement Income Security Act of 1974, as amended. 18 IN WITNESS WHEREOF, the Company has executed this document this 19th day of December, 2002. OCCIDENTAL PETROLEUM CORPORATION By /s/ RICHARD W. HALLOCK Richard W. Hallock Executive Vice-President, Human Resources 19 -

Page 142

-

Page 143

EXHIBIT 10.47 OCCIDENTAL PETROLEUM CORPORATION 2001 INCENTIVE COMPENSATION PLAN RESTRICTED SHARE UNIT AGREEMENT (MANDATORY DEFERRED ISSUANCE OF SHARES) NAME OF GRANTEE DATE OF GRANT RESTRICTED SHARE UNITS VESTING SCHEDULE: 1ST ANNIVERSARY RESTRICTED SHARE UNITS 2ND ANNIVERSARY RESTRICTED SHARE... -

Page 144

... of the Occidental Petroleum Corporation Deferred Stock Program as such Program may be amended from time to time. The administration of the Deferred Stock Program is governed by the Executive Compensation and Human Resources Committee, whose decision on all matters shall be final. The deferral... -

Page 145

..., and enforcement of this Agreement. IN WITNESS WHEREOF, the Company has caused this Agreement to be executed on its behalf by its duly authorized officer and Grantee has also executed this Agreement in duplicate, effective as of the Date of Grant. OCCIDENTAL PETROLEUM CORPORATION By Grantee -

Page 146

EXHIBIT 12 OCCIDENTAL PETROLEUM CORPORATION AND SUBSIDIARIES COMPUTATION OF TOTAL ENTERPRISE RATIOS OF EARNINGS TO FIXED CHARGES FOR THE FIVE YEARS ENDED DECEMBER 31, 2002 (Amounts in millions, except ratios) Income from continuing operations (a) 2002 1,548 ---------- 2001 1,418 ---------- ... -

Page 147

... Quimica do Brasil Ltda. Occidental Yemen Ltd. OOG Partner Inc. OOOI Chemical International, LLC OOOI Chemical Management, Inc. OOOI Oil and Gas Management, Inc. OOOI Oil and Gas Sub, LLC Oxy CH Corporation Oxy Chemical Corporation OXY Dolphin E&P, LLC OXY Dolphin Pipeline, LLC Oxy Energy Services... -

Page 148

-

Page 149

... of operations, stockholders' equity, comprehensive income, and cash flows for each of the years in the three-year period ended December 31, 2002 and the related financial statement schedule, which report appears in the Form 10-K dated March 4, 2003 of Occidental Petroleum Corporation. Our report...