Occidental Petroleum 2001 Annual Report Download - page 5

Download and view the complete annual report

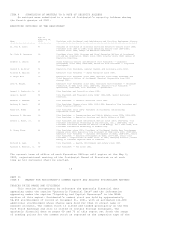

Please find page 5 of the 2001 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.deepwater Gulf of Mexico (GOM), with first production expected late in 2002. BP

p.l.c. (BP) is the operator.

Occidental has integrated the Altura properties purchased in April 2000

from BP and the Royal Dutch/Shell Group (Shell) with its previously existing

Permian Basin operation (Oxy Permian) in Southwest Texas and Southeast New

Mexico. Over half of Oxy Permian's production is from fields into which carbon

dioxide (CO2) is injected as a tertiary recovery technique.

In late 2000, Occidental purchased BP's 75-percent working interest in the

Bravo Dome CO2 unit in northern New Mexico, which has gross CO2 production of

approximately 320 MMcf per day.

Occidental also owns a large concentration of gas reserves, production

interests and royalty interests in the Hugoton area of Kansas and Oklahoma. The

Hugoton field is the largest natural gas field ever discovered in North America.

4

MIDDLE EAST

In Qatar, Occidental is the operator of the Idd el Shargi North and South

Dome fields under separate production-sharing contracts.

In Yemen, Occidental owns working interests in the Masila field in Block 14

(38 percent) and the East Shabwa field in Block 10 (28.6 percent). In addition,

Occidental has interests in seven exploration blocks encompassing nearly 15

million acres. Of these, Occidental is the operator of Blocks 44 and 20 with

working interests of 75 percent and 50 percent, respectively, and has a

40-percent working interest in each of five blocks - Blocks 11, 12, 36, 56 and

59 - on the border with Saudi Arabia.

In Oman, Occidental is the operator of Block 9, with a 65-percent working

interest, which contains the Safah oil field and six small oil fields along the

southern border of the block. Occidental also is pursuing exploration

opportunities in Block 27.

Operations in Qatar, Oman and Yemen are all conducted under

production-sharing contracts. Occidental's contractual net share of production

in each of these operations varies annually depending on the market price of oil

and the level of investment.

In 2001, Occidental was selected to participate in Core Venture Two of the

Kingdom of Saudi Arabia's Natural Gas Initiative, which includes exploration

acreage, appraisal and development of discovered gas fields, a power plant and

an optional petrochemical plant. Final agreements are currently expected to be

signed in 2002.

OTHER EASTERN HEMISPHERE

In southern Pakistan, Occidental has working interests, which vary from 25

to 30 percent, in the three Badin Blocks.

In Russia, Occidental owns a 50-percent interest in a joint venture

company, Vanyoganneft, in the western Siberian oil basin.

LATIN AMERICA

Occidental has a 35-percent working interest and is operator of the Cano

Limon oil field in Colombia. Occidental also has an approximately 44-percent

interest in the Cano Limon-Covenas oil pipeline and a marine export terminal

operated by Colombia's national oil company, Ecopetrol. The pipeline transports

oil produced from the Cano Limon field for export to international markets. In

addition, Occidental has an 88-percent working interest in three exploration

blocks encompassing 9,325 square miles in the Central Llanos Basin.

In Ecuador, Occidental has a 60-percent working interest and is operator of

Block 15, in the Oriente Basin, under a production-sharing agreement, converted

in 1999 from a risk-service contract.

Occidental also has an approximately 12-percent interest in a 500-kilometer

heavy oil pipeline being constructed to transport oil from the Oriente Basin to

the port of Esmeraldas. The pipeline is expected to be operational in the first