Occidental Petroleum 2001 Annual Report Download - page 13

Download and view the complete annual report

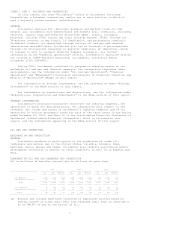

Please find page 13 of the 2001 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(a) See "Management's Discussion and Analysis of Financial Condition and

Results of Operations" and the "Notes to Consolidated Financial Statements"

for information regarding accounting changes, asset acquisitions and

dispositions, discontinued operations, and charges for asset write-downs,

litigation matters, environmental remediation and other costs and other

special items affecting comparability.

(b) Earnings before special items reflects adjustments to net income(loss) to

exclude the after-tax effect of certain infrequent transactions that may

affect comparability between years. See the "Special Items" table for the

specific nature of these items in 2001, 2000 and 1999. Management believes

the presentation of earnings before special items provides a meaningful

comparison of earnings between years to the readers of the consolidated

financial statements. Earnings before special items is not considered to be

an alternative to operating income in accordance with generally accepted

accounting principles.

ITEM 7

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS (INCORPORATING ITEM 7A)

2001 BUSINESS ENVIRONMENT

In this report, the term "Occidental" refers to Occidental Petroleum

Corporation and/or one or more entities in which it owns a majority voting

interest (subsidiaries). Occidental is divided into two major operating

businesses.

OIL AND NATURAL GAS INDUSTRY

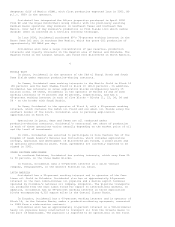

The market price of West Texas Intermediate (WTI) declined considerably

during 2001, falling from around $30/bbl in January to less than $20/bbl in

December. The fourth quarter was the weakest for oil prices since the third

quarter of 1999. Overall, the crude oil market continued to indicate both

long-term and short-term price uncertainty.

NYMEX domestic natural gas prices were subject to greater volatility in

2001. Natural gas prices, which were over $5/thousand cubic feet (Mcf) in the

fourth quarter of 2000, rose to $7/Mcf in the first quarter of 2001 and then

declined significantly to less than $3/Mcf by year-end. Increased supply from

heavy investment in drilling by the industry in 2000 and 2001, higher

inventories and decreased demand combined to lower gas prices back to the level

last seen in the first quarter of 2000.

The number of U.S. onshore rigs in use climbed from under 500 in mid-1999

to over 1,100 in mid-2001, but the decline in oil and gas prices resulted in

fewer than 800 rigs in use by the end of the year.

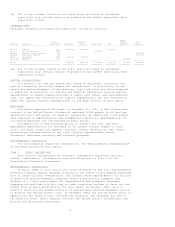

CHEMICAL INDUSTRY

The chemical industry experienced a significant decrease in demand as the

decade-long U.S. economic expansion gave way to a recession in March 2001

following a slowdown that began midway through 2000. Due to a pessimistic

outlook and no near-term signs of economic recovery, customers and distributors

continued with inventory reduction and limited purchases. Most Asian, European

and South American countries also experienced an economic downturn similar to

North American trends. Record-high energy prices and feedstock costs began to

drop in the second quarter, but poor product demand for the year resulted in

overall weaker prices and profit margins.

12

Domestic chlorine demand decreased significantly in 2001, compared with

2000, due to poor demand for chlorine derivatives including vinyls, polyurethane

chemicals, epichlorohydrin and others, which are primarily used in durable goods

and consumer products. The poor chlorine demand resulted in chlorine prices

declining throughout the year. Caustic soda prices peaked in the first half of

the year due to major cutbacks in chlorine production. Demand was stable in the

first half of the year but began to soften in the third quarter. Polyvinyl

chloride (PVC) prices, but not margins, improved for a short time reflecting

higher energy and feedstock prices during the first few months before reaching a

peak in April, but weakened throughout the remainder of the year due to poor

demand and increased industry capacity.