Occidental Petroleum 2001 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2001 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. PVC resin prices increased only slightly in the first half of 2001, but

declined throughout the remainder of the year. Higher exports in 2001 prevented

operating rates from falling lower, but export sales returned only minimal

margins.

On June 1, 2001, OxyChem temporarily idled its Ingleside, TX ethylene

dichloride (EDC) plant and on December 27, 2001, OxyChem temporarily idled the

Deer Park chlor-alkali plant in Houston, TX due to a combination of

deteriorating prices and weak demand. These facilities will remain idle until

economic conditions improve.

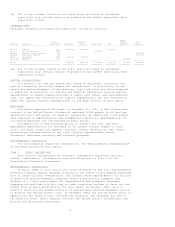

In Occidental's chlor-alkali business, reduced demand for chlorine led to

significantly reduced operating rates. OxyChem's operating rate, as a percent of

capacity, fell from 92 percent in 2000 to 84 percent in 2001. The chlorine

industry's 2001 operating rate was 85 percent compared to 92 percent for 2000.

Despite reduced liquid caustic production, caustic prices declined in the second

half of the year on weak demand. As 2001 progressed, chlorine prices fell due to

declining demand, especially in the global vinyls market. Operations at the

Convent chlor-alkali and EDC plant, which had been curtailed, were recommenced

in 2001.

Record-high energy costs in the first quarter of 2001 adversely affected

earnings. For the total year, energy costs were higher than 2000, but well below

first quarter levels. Feedstock costs followed the same trend as energy costs.

Petrochemical margins were under pressure throughout 2001 due to weak

demand and significant capacity additions by BASF/AtoFina, Formosa Plastics and

Union Carbide/Nova Chemical. Lower feedstock costs in the fourth quarter were

offset by lower prices due to continued weak demand.

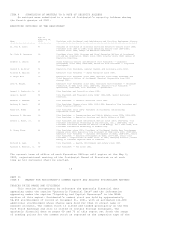

The primary goal of Occidental's chemical business is to provide free cash

flow. From 1995 through 2001, total cash flow from the chemicals business was

$3.8 billion, including asset sales, net of acquisitions, of $1.0 billion.

2002 OUTLOOK

OIL AND GAS

The petroleum industry is highly competitive and subject to significant

volatility due to numerous market forces. Crude oil and natural gas prices are

affected by market fundamentals such as weather, inventory levels, competing

fuel prices, overall demand and the availability of supply.

16

In the fourth quarter of 2001, worldwide oil prices weakened considerably

and have remained lower than their ten-year averages in the first quarter of

2002. Sustained low prices will significantly impact profitability and returns

for Occidental and other upstream producers. However, the industry has

historically experienced wide fluctuations within price cycles.

While fundamentals are a decisive factor affecting crude oil prices over

the long term, day-to-day prices may be more volatile in the futures markets;

such as on the NYMEX and other exchanges, which make it difficult to accurately

predict oil and natural gas prices. In the short term, other factors such as

weather patterns do have a significant effect, particularly on natural gas

prices. In the United States, increased gas supplies from large capital

investment over the past year, combined with a later winter, resulted in

inventory levels at the end of 2001 exceeding the average of the preceding five

years by 20 percent.

The combination of higher gas supplies and lower demand, which is

continuing into the first quarter of 2002, is expected to result in

significantly lower average gas price realizations for Occidental in 2002 than

in 2001.

CHEMICAL

The performance of the chemical business is difficult to forecast, but this

business is capable of contributing significant earnings and cash flow when

demand is strong.

Industry operating rates in the chlor-alkali/vinyls business are expected

to recover gradually in 2002.

CHLOR-ALKALI

Domestic chlorine demand is expected to increase by nearly 2 percent in

2002, which should allow the industry's operating rates to improve in the

absence of capacity additions. Liquid caustic pricing is expected to continue to

be weak.