Occidental Petroleum 2001 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2001 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DEBT STRUCTURE

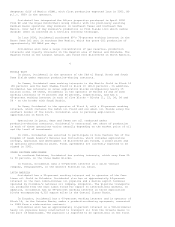

Occidental's total debt comprises three components, as shown in the table

below (amounts in millions):

Occidental Other Altura Non-

Public Recourse Recourse Total

Date Debt Debt Debt Debt(a)

================ =========== =========== =========== ===========

12/31/97 $ 4,965 $ 1,361 $ -- $ 6,326

12/31/98 $ 5,402 $ 776 $ -- $ 6,178

12/31/99 $ 4,401 $ 1,047 $ -- $ 5,448

April 2000(b) $ 5,766 $ 1,009 $ 2,400 $ 9,175

12/31/00 $ 3,544 $ 912 $ 1,900 $ 6,356

12/31/01 $ 4,119 $ 771 $ -- $ 4,890

---------------- ----------- ----------- ----------- -----------

(a) Includes Trust Preferred Securities, natural gas delivery commitment,

preferred stock and capital lease obligations.

(b) Reflects, on a pro-forma basis, the effect of $1.2 billion in debt from the

Altura acquisition on Occidental's debt as of April 2000.

13

Occidental took full advantage of its increased production profile and high

oil and gas prices over an eighteen-month period in 2000 and 2001 to reduce

total debt. The Altura purchase increased pro-forma debt to nearly $9.2 billion

in April 2000. By the end of 2001, total debt had been lowered to $4.9 billion,

$1.4 billion below the year-end total in 1997. Occidental's public debt at

year-end 2001 is more than $800 million below the year-end 1997 level and more

than $275 million below year-end 1999.

Occidental's other recourse debt, which includes preferred stock and Trust

Preferred Securities in the above table, decreased from $1.4 billion in 1997 to

$771 million in 2001.

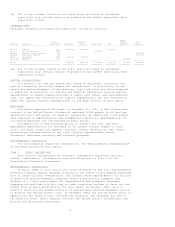

Total Debt/Capitalization Ratio (%)

Date Total Debt/Capitalization Ratio

=============================== ===============================

12/31/97 67%

12/31/98 66%

12/31/99 61%

April 2000(a) 71%

12/31/00 57%

12/31/01 46%

------------------------------- -------------------------------

(a) Reflects, on a pro-forma basis, the effect of $1.2 billion in debt from the

Altura acquisition on Occidental's public debt as of April 2000.

Occidental's year-end 2001 total debt-to-capitalization ratio has declined

to approximately 46 percent from the 67-percent level that existed at the end of

1997. The debt-to-capitalization ratio is computed by dividing total debt by

total capitalization, excluding minority interest.

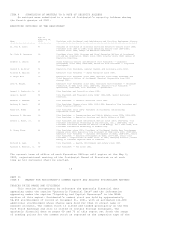

BUSINESS REVIEW - OIL AND GAS

Occidental's overall performance during the past three years reflected the

successful implementation of its oil and gas business strategy, beginning with

the 1998 $3.5 billion acquisition of the Elk Hills oil and gas field in

California. Elk Hills is one of the top ten oil and gas fields in the U.S. and

the largest source of gas in California. The Elk Hills acquisition was followed

in April 2000 by the purchases of Altura Energy in Texas for $3.6 billion and

the much smaller THUMS property in Long Beach for $110 million.

At the end of 2001, these three assets made up 65 percent of Occidental's