Occidental Petroleum 2001 Annual Report Download - page 17

Download and view the complete annual report

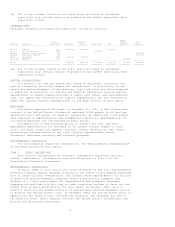

Please find page 17 of the 2001 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1999 and 2000. Elk Hills has generated total free cash flow, after capital

expenditures, of approximately $2.4 billion since Occidental acquired the asset

in early 1998.

Since the date of acquisition, Occidental has replaced 108 percent of its

total Elk Hills oil and gas production of 136 million BOE. At the end of 2001,

the property still had an estimated 437 million BOE of proved reserves, compared

to the 425 million BOE that were recorded at the time of the acquisition.

MIDDLE EAST

OMAN

Occidental's Oman business centers on its 300-million barrel discovery in

Block 9. Occidental has produced more than 150 million gross barrels from the

Block, most of it from the Safah field.

Net production to Occidental averaged 14,000 barrels of oil per day in the

fourth quarter, and Occidental expects to expand its Oman business over the next

few years.

Occidental uses multi-lateral horizontal wells to increase production and

recovery rates and to minimize the number of wells needed. Today, 60 percent of

Occidental's production in Oman relies on horizontal wells. A new waterflood

program is currently under way at Safah that will enhance production and improve

the ultimate recovery of reserves from the field.

YEMEN

In Yemen, Occidental's net production averaged 33,000 barrels of oil per

day in 2001, with 29,000 coming from the Masila field and the remainder from

East Shabwa. A series of step-out wells are planned for Masila in 2002 that are

expected to add new reserves.

In 2001, Occidental completed a 3-D seismic program in Block 20.

Preliminary analysis of these data was completed, and plans are under way to

begin drilling two exploratory wells in Block 20 in late 2002. In addition, a

3-D seismic program is beginning in the first quarter of 2002 in Block 44.

Analysis of seismic data for Block 59, which is part of the under-explored

southern portion of the Rub al Khali desert, has been completed and a test well

began drilling in January 2002.

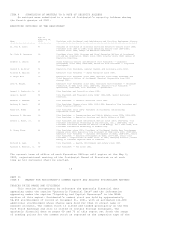

QATAR

In Qatar, Occidental successfully reversed 25 years of declining production

in the Idd el Shargi North Dome field. By introducing advanced drilling systems

and by applying new waterflooding and reservoir characterization techniques,

gross production increased from 20,000 barrels per day to more than 100,000

barrels per day, peaking at 138,000 barrels in 1998.

Occidental is developing the South Dome field as a satellite to the North

Dome, which reduces the overall capital requirement of the two projects.

Combined production from the two fields in the fourth quarter of 2001 was 43,000

barrels per day, net to Occidental.

Occidental also has implemented a waterflood program in the North Dome's

Shuaiba Reservoir and is currently evaluating a second-generation redevelopment

project.

Occidental is also pursuing new exploration opportunities in Qatar.

SAUDI ARABIA

In Saudi Arabia, Occidental has a 20-percent interest in the Core Venture

Two consortium, which expects to invest in the Red Sea area to help the Kingdom

identify and develop new natural gas reserves for the domestic market.

The Red Sea venture currently consists of development of discovered gas

from the Midyan and Barqan fields in the northwest part of the Kingdom, and

construction of related gas-processing and pipeline facilities. The consortium

expects to build at least one power plant and possibly a water-desalination unit

and will also evaluate the potential for a petrochemical plant.

The project also calls for onshore and offshore exploration in Blocks 40 to

49 located in and along the Red Sea. Exploration success in these blocks will

lay the foundation for additional investment opportunities in power generation,

water desalination and petrochemicals in the western part of the Kingdom.

An initial agreement was signed with the Kingdom on June 3, 2001. Final

agreements are currently expected to be signed in 2002.

OTHER EASTERN HEMISPHERE

PAKISTAN

Occidental holds oil and gas interests in the Badin Blocks in Pakistan,

which BP operates. Current gross production is 65,000 BOE per day. Occidental's

net share is approximately 16,000 BOE per day.