Occidental Petroleum 2001 Annual Report Download - page 14

Download and view the complete annual report

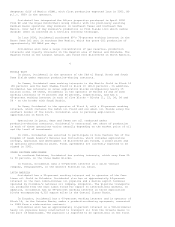

Please find page 14 of the 2001 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STRATEGIC OVERVIEW AND REVIEW OF BUSINESS RESULTS - 1999 - 2001

STRATEGY

Occidental's overall strategy to add value for shareholders consists of

three basic elements:

>> Shift corporate assets to large, long-lived oil and gas assets with growth

potential

>> Maintain financial discipline and strengthen the balance sheet

>> Harvest cash from chemicals

Implementation of this strategy included divesting interests in the natural

gas pipeline segment and buying large "legacy" oil and gas assets in California

and Texas that are expected to provide stable production, strong earnings and

cash flow and a solid platform for new growth initiatives.

At Occidental, financial discipline means prudently investing capital in

projects that are expected to produce superior returns while strengthening the

balance sheet to reduce both risk and earnings volatility.

The chemicals business is being used to provide free cash flow.

SPECIFIC ACTIONS

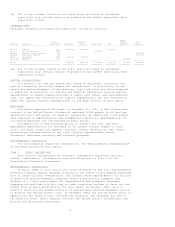

OIL AND GAS

The oil and gas business strategy has three parts that, together, are

focused on adding new oil and natural gas reserves at a pace well ahead of

production, while simultaneously keeping finding and development costs among the

lowest in the industry.

>> Continue to add commercial reserves in and around core areas in the U.S.,

Middle East and Latin America through a combination of focused exploration

and development programs.

>> Pursue commercial opportunities with host governments in core areas to

enhance the development of mature fields with large volumes of remaining

oil in place by applying appropriate technology and innovative

reservoir-management practices.

>> Maintain a disciplined approach in buying and selling assets at attractive

prices.

Occidental's oil and gas business is currently concentrated in five U.S.

states and nine foreign countries.

The asset mix within each of these areas has been strengthened by the sale

of properties with low or no current return and investment in assets with much

higher performance potential. The results of these changes are discussed below

in "Business Review - Oil & Gas."

CHEMICAL

Occidental conducts its chemical operations through Occidental Chemical

Corporation and its various subsidiaries and affiliates (collectively, OxyChem).

OxyChem focuses on the chlorovinyls chain where it begins with ethylene and

chlorine, which is co-produced with caustic soda, and converts them through a

series of intermediate products into PVC. In order to strengthen its position

along the chlorovinyls chain, Occidental entered into a major business alliance

in 1999, a vinyls partnership with Geon (now known as PolyOne) named OxyVinyls,

LP (OxyVinyls).

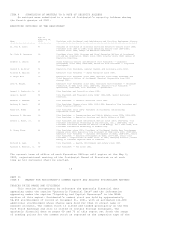

CORPORATE

In July 2001, Occidental sold its interests in a subsidiary that owned a

Texas intrastate pipeline and its interest in a liquefied natural gas (LNG)

project in Indonesia. After-tax proceeds of approximately $750 million from

these transactions were used to reduce debt.

In April 2000, Occidental sold its interest in Canadian Occidental

Petroleum Ltd., renamed Nexen Inc. (CanadianOxy or Nexen). After-tax proceeds,

together with tax benefits from the disposition of oil-producing properties in

Peru, totaling $700 million were used to reduce debt following the Altura

acquisition.

Occidental received $775 million from Chevron in a litigation settlement in

November 1999, which was used mainly to reduce high-cost debt.