Occidental Petroleum 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

[X] Annual Report Pursuant to Section 13 or 15(d) [ ] Transition Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of the Securities Exchange Act of 1934

of 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2001 FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER 1-9210

OCCIDENTAL PETROLEUM CORPORATION

(Exact name of registrant as specified in its charter)

State or other jurisdiction of incorporation or organization Delaware

I.R.S. Employer Identification No. 95-4035997

Address of principal executive offices 10889 Wilshire Blvd., Los Angeles, CA

Zip Code 90024

Registrant's telephone number, including area code (310) 208-8800

Securities registered pursuant to Section 12(b) of the Act:

TITLE OF EACH CLASS NAME OF EACH EXCHANGE ON WHICH REGISTERED

10 1/8% Senior Debentures due 2009 New York Stock Exchange

9 1/4% Senior Debentures due 2019 New York Stock Exchange

Oxy Capital Trust I 8.16% Trust Originated Preferred Securities New York Stock Exchange

Common Stock New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant (1) has filed all reports required

to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements the past 90 days.

[X] YES [ ] NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405

of Regulation S-K is not contained herein, and will not be contained, to the

best of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K.

The aggregate market value of the voting stock held by nonaffiliates of the

registrant on February 28, 2002, was approximately $10.0 billion, based on the

closing price on the New York Stock Exchange composite tape of $26.84 per share

of Common Stock on February 28, 2002. Shares of Common Stock held by each

executive officer and director have been excluded from this computation in that

such persons may be deemed to be affiliates. This determination of affiliate

status is not a conclusive determination for other purposes.

At February 28, 2002, there were approximately 374,455,513 shares of Common

Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement, filed in connection

with its May 3, 2002, Annual Meeting of Stockholders, are incorporated by

reference into Part III.

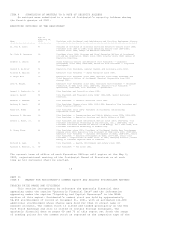

TABLE OF CONTENTS

Table of contents

-

Page 1

... NUMBER 1-9210 OCCIDENTAL PETROLEUM CORPORATION (Exact name of registrant as specified in its charter) State or other jurisdiction of I.R.S. Employer Identification Address of principal executive Zip Code Registrant's telephone number, incorporation or organization No. offices including area code... -

Page 2

...10 Directors and Executive Officers of the Registrant...77 ITEM 11 Executive Compensation... 77 ITEM 12 Security Ownership of Certain Beneficial Owners and Management... 77 ITEM 13 Certain Relationships and Related Transactions... 77 PART IV ITEM 14 Exhibits, Financial Statement Schedules and... -

Page 3

... to sell to Lyondell Chemical Company (Lyondell). See further information in the "Chemical Operations" section. Occidental's executive offices are located at 10889 Wilshire Boulevard, Los Angeles, California 90024; telephone (310) 208-8800. During 2001, Occidental continued its program to redeploy... -

Page 4

... years, Occidental has focused domestic exploration and development efforts on core assets in California, the Permian Basin and Hugoton, and has focused its international exploration and development efforts on core assets in the Middle East and Latin America. Occidental's oil and gas operations... -

Page 5

... Initiative, which includes exploration acreage, appraisal and development of discovered gas fields, a power plant and an optional petrochemical plant. Final agreements are currently expected to be signed in 2002. OTHER EASTERN HEMISPHERE In southern Pakistan, Occidental has working interests, which... -

Page 6

... 27, 2001, OxyChem temporarily idled the Deer Park chlor-alkali plant in Houston, TX. These facilities will remain idle until market conditions improve. In June 2000, OxyChem announced its decision to withdraw from several of its chemical intermediates businesses principally located in Niagara Falls... -

Page 7

all of the Niagara Falls chemical intermediates production units have been shut down, and the sale or disposal of these assets is underway. In April 1999, OxyChem and The Geon Company, now known as PolyOne Corporation (PolyOne), formed the OxyVinyls partnership, combining the commodity PVC resin ... -

Page 8

... ability to meet customer delivery requirements. PROPERTIES As of December 31, 2001, OxyChem, which is headquartered in Dallas, Texas, operated 27 chemical-manufacturing plants in the United States. Many of the larger facilities are located in the Gulf Coast areas of Texas and Louisiana. In addition... -

Page 9

CHLOROVINYLS Principal Products and U.S. Production Capacities at December 31, 2001 Plants (a BASIC Mobile, Alabama Muscle Shoals, Alabama Delaware City, Delaware Convent, Louisiana Taft, Louisiana Niagara Falls, New York Ingleside, Texas (b, c Total Chlorine (tons Caustic Soda (tons ... -

Page 10

...555 people in chemical operations. An additional 1,035 people were employed in administrative and headquarters functions. Approximately 733 U.S.-based employees are represented by labor unions. Occidental has a long-standing policy to ensure that fair and equal employment opportunities are extended... -

Page 11

...fourth quarter of 2001. EXECUTIVE OFFICERS OF THE REGISTRANT Name Dr. Ray R. Irani Age at February 28, 2002 -----------67 Positions with Occidental and Subsidiaries and Five-Year Employment History Chairman of the Board of Directors and Chief Executive Officer since 1990; President from 1984 to... -

Page 12

...(b) FINANCIAL POSITION(a) Total assets Long-term debt, net and Altura non-recourse debt Trust Preferred Securities and preferred stock Common stockholders' equity Dividends per common share AVERAGE SHARES OUTSTANDING (thousands 2001 ========== 2000 ========== Occidental Petroleum Corporation... -

Page 13

...In this report, the term "Occidental" refers to Occidental Petroleum Corporation and/or one or more entities in which it owns a majority voting interest (subsidiaries). Occidental is divided into two major operating businesses. OIL AND NATURAL GAS INDUSTRY The market price of West Texas Intermediate... -

Page 14

...by the sale of properties with low or no current return and investment in assets with much higher performance potential. The results of these changes are discussed below in "Business Review - Oil & Gas." CHEMICAL Occidental conducts its chemical operations through Occidental Chemical Corporation and... -

Page 15

... and gas fields in the U.S. and the largest source of gas in California. The Elk Hills acquisition was followed in April 2000 by the purchases of Altura Energy in Texas for $3.6 billion and the much smaller THUMS property in Long Beach for $110 million. At the end of 2001, these three assets made up... -

Page 16

...production averaged approximately 320 million cubic feet per day in 2001. Because of third-party sales commitments, Bravo Dome currently meets approximately one-third of Occidental's CO2 demand in the Permian Basin. THUMS At year-end 2001, net production from the THUMS oil property in Long Beach, CA... -

Page 17

... of its total Elk Hills oil and gas production of 136 million BOE. At the end of 2001, the property still had an estimated 437 million BOE of proved reserves, compared to the 425 million BOE that were recorded at the time of the acquisition. MIDDLE EAST OMAN Occidental's Oman business centers on its... -

Page 18

... was in its initial phase of development, to Mitsubishi Corporation of Japan for a sale price of $480 million. The proceeds were used in Occidental's debt-reduction program. 15 LATIN AMERICA COLOMBIA In 2001, production from Occidental's Cano Limon operations in Colombia was substantially reduced... -

Page 19

...year. Higher exports in 2001 prevented operating rates from falling lower, but export sales returned only minimal margins. On June 1, 2001, OxyChem temporarily idled its Ingleside, TX ethylene dichloride (EDC) plant and on December 27, 2001, OxyChem temporarily idled the Deer Park chlor-alkali plant... -

Page 20

... automotive end markets for PVC products will likely remain well below peak demand levels. North American PVC industry operating rates are expected to average between 80-85 percent for the year. PETROCHEMICALS (EQUISTAR PARTNERSHIP) In January 2002, Occidental and Lyondell Chemical Company (Lyondell... -

Page 21

...attributed to the sale of the entity that owns pipelines in Texas. < OIL AND GAS In millions, except as indicated SEGMENT SALES SEGMENT EARNINGS EARNINGS BEFORE SPECIAL ITEMS(a) NET PRODUCTION PER DAY UNITED STATES Crude oil and liquids (MBBL) California Permian U.S. Other Total Natural Gas (MMCF... -

Page 22

...) California Hugoton Permian U.S. Other Total LATIN AMERICA Crude oil & condensate (MBBL) Colombia Ecuador Peru Total EASTERN HEMISPHERE Crude oil & condensate (MBBL) Oman Pakistan Qatar Russia Yemen Total Natural Gas (MMCF) Bangladesh Pakistan Total BARRELS OF OIL EQUIVALENT (MBOE) AVERAGE SALES... -

Page 23

...2000 and 43 percent in 1999. These trading activities focus on obtaining the highest sale price available. Occidental also occasionally engages in hedging activities for relatively small parts of its total production to reduce exposure to price risk, thereby mitigating cash-flow volatility. Refer to... -

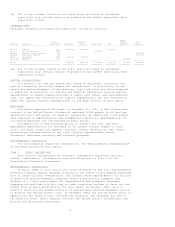

Page 24

... of chemical intermediate businesses and various assets Gain on sale of Durez business(a) Loss on foreign investment abandonment (a) Write-downs by Equistar Severance, plant shutdown, idling and plant write-down costs Gain on sale of chemical plant by Equistar Claims and settlements CORPORATE Loss... -

Page 25

...the partial sale of the Gulf of Mexico assets, the pre-tax gain of $63 million on the receipt of contingency payments related to a prior-year sale of a Dutch North Sea subsidiary and the pre-tax gain of $34 million on the sale of the Durez business. The loss from equity investments in 2001, compared... -

Page 26

...of the chemical intermediate businesses and other miscellaneous items. Other non-cash charges in 1999 included the write-down of chemical assets and other miscellaneous items. See the "Special Items" table on page 19. Each of the three years also included charges for employee benefit plans and other... -

Page 27

...higher development spending resulting, primarily, from a larger asset base. Amounts from all three years exclude any significant acquisitions. Occidental's capital spending budget for 2002 is $1.1 billion. Of the total, approximately $1 billion will be allocated to oil and gas, with Qatar, Elk Hills... -

Page 28

... in Texas operated by OxyChem. Marubeni Corporation (Marubeni) owns the remaining 21.4 percent of OxyMar, but has a 50-percent voting interest. The OxyMar VCM plant is a modern, efficient manufacturing facility. Occidental's chlorovinyls business derives economic benefit as the supplier of chlorine... -

Page 29

... financial statements using the equity method of accounting. ELK HILLS POWER Occidental and Sempra Energy (Sempra) each has a 50-percent interest in Elk Hills Power LLC, a limited liability company that is currently constructing a gas-fired, power-generation plant in California. Occidental accounts... -

Page 30

... and mark-to-market adjustments related to fair-value hedges. Offset by sub lease rental income. Excludes capital commitments. The $360 million receivable securitization amount is reflected in the 2005-2006 year column since Occidental could finance the amount with its committed credit line, which... -

Page 31

... issuing long-term debt. The decrease in accounts payable was due to lower trade payable balances in the oil and gas marketing and trading operations. The decrease in accrued liabilities was due to lower mark-to-market adjustments on derivative financial instruments in the oil and gas trading group... -

Page 32

...31, 2001 was $4.3 billion. Occidental has the option to call certain issues of long-term debt before their maturity dates. In February 2002, Occidental filed a shelf registration statement for up to $1 billion of its senior debt securities, subordinated debt securities, preferred stock, common stock... -

Page 33

... in Texas that are leased to a former subsidiary. The entity was sold to Kinder Morgan Energy Partners, L.P. Occidental recorded an after-tax loss of approximately $272 million in connection with this transaction. SALE OF INDONESIA GAS PROPERTIES On July 10, 2001, Occidental completed the sale of... -

Page 34

... EOG Resources, Inc. (EOG) exchanged certain oil and gas assets. Occidental received producing properties and exploration acreage in its expanding California asset base, as well as producing properties in the western Gulf of Mexico near existing operations, in exchange for oil and gas production and... -

Page 35

... will fund these commitments and capital expenditures with cash from operations and proceeds from existing credit facilities as necessary. DERIVATIVE AND HEDGING ACTIVITIES GENERAL Occidental's market-risk exposures relate primarily to commodity prices, and, to a lesser extent, interest rates... -

Page 36

... for crude oil hedging. Purchased put options were used for natural gas hedging and were executed for the Mid-continent production area to establish a minimum sales price for its production. Occidental used no fair-value hedges for crude oil or natural gas production during 2001. Occidental's cash... -

Page 37

..., 2001, total assets and liabilities include $108 million and $101 million for the fair value of derivative instruments used in marketing and trading operations. Prior to the physical settlement of any energy contract held for trading purposes, favorable or unfavorable price movement is reported in... -

Page 38

... income statement. The majority of the gain was from the mark-to-market adjustment under EITF Issue No. 98-10 of a long-term sales contract. INTEREST-RATE DERIVATIVES FAIR-VALUE HEDGES Interest-rate swaps, forward locks and futures contracts are entered into as part of Occidental's overall strategy... -

Page 39

..., parental guarantees and letters of credit. Credit limits for all customers (whether financial or physical) are established and entered into Occidental's risk-management systems, and these limits are monitored for compliance on an aggregated basis across all traded commodities. Credit exposure... -

Page 40

... expenditures related to current operations are factored into the overall business planning process. These expenditures are mainly considered an integral part of production in manufacturing quality products responsive to market demand. ENVIRONMENTAL REMEDIATION The laws that require or address... -

Page 41

... of Occidental's total assets at that date. Of such assets, approximately $1.3 billion was located in the Middle East, approximately $502 million was located in Latin America, and substantially all of the remainder were located in Pakistan and Russia. CRITICAL ACCOUNTING POLICIES Generally accepted... -

Page 42

...-line method, both based upon the estimated productive life of the facilities. Occidental makes annual capital renewal expenditures for its chemical plants on a continual basis while the plants are in operation. Impairment reserves are provided when a decision is made to dispose of a property... -

Page 43

...revenues and included in cost of sales on Occidental's Statements of Operations totaled $245 million in 2000 and $210 million in 1999. SFAS NO. 140 In the fourth quarter of 2000, Occidental adopted the disclosure provisions of SFAS No. 140, "Accounting for Transfers and Servicing of Financial Assets... -

Page 44

...reflect fairly the consolidated financial position, results of operations and cash flows of Occidental. 33 ITEM 8 FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA REPORT OF INDEPENDENT PUBLIC ACCOUNTANTS To the Stockholders and Board of Directors, Occidental Petroleum Corporation: We have audited the... -

Page 45

... therein in relation to the basic financial statements taken as a whole. ARTHUR ANDERSEN LLP /s/ ARTHUR ANDERSEN LLP Los Angeles, California February 8, 2002 34 CONSOLIDATED STATEMENTS OF OPERATIONS In millions, except per-share amounts For the years ended December 31 REVENUES Net sales Interest... -

Page 46

... financial statements. 36 CONSOLIDATED BALANCE SHEETS In millions, except share amounts Occidental Petroleum Corporation and Subsidiaries 2001 ========== 2000 ========== Liabilities and Equity at December 31 CURRENT LIABILITIES Current maturities of long-term debt and capital lease liabilities... -

Page 47

...The accompanying notes are an integral part of these financial statements. 37 CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY In millions NonRedeemable Preferred Stock 243 -----(243 Occidental Petroleum Corporation and Subsidiaries BALANCE, DECEMBER 31, 1998 Net income Other comprehensive... -

Page 48

... ACCOUNTING POLICIES PRINCIPLES OF CONSOLIDATION The consolidated financial statements include the accounts of Occidental Petroleum Corporation, all entities where it owns a majority voting interest (subsidiaries) and their proportionate interests in oil and gas exploration and production... -

Page 49

...such risks and would expect to receive compensation in the event of nationalization. Since Occidental's major products are commodities, significant changes in the prices of oil and gas and chemical products could have a significant impact on Occidental's results of operations for any particular year... -

Page 50

... related assets (see Note 15). Oil and gas properties are accounted for using the successful-efforts method. Costs of acquiring proved and unproved properties, costs of drilling successful exploration wells and development costs are capitalized. Annual lease rentals and exploration costs, including... -

Page 51

... production, Occidental assumes that the salvage value of the oil and gas property will equal the dismantlement restoration and reclamation costs so no accrual is necessary. For the chemical segment, appropriate reserves are provided when a decision is made to dispose of a property, since Occidental... -

Page 52

... as an adjustment to sales revenue or purchase costs when the related transaction being hedged was finalized. Except where a right of setoff exists, gains are recognized as assets and losses are recognized as liabilities. FINANCIAL INSTRUMENTS Occidental values financial instruments as required by... -

Page 53

... for crude oil hedging. Purchased put options were used for natural gas hedging and were executed for the Mid-continent production area to establish a minimum sales price for its production. Occidental used no fair-value hedges for crude oil or natural gas production during 2001. Occidental's cash... -

Page 54

..., parental guarantees and letters of credit. Credit limits for all customers (whether financial or physical) are established and entered into Occidental's risk-management systems, and these limits are monitored for compliance on an aggregated basis across all traded commodities. Credit exposure... -

Page 55

... ineffectiveness did not have a significant impact on earnings for the year. FOREIGN CURRENCY DERIVATIVES Many of Occidental's foreign oil and gas operations and foreign chemical operations are located in countries whose currencies generally depreciate against the U.S. dollar on a continuing basis... -

Page 56

... businesses and assets to Sumitomo Bakelite Co., Ltd. The gross proceeds of approximately $150 million from the sale will be applied to Occidental's debt-reduction program. Manufacturing facilities included in the sale are located in Niagara Falls, New York; Kenton, Ohio; Fort Erie, Ontario, Canada... -

Page 57

...cost savings through operational benefits. Occidental received producing properties and exploration acreage in its expanding California asset base, as well as producing properties in the western Gulf of Mexico near existing operations in exchange for oil and gas production and reserves in east Texas... -

Page 58

... Long-Lived Assets." SFAS No. 144 addresses financial accounting and reporting for the impairment or disposal of long-lived assets. The provisions of this statement are effective for financial statements issued for fiscal years beginning after December 15, 2001. Occidental will adopt this statement... -

Page 59

...$9 million for various oil and gas assets. Effective January 1, 1999, Occidental adopted the provisions of American Institute of Certified Public Accountants Statement of Position (SOP) 98-5, "Reporting on the Costs of Start-Up Activities", which requires that costs of start-up activities, including... -

Page 60

... hedge. 49 At December 31, 2001, $199 million of notes due in 2002 were classified as non-current since it is management's intention to refinance this amount on a long-term basis by issuing long-term debt. In addition, at December 31, 2001, Occidental had available lines of committed bank credit... -

Page 61

... delivery schedule that corresponds to the natural gas delivery commitment. Under the terms of the swap, Occidental will pay an average fixed price... million loss applicable to the related physical positions. Occidental has the ability to satisfy the delivery commitment with open market purchases and ... -

Page 62

... power requirements for Occidental's Taft chlor-alkali plant for less cost than if the plant were to generate its own steam and purchase electricity from a public utility. An owner trust with investors as participating beneficiaries owns the project, with Occidental acting as general contractor... -

Page 63

... cases, compensation for alleged property damage, punitive damages and civil penalties, aggregating substantial amounts. Occidental is usually one of many companies in these proceedings, and has to date been successful in sharing response costs with other financially sound companies. Occidental has... -

Page 64

... Deferred 52 The credit for deferred state and local income taxes in 2001 reflects a benefit of $70 million related to the settlement of a state tax issue, deferred tax reversing due to the sale of the entity owning pipelines in Texas that are leased to a former subsidiary and an adjustment... -

Page 65

... the executive officers and other key employees of Occidental and its subsidiaries. An aggregate of 9,000,000 shares of common stock was reserved for issuance upon exercise of ISOs, NQSOs or SARs granted. Options granted under the plan were granted at an exercise price not less than the fair market... -

Page 66

...purposes of further grants upon the effective date of the 1995 Incentive Stock Plan. The 1995 Incentive Stock Plan, as amended, provided for the grant of awards in the form of options, SARs, performance stock or restricted stock to salaried employees of Occidental and its subsidiaries or persons who... -

Page 67

...shares were awarded in 1995 at a weighted-average grant-date value of $20.875 per share. PERFORMANCE STOCK AWARDS AND OPTIONS Performance stock awards have been made to various executive officers pursuant to the 2001 Incentive Compensation Plan and the 1995 Incentive Stock Plan. The number of shares... -

Page 68

... non-employee Director of the Company will receive awards of restricted common stock each year as additional compensation for their services as a member of the Board of Directors. A maximum of 150,000 shares of common stock may be awarded under the Directors Plan and 21,000, 21,000 and 18,800 shares... -

Page 69

... of a Subsidiary Trust Holding Solely Subordinated Notes of Occidental in the accompanying consolidated financial statements. Distributions on the Trust Preferred Securities are reported under the caption minority interest in the statement of operations. Total net proceeds to Occidental were $508... -

Page 70

... -- beginning of year Service cost--benefits earned during the period Interest cost on projected benefit obligation Actuarial (gain)loss Foreign currency exchange rate changes Benefits paid Plan amendments Businesses acquired Divestitures Curtailments and settlements Pension Benefits 2001 2000... -

Page 71

... exchange rate changes Employer contribution Benefits paid Businesses acquired Divestitures Fair value of plan assets-- end of year Pension Benefits 2001 2000 254 14 (1) 8 (20 255 ========== $ 254 10 (1) 2 (18) 21 (a) (14)(b 254 ========== $ (a) (b) Relates to Oxy Permian and THUMS... -

Page 72

... in Texas operated by OxyChem. Marubeni Corporation (Marubeni) owns the remaining 21.4 percent of OxyMar, but has a 50-percent voting interest. The OxyMar VCM plant is a modern, efficient manufacturing facility. Occidental's chlorovinyls business derives economic benefit as the supplier of chlorine... -

Page 73

... consolidated financial statements using the equity method of accounting. Occidental and Sempra Energy (Sempra) each has a 50-percent interest in Elk Hills Power LLC, a limited liability company that is currently constructing a gas-fired, power-generation plant in California. Occidental accounts for... -

Page 74

... of their operations. They are managed as separate business units because each requires and is responsible for executing a unique business strategy. The oil and gas segment explores for, develops, produces and markets crude oil and natural gas domestically and internationally. The chemical segment... -

Page 75

...-down of chemical intermediate businesses and various assets Gain on sale of Durez business(a) ` Loss on foreign investment abandonment(a) Write-downs by Equistar Severance, plant shutdown, idling and plant write-down costs Gain on sale of a chemical plant by Equistar Claims and settlements 2001... -

Page 76

... in chemical in 1999, but include capitalized interest of $5 million in 2001, $3 million in 2000 and $4 million in 1999. 64 GEOGRAPHIC AREAS In millions For the years ended December 31 United States Qatar Yemen Colombia Russia Oman Canada Pakistan Ecuador Other Foreign Total Net sales(a 2001... -

Page 77

...exclude oil and gas trading activities and items such as asset dispositions, corporate overhead and interest, were as follows (in millions): FOR THE YEAR ENDED DECEMBER 31, 2001 Revenues Production costs United States ========== Latin America (a) ========== Eastern Hemisphere ========== Total... -

Page 78

...is located. Includes amounts in Latin America and Canada. 67 RESULTS PER UNIT OF PRODUCTION (Unaudited) FOR THE YEAR ENDED DECEMBER 31, 2001 Revenues from net production Oil ($/bbl.) Natural gas ($/Mcf) Barrel of oil equivalent ($/bbl.)(b,c) Production costs Exploration expenses Other operating... -

Page 79

... net production exclude royalty payments and other adjustments. 68 2001 QUARTERLY FINANCIAL DATA (Unaudited) In millions, except per-share amounts Three months ended Segment net sales Oil and gas Chemical Net sales MARCH 31 JUNE 30 Occidental Petroleum Corporation and Subsidiaries SEPTEMBER... -

Page 80

...-down the chemical intermediate businesses. Includes an after-tax gain of $39 million related to the sale of an interest in Occidental's Gulf of Mexico assets, an after-tax gain of $41 million on the receipt of a contingency payment related to a prior-year sale of a Dutch North Sea subsidiary, and... -

Page 81

.... Future cash flows were computed by applying year-end prices to Occidental's share of estimated annual future production from proved oil and gas reserves, net of royalties. Future development and production costs were computed by applying year-end costs to be incurred in producing and further... -

Page 82

... CASH FLOWS In millions AT DECEMBER 31, 2001 Future cash flows Future costs Production costs and other operating expenses Development costs(b) United States ========== Latin America (a) ========== Eastern Hemisphere ========== Total Worldwide ========== $ 28,146 $ 2,119 $ 6,619 $ 36... -

Page 83

...general and administrative and other expenses. AVERAGE SALES PRICES AND AVERAGE PRODUCTION COSTS OF OIL AND GAS For the years ended December 31 2001 Oil Gas United States ========== Latin America (a,b) ========== Eastern Hemisphere (a) ========== --- Average sales price ($/bbl.) Average sales... -

Page 84

...) 2,226 (20) 1,858 (13 Latin America 241 (--) 114 Eastern Hemisphere 951 (72) 517 (47) 32 (1) 13 (1 Total Worldwide 17,865 (318) 12,044 (214) 2,258 (21) 1,871 (14 (a) (b) The total number of wells in which interests are owned or which are operated under service contracts. The sum of... -

Page 85

...Production Millions of cubic feet per day 2001 2000 1999 50 -----------50 49 -----------49 ======== 8 ---44 -----------52 ======== 75 SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS (Unaudited) In millions Occidental Petroleum Corporation and Subsidiaries Additions Charged to Charged to Costs... -

Page 86

... "Election of Directors" in Occidental's definitive proxy statement filed in connection with its May 3, 2002, Annual Meeting of Stockholders (the "2002 Proxy Statement"). See also the list of Occidental's executive officers and related information under "Executive Officers of the Registrant" in Part... -

Page 87

... and each of its directors and certain executive officers (filed as Exhibit B to the Proxy Statement of Occidental for its May 21, 1987, Annual Meeting of Stockholders, File No. 1-9210). Occidental Petroleum Corporation Split Dollar Life Insurance Program and Related Documents (filed as Exhibit... -

Page 88

... ended March 31, 2001, File No. 1-9210). Occidental Petroleum Corporation Senior Executive Deferred Compensation Plan (effective as of January 1, 1986, as amended and restated effective as of January 1, 1996) (filed as Exhibit 10.24 to the Annual Report on Form 10-K of Occidental for the fiscal... -

Page 89

...2000, File No. 1-9210). Form of Restricted Stock Option Assignment under Occidental Petroleum Corporation 1996 Restricted Stock Plan for Non-Employee Directors (filed as Exhibit 99.2 to the Registration Statement on Form S-8 of Occidental, File No. 333-02901). Incorporated herein by reference 79 -

Page 90

... Plan Occidental Petroleum Corporation Executive Incentive Compensation Plan (filed as Exhibit 10.2 to the Quarterly Report on Form 10-Q of Occidental for the quarterly period ended March 31, 2001, File No. 1-9210) Master Transaction Agreement, dated May 15, 1998, by and among Equistar Chemicals... -

Page 91

... Stephen I. Chazen, Chief Financial Officer and Executive Vice President - Corporate Development. 2. Current Report on Form 8-K dated October 17, 2001 (date of earliest event reported), filed on October 17, 2001, for the purpose of reporting, under Item 5, Occidental's results of operations for the... -

Page 92

... Hirl /s/ DALE R. LAURANCE Dale R. Laurance TITLE ----Chairman of the Board of Directors and Chief Executive Officer Executive Vice President Corporate Development and Chief Financial Officer Vice President and Controller (Chief Accounting Officer) Director DATE ---March 13, 2002 March 13, 2002... -

Page 93

...under Occidental Petroleum Corporation 2001 Incentive Compensation Plan Statement regarding computation of total enterprise ratios of earnings to fixed charges for the five years ended December 31, 2001 List of subsidiaries of Occidental at December 31, 2001 Consent of Independent Public Accountants... -

Page 94

... December, 2001, by and between Occidental Petroleum Corporation, a Delaware corporation (hereinafter referred to as "Employer"), and J. Roger Hirl (hereinafter referred to as "Employee"). WITNESSETH: WHEREAS, Employee has been serving as President and Chief Executive Officer of Occidental Chemical... -

Page 95

... under this Agreement or the Consulting Agreement. (d) Compliance with Company Policies. In performing all duties and services hereunder, Employee shall comply with Employer's Code of Business Conduct and Corporate Policies, as the same may be amended from time to time. 2 (e) Change of Duties... -

Page 96

... employee benefit plans of Employer, in which he is participating at the time of the notice and so long as such plans are available to salaried employees and senior executives, and (ii) exercise all stock options previously granted to Employee under Employer's Stock Option and Incentive Stock Plans... -

Page 97

...beneficial owner, directly or indirectly, of 25% or more of the combined voting power of Employer's then outstanding voting securities. IN WITNESS WHEREOF, the parties hereto have executed this Agreement the day and year first above written. OCCIDENTAL PETROLEUM CORPORATION By /s/ RAY R. IRANI Dr... -

Page 98

... information, manufacturing information, plant design, location or operation, financial results, reports or similar information, or any other OPC confidential information affecting or concerning the business or operation of OPC or any of its directors, officers or employees developed, acquired... -

Page 99

... as an employee, officer or director of either OPC or its subsidiaries pursuant to either OPC's by-laws, its Directors and Officers Liability Insurance or any other of its insurance applicable thereto, Consultant absolutely and forever releases and discharges Occidental Petroleum Corporation and its... -

Page 100

... arbitration conducted in Los Angeles, California in accordance with the then current rules of the American Arbitration Association in effect in Los Angeles, California applicable to employment disputes. In the event the parties are unable to agree upon an arbitrator, they shall select from a list... -

Page 101

... beneficial owner, directly or indirectly, of 25% or more of the combined voting power of Employer's then outstanding voting securities. - 5 - IN WITNESS WHEREOF, the parties have caused this Agreement to be executed the day and year first hereinabove written. OCCIDENTAL PETROLEUM CORPORATION By -

Page 102

... Board has exclusive jurisdiction; claims by the Employer for injunctive and/or other equitable relief for intellectual property, unfair competition and/or the use and/or unauthorized disclosure of trade secrets or confidential information; and claims based upon an employee pension or benefit plan... -

Page 103

...Arbitration Act, California Code of Civil Procedure Section 1981 et seq. 3.2 The Arbitrator shall apply the substantive law (and the law of remedies, if applicable) of the State of California, or federal law, or both, as applicable to the Claims asserted. 4. Binding Effect 4.1 The arbitration Award... -

Page 104

... and work product doctrine, and any applicable state or federal law regarding confidentiality of documents and other information (including, without limitation, pursuant to rights of privacy). 7.4 The Arbitrator shall decide the relevance of any evidence offered, and the Arbitrator's decision on... -

Page 105

... days' duration each. 8.6 Physical and/or mental examinations may be conducted in accordance with the standards established by the Federal Rules of Civil Procedure. 8.7 At a mutually agreeable date, the parties will exchange lists of experts who will testify at the arbitration. Each party may depose... -

Page 106

... and dated by the Arbitrator. The Award shall decide all issues submitted, shall contain express findings of fact and law (including findings on each issue of fact and law raised by a party), and provide the reasons supporting the decision including applicable law. The Arbitrator shall give signed... -

Page 107

... Date of Grant between OCCIDENTAL PETROLEUM CORPORATION, a Delaware corporation ("Occidental") and, with its subsidiaries, (the "Company"), and Grantee. 1. GRANT OF RESTRICTED COMMON SHARES. In accordance with this Agreement and the Occidental Petroleum Corporation 2001 Incentive Compensation Plan... -

Page 108

..., and, if applicable a new certificate for any nonforfeitable Restricted Common Shares represented by a cancelled certificate will be issued. 6. NO EMPLOYMENT CONTRACT. Nothing in this Agreement confers upon the Grantee any right with respect to continued employment by the Company, nor limits in any... -

Page 109

... and enforcement of this Agreement. IN WITNESS WHEREOF, the Company has caused this Agreement to be executed on its behalf by its duly authorized officer and Grantee has also executed this Agreement in duplicate, effective as of the Date of Grant. OCCIDENTAL PETROLEUM CORPORATION By Grantee 3 -

Page 110

... Date of Grant between OCCIDENTAL PETROLEUM CORPORATION, a Delaware corporation ("Occidental") and, with its subsidiaries, (the "Company"), and Grantee. 1. GRANT OF TARGET PERFORMANCE SHARES. In accordance with this Agreement and the Occidental Petroleum Corporation 2001 Incentive Compensation Plan... -

Page 111

... this Grant as permitted by Section 4.2.3 of the Plan. 8. NO EMPLOYMENT CONTRACT. Nothing in this Agreement confers upon the Grantee any right with respect to continued employment by the Company, nor limits in any manner the right of the Company to terminate the employment or adjust the compensation... -

Page 112

..., the Company has caused this Agreement to be executed on its behalf by its duly authorized officer and Grantee has also executed this Agreement in duplicate, effective as of the Date of Grant. OCCIDENTAL PETROLEUM CORPORATION By 4 2001 INCENTIVE COMPENSATION PLAN 2002 GRANT TO OPC/OXY INC... -

Page 113

--------Ranking --------1 --------2 --------3 --------4 --------5 --------6 --------7 --------8 --------9 --------- ---------9 COS. ---------200% ---------175% ---------150% ---------125% ---------100% ---------75% ---------50% ---------25% ---------0% ---------- ---------8 COS. ---------200% ... -

Page 114

...OCCIDENTAL PETROLEUM CORPORATION AND SUBSIDIARIES COMPUTATION OF TOTAL ENTERPRISE RATIOS OF EARNINGS TO FIXED CHARGES FOR THE FIVE YEARS ENDED DECEMBER 31, 2001 (Amounts in millions, except ratios) Income from continuing operations(a) 2001...(b) Portion of lease rentals representative of the... -

Page 115

..., Inc. Occidental Andina, LLC Occidental Chemical Chile S.A.I. Occidental Chemical Corporation Occidental Chemical Holding Corporation Occidental Crude Sales, Inc. (International) Occidental de Colombia, Inc. Occidental Energy Marketing, Inc. Occidental Exploration and Production Company Occidental... -

Page 116

... public accountants, we hereby consent to the incorporation by reference of our report, dated February 8, 2002, appearing in Occidental Petroleum Corporation's Annual Report on Form 10-K for the year ended December 31, 2001, into Occidental Petroleum Corporation's previously filed Registration...