Nissan 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

* Based on continuation of proportionate consolidation of China JV

523.5 605.7

+70.4

–266.5

–24.2 –36.8 –72.1 –38.8

+247.6

+202.6

800.0

600.0

400.0

200.0

0

2014201320122009 2010 2011

537.5

311.6

545.8 523.5

605.7

498.4535.0

12,000.0

6,000.0

9,000.0

3,000.0

0

2014201320122010 2011

8,773.1 9,409.0

7,517.3

9,629.6

11,434.8

10,482.5

10,790.0

2009

2014201320122010 2011

319.2

42.4

341.4 342.4

389.0 405.0

2009

600.0

450.0

300.0

150.0

0

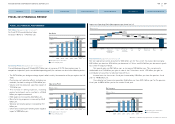

FISCAL 2013 FINANCIAL REVIEW

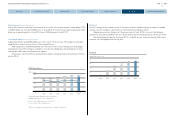

Net Sales (Management pro forma basis*)

For fiscal 2013, consolidated net sales

increased 18.7%, to 11.43 trillion yen.

Operating Profit (Management pro forma basis*)

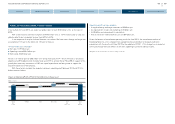

Consolidated operating profit totaled 605.7 billion yen, an increase of 15.7% from previous year. In

comparison to previous year’s consolidated operating profit, the variance was due to the following factors:

l The 247.6 billion yen foreign exchange impact reflects mainly the correction of the yen against the U.S.

dollar.

l Purchasing cost reduction efforts, including raw

materials, resulted in savings of 202.6 billion yen.

l Volume and mix produced a positive impact of

70.4 billion yen

l The increase in selling expenses, including

product enrichment costs, resulted in a 266.5

billion yen negative movement.

l R&D expenses increased by 24.2 billion yen.

l Manufacturing expenses increased by 36.8

billion yen.

l Warranty and recall expenses increased by 72.1

billion yen.

l Other items including remarketing had a negative

impact of 38.8 billion yen.

Net income (Management pro forma basis*)

Net non-operating income amounted to 53.3 billion yen for the current fiscal year, decreasing by

59.1 billion yen due to a 32.4 billion yen decrease in FX loss and 30.0 billion yen decrease in profit

loss under the equity method.

Net special gain was 26.0 billion yen, an increase of 38.6 billion yen. This was primarily

attributable to a 16.3 billion yen gain on sale of the CV business and a 12.2 billion yen gain on

contribution of securities to retirement benefit trust.

Income taxes for the current fiscal year increased by 3.5 billion yen from the previous fiscal

year to 149.8 billion yen.

Consolidated net income increased by 46.6 billion yen from 342.4 billion yen for the previous

fiscal year to 389.0 billion yen for the current fiscal year.

FISCAL 2013 FINANCIAL PERFORMANCE Impact on Operating Profit (Management pro forma basis*)

(Billions of yen)

FY12

O.P.

Purch. cost

reduction

(Including raw

material)

Selling exp. /

product

enrichment

MFG

exp.

FOREX Volume/

mix

R&D

exp.

Warranty &

Recall exp.

Other

Items

FY13

O.P.

Net income

(Billions of yen)

(FY)

(Forecast)

Operating Profit

(Billions of yen)

(FY)

(Forecast)

Net Sales

(Billions of yen)

(FY)

(Forecast)

Management pro forma basis*

China JV Equity basis

Management pro forma basis*

China JV Equity basis

Management pro forma basis*

China JV Equity basis

25

NISSAN MOTOR CORPORATION ANNUAL REPORT 2014

PERFORMANCE

CONTENTS

CORPORATE FACE TIME

CEO MESSAGE

EXECUTIVE PROFILE

NISSAN POWER 88

CORPORATE GOVERNANCE