Nissan 2014 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2014 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

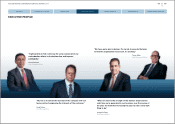

Joseph G. Peter

Chief Financial Officer

Marking his fifth year as Chief Financial Officer (CFO), Joseph Peter says:

“We know what we need to do in terms of product, quality, revenue

management, and in the cost side of the business. Our margin-objective is

within our line of sight, and we are moving forward.”

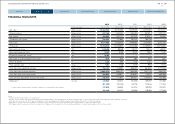

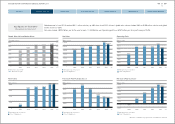

That forward momentum was reflected in the last fiscal year. On a pro-

forma basis, Nissan reported consolidated net sales up 18.7% to 11.43 trillion

yen for the 12 months to March 31, 2014. Operating profit increased by

15.7% to 605.7 billion yen, and net income rose 13.6% to 389 billion yen*.

Auto business free cash flow was a positive 208.1 billion yen for the

fiscal period, contributing to a year-end net cash position of 1.13 trillion yen in

Nissan’s automotive business. The CFO regards the generation of free cash

flow and the creation of a strong balance sheet as some of the highlights of

his tenure. Since Peter assumed the role, Nissan’s credit rating has been

upgraded and the company has moved from a net debt to a strong net cash

position.

“As we began the Power 88 plan, we were focused on solid free cash

flow,” Peter recalls. “We had an objective to generate 1.5 trillion yen over the

period of the plan. Over the first three years we are more than 50% there.”

It is a creditable performance given some of the headwinds that Nissan

has faced since the start of the plan. “We started our Power 88 mid-term plan

with the stress of natural disasters, first in Japan and then in Thailand,” says

Peter. “We were able to recover faster than others because of the teamwork

by Nissan’s members across multiple disciplines.”

Since then, the company has benefited from a correction in the value of

the yen, although Peter maintains it remains overvalued compared to the

average historic exchange rate against the US dollar. Nissan, moreover, has

not enjoyed the same “bounce” from the yen correction as some other

Japanese carmakers.

Peter argues that there are better indicators of business strength than

favorable currency movements. “When you look at the measure of out-

performance attributed to other companies, you need to be clear what is

driving that performance.

“At Nissan our sales performance has exceeded that of our key

competitors in key markets around the world, particularly the US and China.

“From a financial perspective, the impact of the yen-correction has been

less favorable for Nissan than others. That is because we previously took

steps to realign our cost and revenue footprint. We have been shifting

production to important markets − it’s better in the long term to have more

products manufactured where they are sold.”

As Nissan embarks on the second half of its Power 88

business plan, Joseph Peter remains focused on the key

financial metrics, cost discipline and free cash flow that is

central to the company’s mid-term strategy.

* Since the beginning of fiscal 2013, Nissan has reported figures calculated under the equity method

accounting for its joint venture with Dongfeng in China. Although net income reporting remains

unchanged under this accounting method, the equity-accounting income statements no longer include

Dongfeng-Nissan's results in revenues and operating profit. Under the equity accounting method,

Nissan reported revenues up 20% to 10.48 trillion yen for the 12 months to March 31 2014, and

operating profit increased by a healthy 13.6% at 498.4 billion yen.

14

NISSAN MOTOR CORPORATION ANNUAL REPORT 2014

EXECUTIVE PROFILE

CONTENTS

CORPORATE FACE TIME

PERFORMANCE

NISSAN POWER 88

CORPORATE GOVERNANCE

CEO MESSAGE