Nissan 2014 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2014 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

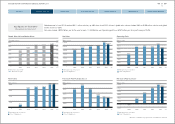

The plant investments associated with this strategy will enable Nissan to

adjust capacity to local demand, particularly serving fast-growing emerging

markets.

Peter explains: “In the second half of the Power 88 plan, we will begin to

leverage these investments, which should close the gap in profit margins

against the competitor set.” A solid financial return on those new investments

is also expected to coincide with improved cost controls in mature markets

such as North America. The CFO admits: “We had some difficulties in 2012 in

the US with regards to new vehicle launches and quality. So our first priority

was to reignite the US market. We have done that, and we have grown at

two-to-three times the pace of some competitors. Now we are venturing into a

strategic timeframe in which the ‘flywheel’ has been reset. The focus is now

on transforming our market momentum into improved business performance

through revenue-management and cost efficiency.”

As part of that exercise, Nissan is paying particular attention to the total

delivered cost of its vehicles: seeking efficiencies that will enhance per-unit

margins even in a tough competitive market. Alongside that initiative, Nissan is

pursuing further synergies from its long-running alliance with Renault of

France. Under a recently announced convergence plan, the Renault-Nissan

Alliance now aims to lift annualized synergies to at least €4.3 billion by 2016.

This gives the CFO confidence that Nissan can meet its 8% commitment

to a sustainable operating profit margin, calculated on the company’s pro-

forma consolidated earnings including contributions from its Chinese joint

venture operations. Nissan is also continuing to target 8% global market

share − a goal that Peter describes as “the north star for us.” He adds: “When

we think about the action we’re taking on brand and sales power, and the

potential of the product portfolio, coupled with our leadership in electric

vehicles, expansion in emerging markets and adoption of new technologies

− then we believe the potential for 8% market share is there.”

He acknowledges that the company’s targets could be disrupted by

market volatility, as was evident in several emerging countries in the past

fiscal year, or policy changes such as Japan’s decision to increase its sales

tax. But the CFO is confident that such issues will not deflect Nissan from its

strategic course.

“When we look at the Japanese market over the first couple of months

of the current fiscal year, we have seen some negative impact on unit sales.

But the amount of reduction is less than we anticipated.”

The modest impact of such moves, combined with improving revenue-

management, demand for new products and better cost controls, is expected

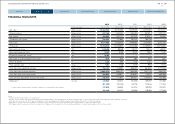

to contribute to net sales of 10.79 trillion yen for the current fiscal year. The

company has also predicted an operating profit of 535 billion yen –

representing a margin of 5% − based on a financial outlook for the 12

months to March 31, 2015 (calculated under the equity accounting method

for Nissan’s Chinese joint venture).

This forecast and further generation of automotive free cash flow has

enabled the company to increase its outlook for the fiscal 2014 full-year

dividend by 10% to 33 yen per share. Over the balance of the Power 88

mid-term plan, the company has also increased the minimum targeted pay out

ratio from 25% to 30% of net income.

After five years of managing Nissan’s balance sheet, improving its

liquidity and enhancing financial controls, the CFO indicates that shareholders

should also share in the benefits. He concludes: “When we look at the

strength of the balance sheet and the cash flow we’ve generated in our

business over the course of the plan, we think that increasing the pay out ratio

is the right thing to do.”

15

NISSAN MOTOR CORPORATION ANNUAL REPORT 2014

EXECUTIVE PROFILE

CONTENTS

CORPORATE FACE TIME

PERFORMANCE

NISSAN POWER 88

CORPORATE GOVERNANCE

CEO MESSAGE