Navy Federal Credit Union 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union • 2013 Financial Section

50

2013 ANNUAL REPORT

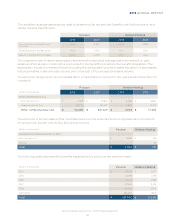

(dollars in thousands)

$

Net gains/(losses)

Originations 52,773

Payos/Maturities (39,642)

(Loss) on changes in value of MSRs (11,410)

$

Change in unrealized losses related to financial instruments

still held at December 31, 2012 $ (12,650)

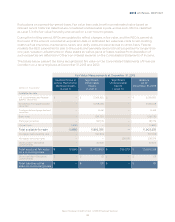

The tables below present the items measured at fair value on the Consolidated Statements of Financial

Condition on a non-recurring basis where assets that are measured at the lower of cost or fair value less

costs to sell were recognized at fair value less costs to sell at December 31, 2013 and December 31, 2012:

(dollars in thousands)

Active Markets for

Identical Assets

Observable

Unobservable

as of

Other real estate owned $ — $ — $ 21,403 $ 21,403

$ — $ — $ $

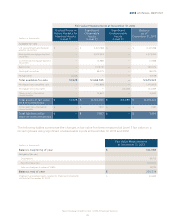

(dollars in thousands)

Active Markets for

Identical Assets

Observable

Unobservable

as of

Other real estate owned $ — $ — $ 15,244 $ 15,244

$ — $ — $ $

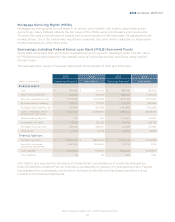

NOTE 22:

ASC 825-10, Fair Value of Financial Instruments—Disclosure, requires disclosure of estimated fair values

of financial instruments, including those financial instruments for which Navy Federal did not elect

fair value treatment. The financial instruments that are accounted for under ASC 820-10, Fair Value

Measurement, are disclosed separately in Note 21. Navy Federal discloses fair value information for its

financial instruments, whether recognized at fair value on the Consolidated Statements of Financial

Condition or not, and for which it is practicable to estimate that value. In cases where quoted market

prices are not available, fair values are based on estimates using present value or other valuation

techniques. Those techniques are significantly aected by the assumptions used, including the discount

rate and estimates of future cash flows. In that regard, the derived fair value cannot be substantiated by

comparison to independent markets and, in many cases, could not be realized in immediate settlement

of the instrument. Certain financial instruments and all non-financial instruments are excluded from these