Navy Federal Credit Union 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union • 2013 Financial Section

20

2013 ANNUAL REPORT

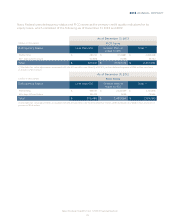

Changes in the allowance for loan losses during the years ended December 31, 2013 and 2012 were

as follows:

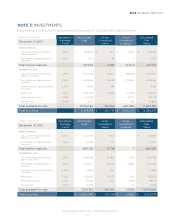

(dollars in thousands)

Credit Cards Real Estate Other Total

$ $ $ $ $

Provision charged to operations 192,707 212,850 50,041 — 455,598

Provision for unfunded

commitment 1,030 11,391 — — 12,421

Loans charged o (234,978) (209,022) (79,776) — (523,776)

Recoveries 41,208 12,041 7,518 2 60,769

Ending balance: loans individually

evaluated for impairment 62,167 54,240 100,175 — 216,582

Ending balance: loans collectively

evaluated for impairment 166,360 197,207 39,765 249 403,581

Ending balance: loans acquired

with deteriorated credit quality 8,831 — 10,245 — 19,076

Ending balance: loans individually

evaluated for impairment $ 352,477 $ 207,491 $ 499,016 $ — $ 1,058,984

Ending balance: loans collectively

evaluated for impairment 11,704,908 7,919,993 19,388,543 — 39,013,444

Ending balance: loans acquired with

deteriorated credit quality 6,587 — 45,529 — 52,116

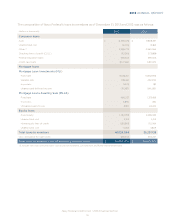

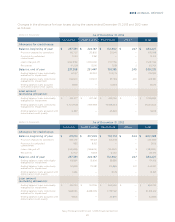

(dollars in thousands)

Credit Cards Real Estate Other Total

$ $ $ $ $

Provision charged to operations 180,479 159,123 106,478 — 446,080

Provision for unfunded

commitment 952 8,157 — — 9,109

Loans charged o (196,948) (169,625) (115,254) 3 (481,824)

Recoveries 42,747 9,263 6,464 — 58,474

Ending balance: loans individually

evaluated for impairment 63,864 51,906 58,389 — 174,159

Ending balance: loans collectively

evaluated for impairment 165,831 172,281 105,888 247 444,247

Ending balance: loans acquired with

deteriorated credit quality 7,696 — 8,125 — 15,821

Ending balance: loans individually

evaluated for impairment $ 254,513 $ 142,756 $ 465,964 $ — $ 863,233

Ending balance: loans collectively

evaluated for impairment 9,881,154 6,658,495 17,791,561 — 34,331,210

Ending balance: loans acquired with

deteriorated credit quality 9,806 — 52,879 — 62,685