Navy Federal Credit Union 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union • 2013 Financial Section

41

2013 ANNUAL REPORT

Retiree Medical Plan (the Plan)

Navy Federal provides post-retirement benefits to certain retired employees in the form of a

contributory group medical plan and supplemental retirement income to oset the cost of medical

insurance premiums or out-of-pocket medical expenses. Under the provisions of the Plan, the retirees

are responsible for the payment of most of the medical insurance premiums. The supplemental

retirement income benefit is an annual benefit of $75 or $100 (depending on the retiree’s age on

September 1, 2008), multiplied by the number of years of continuous service the retiree provided

Navy Federal. There are no assets set aside to pre-fund the liability associated with the Plan.

Medical cost trends have a negligible impact on the determination of the retiree medical benefit

obligation. Employees hired on or after January 1, 2009 will not receive the medical supplement but

will be eligible for medical coverage at age 55 with 10 years of service by paying full cost.

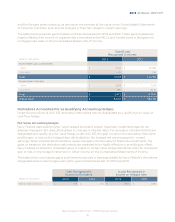

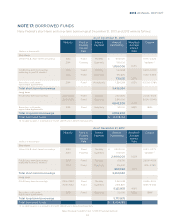

The following table sets forth the over/(under) funded status of the pension and retiree medical

benefit plans:

Retiree Medical

(dollars in thousands)

Fair value of plan assets $ 1,141,342 $ 973,676 $ — $ —

Benefit obligations 856,149 936,457 44,559 50,090

$ $ $ $

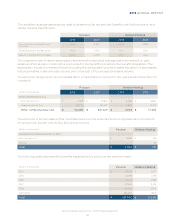

The weighted-average assumptions used to determine the projected benefit obligation for the pension

and retiree medical benefit plans were as follows:

Retiree Medical

Discount rate 5.05% 4.10% 5.05% 4.10%

Rate of compensation increase 4.25% 4.25% N/A N /A

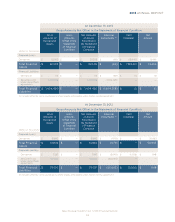

The following table sets forth the net periodic benefit cost, contributions received, and benefits paid for

the benefit plans:

Retiree Medical

(dollars in thousands)

Benefit cost $ 24,889 $ 30,268 $ 5,142 $ 4,949

Employer contribution 25,000 55,000 1,200 1,680

Plan participants’ contributions — — 1,401 720

Benefits paid 29,884 30,035 2,602 2,400