Navy Federal Credit Union 2013 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2013 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union • 2013 Annual report

3

2013 was a monumental year for Navy Federal. New members chose Navy Federal in record

numbers. They joined for the valuable products and services we oer, and for our reputation for

trustworthiness and putting the best interests of our members first. The many achievements of

2013 took place during a year in which we experienced a government shutdown, a resurgence in

the housing market, and a continuing digital explosion that is changing the way members manage

their finances and communicate with us. As always, we strive to anticipate our members’ changing

financial needs by delivering innovative products and services, while remaining true to our guiding

principles of service, commitment, and integrity.

2013—Behind The Numbers

As we look back on our 80th year of service, it is important to remember that behind the

numbers is a member who got a new car, bought a first house, or started saving for retirement.

These are real individuals with real needs, whom Navy Federal is proud to help and to serve.

Nearly 700,000 new members joined Navy Federal in 2013,

bringing total membership to 4.7 million, an 11% increase

over the previous year. This was also the year we welcomed

the U.S. Coast Guard into our field of membership. Why did

so many individuals choose Navy Federal? The reasons are

many. For some, it’s the appeal of low loan rates—maybe

to get that new car. Many join on the recommendation of a

friend, family member, or coworker. Active Duty members

appreciate Navy Federal’s expanding branch presence around

military installations. These new members are very engaged,

depositing nearly $1 billion and taking out over $1 billion in

consumer and mortgage loans.

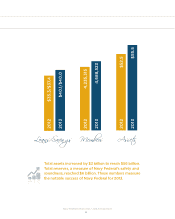

Navy Federal’s members clearly embrace the virtue of thrift, adding nearly $3 billion in deposits

during 2013. By year end, total savings stood at $40 billion, an increase of 7%. Member investments

through Navy Federal Financial Group, our subsidiary, increased by 27% to reach $1.8 billion.

Navy Federal Financial Group oers investment services, insurance products, and financial

planning to our members.

Our checking accounts, which feature dividends, no fees, free debit cards, and mobile deposit

capability, also experienced record growth. The number of checking accounts increased by

13% to surpass 3 million. Active Duty Checking® remains a popular favorite of our young military

members. They appreciate the early posting of pay and ATM fee rebates of up to $20 per month.

Checking accounts with direct deposit increased 13% to 1.5 million accounts. Direct deposit is a

key indicator that the member views Navy Federal as their primary financial institution. By year

end, members had $7 billion on deposits in checking accounts.

Report of the Chairman & President

As we look back on our

80th year of service, it is

important to remember

that behind the numbers

is a member who got a

new car, bought a first

house, or started saving

for retirement.