Navy Federal Credit Union 2013 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2013 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Navy Federal Credit Union • 2013 Financial Section

6

2013 ANNUAL REPORT

NOTE 1:

Organization

Navy Federal Credit Union is a member-owned, not-for-profit financial institution formed to provide a

variety of financial services to those individuals in its field of membership, which includes military and

civilian personnel who are or were employed by the Department of Defense and their families.

Basis of Presentation and Consolidation

The consolidated financial statements include the accounts of Navy Federal Credit Union and its

consolidated entities presented in accordance with accounting principles generally accepted in the

United States of America (GAAP). Navy Federal Credit Union consolidates its wholly-owned entities.

All significant intercompany accounts and transactions are eliminated in consolidation.

Navy Federal Financial Group (NFFG) is a credit union service organization wholly owned by

Navy Federal Credit Union that provides investment, insurance, and other financial services to

members of Navy Federal Credit Union. Navy Federal Brokerage Services and Navy Federal Asset

Management are wholly-owned subsidiaries of NFFG. In this Annual Report, Navy Federal Credit

Union and its consolidated entities are called “Navy Federal.”

Navy Federal evaluated subsequent events through March 27, 2014, the date these financial statements

were issued.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management

to make estimates and assumptions that aect the reported amounts of assets, liabilities, revenues, and

expenses, and the disclosure of contingent assets and liabilities in the consolidated financial statements

and accompanying notes. Actual results could dier from those estimates.

Business Combinations

The Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 805-10,

Business Combinations, requires that all business combinations be accounted for by applying the

acquisition method. Accordingly, Navy Federal recognizes assets obtained and liabilities assumed in

a business combination at fair value on the acquisition date and includes the results of operations of

the acquired entity on its Consolidated Statements of Income from the acquisition date. Navy Federal

recognizes as goodwill the excess of acquisition price over the fair value of net assets acquired.

Cash

Cash includes cash and balances due from other financial institutions.

Short-Term Investments

Short-term investments include federal funds sold and securities purchased under agreements to resell,

all of which have original maturities of 90 days or less. As of December 31, 2013 and 2012, all short-term

investments were carried at cost, which approximated fair value.

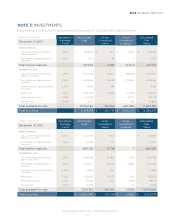

Investments

Navy Federal’s securities are classified as held-to-maturity (HTM) or available-for-sale (AFS) in

accordance with ASC 320-10, Investments—Debt and Equity Securities. Securities classified as HTM are

carried at cost, adjusted for the amortization of premiums and accretion of discounts. Management

has the ability and intent to hold these securities to maturity. Securities classified as AFS are carried at

fair value, with any unrealized gains and losses recorded as accumulated other comprehensive income

(AOCI), which is a separate component of members’ equity. See Note 3 for details. Gains and losses