Navy Federal Credit Union 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union • 2013 Financial Section

13

2013 ANNUAL REPORT

NOTE 3:

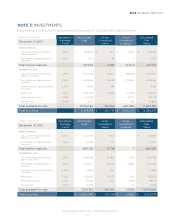

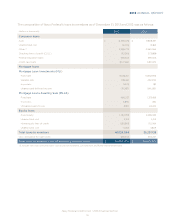

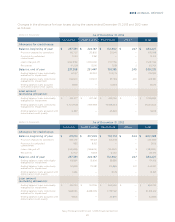

Navy Federal’s HTM and AFS securities as of December 31, 2013 and 2012 were as follows:

(dollars in thousands) Weighted-

Average

Yield

Amortized

Cost

Unrealized

Unrealized

(Losses)

Estimated

Fair

U.S. government and federal

agency securities 2.32% $ 359,922 $ 4,417 $ (4,506) $ 359,833

Residential mortgage-backed

securities 0.58% 17,112 68 (1) 17,179

Available-for-sale

U.S. government and federal

agency securities 2.19% 5,047,768 111,077 (88,925) 5,069,920

Residential mortgage-backed

securities 2.58% 5,165,966 63,346 (170,844) 5,058,468

Commercial mortgage-backed

securities 3.07% 13,976 485 — 14,461

Bank notes 1.90% 1,552,096 24,326 (14,692) 1,561,730

Municipal securities 3.28% 210,935 — (23,159) 187,776

Mutual funds -0.08% 11,043 — (163) 10,880

Total available-for-sale

$ $ $ $

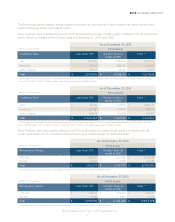

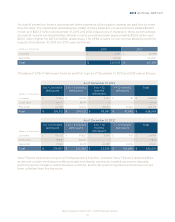

(dollars in thousands) Weighted-

Average

Yield

Amortized

Cost

Unrealized

Unrealized

(Losses)

Estimated

Fair

U.S. government and federal

agency securities 2.47% $ 440,256 $ 15,612 $ — $ 455,868

Residential mortgage-backed

securities 0.62% 29,496 126 — 29,622

—

Available-for-sale

U.S. government and federal

agency securities 2.30% 5,998,082 304,812 (1,106) 6,301,788

Residential mortgage-backed

securities 2.12% 4,512,747 163,130 (1,884) 4,673,993

Commercial mortgage-backed

securities 2.90% 13,969 1,019 — 14,988

Bank notes 2.33% 1,525,505 55,037 (791) 1,579,751

Municipal securities 3.33% 95,952 2,412 (289) 98,075

Mutual funds -0.07% 10,939 — (11) 10,928

Total available-for-sale

$ $ $ $