Navy Federal Credit Union 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union • 2013 Financial Section

43

2013 ANNUAL REPORT

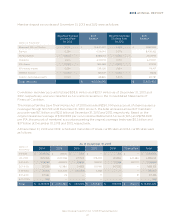

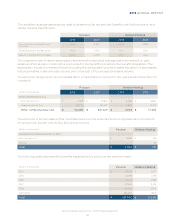

The anticipated employer contribution for 2014 is $25.0 million for the pension plan and $2.1 million for

the retiree medical benefit plan. The accumulated benefit obligation for the pension plan was $774.8

million and $828.5 million at December 31, 2013 and 2012, respectively. The measurement date for the

pension and retiree medical benefit plan for 2013 and 2012 was December 31.

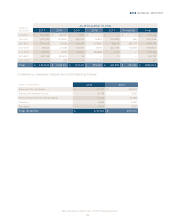

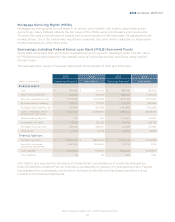

The investment strategy of the Navy Federal Credit Union Employees’ Retirement Plan is to employ

an investment approach, whereby a mix of equity and fixed income investments are used to maximize

the long-term return of plan assets at a prudent level of risk that includes consideration of benefit

obligation volatility. The intent of this strategy is to minimize contributions and keep the Plan well-

funded over the long run. Risk tolerance is established through careful consideration of plan liabilities,

plan-funded status, and Navy Federal’s financial condition. Investment risk is measured and monitored

on an ongoing basis through annual liability measurements, periodic asset/liability studies, and

quarterly investment portfolio reviews.

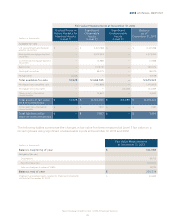

At December 31, 2013, the target allocation of plan assets was 25% U.S. equity securities, 40% global

equity securities, and 35% fixed income securities. Most of the U.S. equity assets are invested in a large

company index fund with the balance invested in mid- and small-company equity securities. Most of

the global equity allocation is in developed markets around the world, but investment managers are

allowed to invest in emerging markets, which make up approximately 11% of global equity markets. The

fixed income allocation comprises a small allocation to cash to provide liquidity for benefit and expense

payments, with the balance invested in intermediate- and long-term bonds, the majority of which are

investment grade.

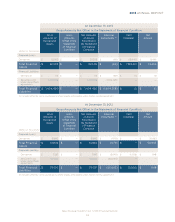

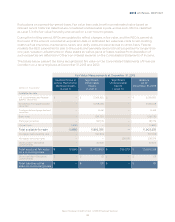

The fair values of the Navy Federal Employees’ Retirement Plan assets, disclosed within their respective

fair value hierarchy (as described further in Note 21) at December 31, 2013 and 2012 were as follows:

(dollars in thousands)

Quoted Prices in

Active Markets

for Identical Assets

Significant

Observable Inputs

Significant

Unobservable

Inputs

Balance

as of

December 31, 2013

U.S. equity securities $ 57,121 $ 237,258 $ — $ 294,379

Global equity securities 465,563 — — 465,563

Intermediate-term fixed

income securities 68,732 135,877 — 204,609

Long-term fixed income securities 161,398 — — 161,398

Cash 15,393 — — 15,393

Total $ $ $ — $