Navy Federal Credit Union 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NAVY FEDERAL CREDIT UNION40

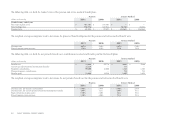

Investments, Including Mortgage-Backed Securities

Fair value is based on quoted market price, if available. If a quoted market price is not available, fair value is estimated using quoted market prices for

similar securities. For repurchase agreements and reverse repurchase agreements, due to their short-term nature, the carrying amount is a reasonable

estimate of fair value.

Cash and Cash Equivalents

Cash and cash equivalents include cash and balances due from banks and credit unions, all of which mature within 90 days. e carrying amount

reported approximates fair value for vault cash and demand balances from other nancial institutions. Fair value for short-term securities is based

on quoted market prices.

Members’ Accounts

e fair value of Savings, Money Market Savings, Checking and Individual Retirement Account (IRA) share accounts is the amount payable on

demand at the reporting date. For IRA Certicate and Share Certicate accounts, fair value is estimated using the discounted value of future cash ows

based upon market interest rates and remaining maturity.

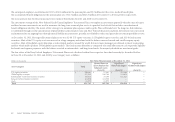

Derivative Instruments and Hedging Activities

Navy Federal does not receive loan commitment fees. e fair value of loan commitments is based upon dierences between the contracted rate

and the current market rate of comparable mortgage loans. e fair value of forward contracts is based on the quoted market price of contracts with

similar characteristics. It is the established practice of Navy Federal to only purchase forward contracts to cover mortgage loans in process which are

anticipated to close for delivery into these forward contracts. Accordingly, the cost to terminate existing contracts, which is based on current market

prices, is not material to Navy Federal.

Mortgage Servicing Rights (MSRs)

Mortgage Servicing Rights do not trade in an active, open market with readily observable prices. Accordingly, Navy Federal obtains the fair value

of the MSRs using a third-party pricing provider. e provider uses a combination of market and income valuation methodologies. All assumptions

are market driven. Once the preliminary results are complete, they are further calibrated to observable market transactions, when they exist.

Federal Home Loan Bank (FHLB) Borrowed Funds

FHLB debt is comprised of both short-term (operational) and long-term (strategic) debt. e fair value of FHLB borrowings is based on the present

value of future discounted cash ows using implied forward rates.