Navy Federal Credit Union 2011 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2011 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 FINANCIAL SECTION 21

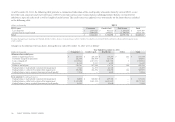

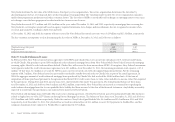

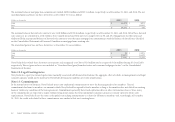

In August 2008, Navy Federal entered into a loss-sharing agreement with Fannie Mae, whereby Navy Federal must indemnify Fannie Mae for certain

loans having high LTVs. e balance of these loans as of December 31, 2011 and 2010 was $1.0 billion and $1.1 billion, respectively. Under this

contract, Navy Federal paid Fannie Mae $13.6 million and $8.0 million in 2011 and 2010, respectively. As of December 31, 2011, Navy Federal has

accrued an estimated loss of $16.6 million to cover 2012 payments to Fannie Mae, and the company’s maximum future exposure to Fannie Mae is

approximately $105.0 million.

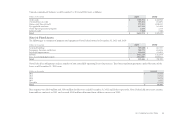

Note 10: Foreclosed Assets

Navy Federal obtains real estate owned (REO) through foreclosure proceedings or when a delinquent borrower chooses to transfer the mortgage

property in lieu of going through the foreclosure process. Foreclosure expenses are recognized in earnings as incurred.

REO is classied as held-for-sale and initially recorded at fair value less estimated costs to sell (e.g., broker commission, legal, title transfer fees and

closing costs) at the time of foreclosure or transfer. REO is carried at lower of cost or market and Navy Federal maintains a valuation allowance to

recognize further declines in fair value subsequent to foreclosure. Holding costs such as insurance, maintenance, taxes and utility costs are expensed

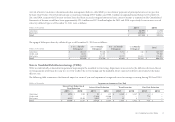

as incurred. Improvements that either increase the value or extend the life of the properties are capitalized. e cumulative total balance of REO

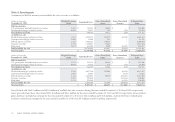

at December 31, 2011 and 2010 was as follows:

(dollars in thousands) 2011 2010

Real Estate Owned (REO) $ 49,515 $ 49,141

Valuation allowance (16,704) (19,727)

Balance, end of period $ 32,811 $ 29,414

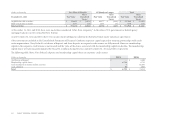

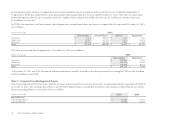

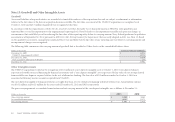

Note 11: Derivative Instruments and Economic Hedging Activities

Navy Federal is an active participant in the production of mortgage loans, which are sold to investors in the secondary market. is mortgage banking

activity involves making mortgage loan commitments to members at specied interest rates. Navy Federal is exposed to changes in the value of its

mortgage loan commitments as interest rates may change between the time that it enters into a mortgage loan commitment and the time that it

ultimately delivers that mortgage loan to an investor. To mitigate its interest rate risk, Navy Federal enters into forward sales contracts at specied

prices to deliver mortgage loans to investors. ese forward sales commitments act as an economic hedge against the risk of changes in the value

of both the mortgage loan commitments and mortgage loans held for sale. As required by ASC 815, Derivatives and Hedging (formerly known as

SFAS No. 133), Navy Federal accounts for both the mortgage loan commitments and the forward sales contracts as derivative instruments on its

Consolidated Statements of Financial Condition at fair value, with changes in fair value included in current earnings. ese derivative instruments

are economic hedges to which Navy Federal does not receive hedge accounting treatment.