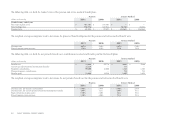

Navy Federal Credit Union 2011 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2011 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NAVY FEDERAL CREDIT UNION20

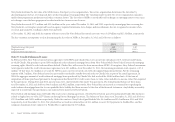

Navy Federal obtains the fair value of its MSRs from a third-party service organization. e service organization determines the fair value by

discounting projected net servicing cash ows of the remaining servicing portfolio. e valuation model used by the service organization considers

market loan prepayment predictions and other economic factors. e fair value of MSRs is mostly aected by changes in mortgage interest rates since

rate changes cause the loan prepayment acceleration factors to increase or decrease.

Navy Federal received $57.5 million and $55.4 million in the years ended December 31, 2011 and 2010, respectively, in mortgage loan servicing fees.

Navy Federal’s servicing fees are priced based on agency-required minimums. Late charges and miscellaneous fees are recognized as income when

received, and totaled $1.1 million in both 2011 and 2010.

At December 31, 2011 and 2010, the amount of loans serviced by Navy Federal for outside investors were $15.9 billion and $15.3 billion, respectively.

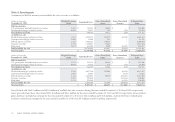

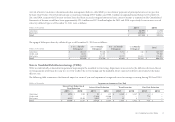

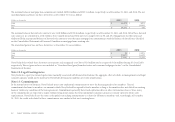

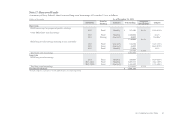

e key economic assumptions used in determining the fair value of MSRs at December 31, 2011 and 2010 were as follows:

2011 2010

Weighted average life (years) 4.60 5.40

Prepayment rate 17.93% 15.33%

Yield to maturity discount rate 10.37% 10.44%

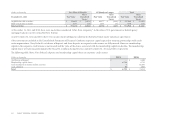

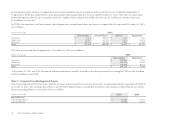

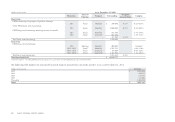

Note 9: Credit-Enhanced Loans

In February 2004, Navy Federal entered into an agreement with NFFG and Charlie Mac, LLC, an investor subsidiary of U.S. Central Credit Union,

in which Charlie Mac purchases up to $200.0 million of credit-enhanced mortgage loans from Navy Federal while Navy Federal retains the mortgage

servicing rights. Should a credit-enhanced loan default, Charlie Mac will recover the loan amount from NFFG. At inception, Navy Federal’s maximum

total exposure under the credit enhancement agreement was $8.5 million. As of December 31, 2011, the remaining maximum total exposure is $7.8

million. Of that total, $1.1 million is set aside by NFFG as non-current restricted cash with a designated nancial institution. For the remaining

amount of $6.7 million, Navy Federal issued an irrevocable transferable standby letter of credit to Charlie Mac as part of the initial agreement. In

2004, the aggregate amount of credit-enhanced mortgage loans purchased by Charlie Mac had reached the $200.0 million limit. At the time of

origination, all loans purchased pursuant to the agreement had better FICO credit scores, loan-to-value ratios and debt-to-income ratios than required

by the agreement. During 2011 and 2010, no new loans were sold to Charlie Mac under this agreement. e total principal balance of these loans

as of December 31, 2011 and 2010 was $46.3 million and $62.5 million, respectively. Navy Federal has not accrued an estimated loss regarding the

credit-enhanced mortgage loans for it is not probable that a liability had been incurred at the date of the nancial statements. Any liability reasonably

expected to result from this agreement is not expected to be material to Navy Federal.

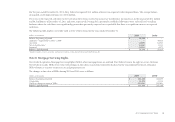

Navy Federal sold mortgage loans to Freddie Mac under a loss-sharing agreement, whereby Navy Federal agreed to indemnify Freddie Mac for losses

related to higher loan-to-value (LTV) loans not having Private Mortgage Insurance. e balance of these loans as of December 31, 2011 and 2010 was

$715.9 million and $450.4 million, respectively. Under this contract, Navy Federal paid Freddie Mac $4.4 million and $5.0 million in 2011 and 2010,

respectively. As of December 31, 2011, Navy Federal has accrued an estimated loss of $3.1 million to cover 2012 payments to Freddie Mac, and the

company’s maximum future exposure to Freddie Mac is approximately $17 million.