Navy Federal Credit Union 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 FINANCIAL SECTION 33

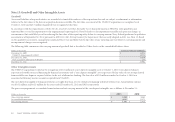

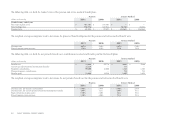

e following is a description of the valuation methodologies used for the Plan’s nancial instruments measured at fair value.

u U.S. Equity Securities & Global Equity Securities (Level 2)—As of December 31, 2011 and 2010, the Plan invested

in one and two common collective trusts, respectively, and one 103-12 investment entity (the trusts). e trusts

are valued at net asset value (NAV), which is calculated based on the underlying investments of the trusts. Most of the

underlying investments in these trusts are traded in markets that are considered to be active, but the trusts themselves

are not actively publicly traded, as they are marketed principally to institutional investors; and most trade less frequent

than daily. For those underlying investments that are not considered actively traded, the values are based on quoted

market prices, dealer quotations or valuations from pricing sources supported by observable inputs. As such, the trusts

are classied within Level 2 of the fair value hierarchy.

Interest in the trusts can generally be purchased and sold at regular intervals. e trusts can be purchased daily, monthly

or quarterly, and can be redeemed daily or monthly, depending on the investment. Contribution or redemption transaction

requests for each of the trusts generally require advance notice of two to thirty business days, depending on the investment.

Trades are usually settled no later than three business days aer the trade date.

u Intermediate Term Fixed Income Securities (Level 2)—e intermediate term xed income securities are generally

valued using benchmark yields, reported trades and broker/dealer quotes for similar assets in an active market.

ere were no signicant concentrations of risk within plan assets at December 31, 2011, as equity and xed income assets are broadly diversied.

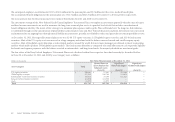

Navy Federal 401(k) Savings Plan

e Navy Federal 401(k) Savings Plan is a dened contribution plan where employees can contribute pre-tax money to a 401(k) retirement account

and receive employer matching contributions. e matching contributions are based on participation in a dened benet retirement plan. Employees

participating in the Cash Balance Plan receive a 100% employer match on the rst 6% of pay they contribute to their 401(k) account and are vested

aer completing two years of service. e employees participating in the Traditional Plan receive an employer match of 50% on the rst 6% of pay they

contribute to their 401(k) account.

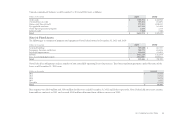

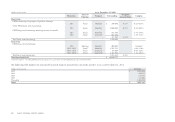

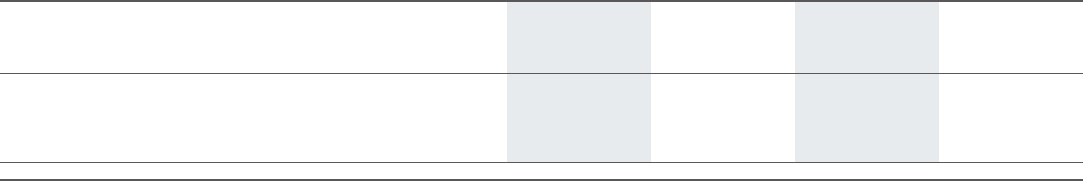

(dollars in thousands) Fair Value Measurements at December 31, 2010

Asset Category Total

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Signicant

Observable Inputs

(Level 2)

Signicant

Unobservable Inputs

(Level 3)

U.S. equity securities $ 277,194 $ 35,296 $ 241,898 $ —

Global equity securities 240,767 115,320 125,447 —

Intermediate-term xed income securities 175,716 64,677 111,039 —

Long-term xed income securities 35,370 35,370 — —

Cash 8,454 8,454 — —

Total $ 737,501 $ 259,117 $ 478,384 $ —