Navy Federal Credit Union 2011 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2011 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NAVY FEDERAL CREDIT UNION16

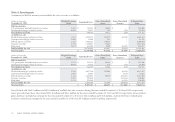

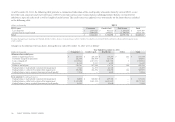

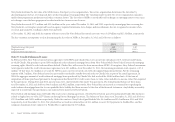

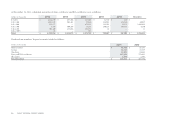

As of December 31, 2011, the following table provides a summarized indication of the credit quality of member loans by current FICO scores

for credit card, consumer and real estate loans. A FICO score takes into account various factors including payment history, current level of

indebtness, types of credit used as well as length of credit history. e credit scores are updated every two months on the loans that are included

in the following table:

(dollars in thousands) 2011

FICO score Consumer Credit Card Real Estate Total

Less than 610 $ 1,737,825 $ 952,526 $ 1,169,218 $ 3,859,569

Greater than or equal to 610 6,605,038 4,830,672 15,190,538 26,626,248

Total $ 8,342,863 $ 5,783,198 $16,359,756 $30,485,817

Excludes Mortgage Loans Awaiting Sale (MLAS) of $692.7 million, Business Consumer Loans of $12.7 million, Overdra Lines of Credit (OLOC) of $265.3 million and Participation Loans

of $30.1 million.

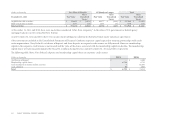

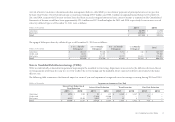

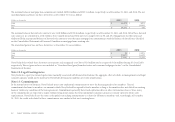

Changes in the allowance for loan losses during the year ended December 31, 2011 were as follows:

Year Ended December 31, 2011

(dollars in thousands) Consumer Credit Cards Real Estate Other Total

Allowance for credit losses

Balance, beginning of year $ 228,353 $ 228,226 $ 159,319 $ 242 $ 616,140

Provision charged to operations 162,589 166,879 121,193 — 450,661

Loans charged o (221,934) (187,153) (110,747) 2 (519,832)

Recoveries 41,153 9,317 4,949 — 55,419

Balance, end of year 210,161 217,269 174,714 244 602,388

Ending balance: individually evaluated for impairment 7,141 32,873 41,343 — 81,357

Ending balance: collectively evaluated for impairment 195,704 184,396 126,733 244 507,077

Ending balance: loans acquired deteriorated credit quality 7,316 — 6,638 — 13,954

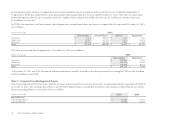

Loan amount (excluding allowance)

Ending balance: individually evaluated for impairment $ 84,053 $ 150,067 $ 439,356 $ — $ 673,476

Ending balance: collectively evaluated for impairment 8,522,590 5,633,131 16,581,637 — 30,737,358

Ending balance: loans acquired deteriorated credit quality 14,163 — 61,640 — 75,803