Navy Federal Credit Union 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 FINANCIAL SECTION 19

For the year ended December 31, 2011, Navy Federal recognized $3.5 million of interest on acquired credit-impaired loans. e average balance

of acquired credit-impaired loans was $55.6 million.

Decreases in the expected cash ows to be received on these loans resulted in an increase in allowance for loan losses in the amount of $6.1 million

and $0.3 million as of December 31, 2011 and 2010, respectively. During 2011, previously established allowances were reduced by $5.0 million

for loans where the cash ows were signicantly greater than previously expected or it is probable that there is a signicant increase in expected

cash ows.

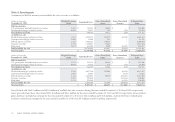

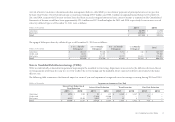

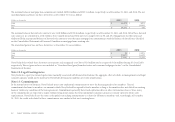

e following table displays accretable yield activity of these loans for the years ended December 31:

(dollars in thousands) 2011 2010

Balance, beginning of period $ 38,328 $ —

Additions—Acquisition October 1, 2010 — 40,414

Accretion (4,889) (1,196)

Net reclassications1(1,446) (333)

Removals (3,223) (557)

Balance, end of period $ 28,770 $ 38,328

1Includes transfers between accretable and non-accretable as well as Navy Federal and USAFCU loan IDs.

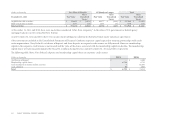

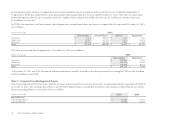

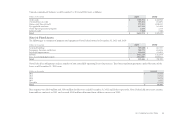

Note 8: Mortgage Servicing Rights

Navy Federal capitalizes Mortgage Servicing Rights (MSRs) when mortgage loans are sold and Navy Federal retains the right to service the loans.

Navy Federal records MSRs at fair value with changes in fair value recorded and separately disclosed in the Consolidated Statement of Income.

MSR valuation is sensitive to interest rate and prepayment risk.

e changes in fair value of MSRs during 2011 and 2010 were as follows:

(dollars in thousands) 2011 2010

Balance, beginning of period $ 161,150 168,699

Originations 32,476 31,554

(Loss) on changes in value of MSRs (51,258) (39,103)

Balance, end of period $ 142,368 $ 161,150