Navy Federal Credit Union 2011 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2011 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 FINANCIAL SECTION 11

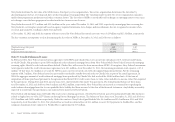

In accordance with ASC 805-10, Navy Federal monitored the original fair values and purchase price allocation of USAFCU’s assets and liabilities

for possible acquisition accounting adjustments. A review of acquisition date fair values at September 30, 2011 resulted in an acquisition accounting

adjustment of $0.26 million, which was adjusted against goodwill. As of that date, Navy Federal considered the analysis of acquisition date values

complete and the acquisition accounting for USAFCU as nal.

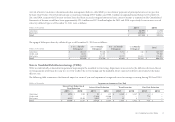

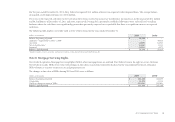

Note 3: Restrictions on Cash

Navy Federal is required to maintain balances with corporate credit unions that are classied as membership shares. ese shares are not insured by

the National Credit Union Share Insurance Fund (NCUSIF) and require three years’ notice prior to withdrawal. e required balance for Navy Federal

at both December 31, 2011 and 2010 was $6.7 million.

NFFG had $1.1 million and $1.6 million set aside in restricted cash at December 31, 2011 and 2010, respectively, as part of the agreement it entered

into with Charlie Mac, LLC.

As of December 31, 2011, Navy Federal maintained a cash balance of $50,000 as collateral for a line of credit with a corporate credit union. As of

December 31, 2010, Navy Federal maintained a cash balance of $4.0 million as collateral for a line of credit with that same corporate credit union,

$1.9 million at the Federal Reserve Bank and $3.2 million as a form of collateral for a business agreement with a major credit card issuer as of

December 31, 2010.

All restricted cash amounts except membership capital shares are classied as Other Assets on the Consolidated Statements of Financial Condition.

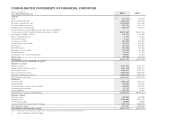

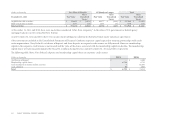

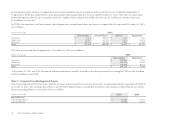

(dollars in thousands) Original Book Value Fair Value Adjustments Final Fair Value Allocation

ASSETS

Cash $ 31,754 $ — $ 31,754

Securities available-for-sale 3,373 — 3,373

Securities held-to-maturity 5,551 — 5,551

Loans to members, net 493,335 (58,127) 435,208

Other investments 11,637 — 11,637

Receivables 33,342 — 33,342

Fixed assets 2,648 — 2,648

NCUSIF deposit 5,727 — 5,727

Other assets 11,838 2,040 13,878

Total assets 599,205 (56,087) 543,118

LIABILITIES

Members’ accounts 570,280 4,007 574,287

Accrued expenses and other payables 12,555 — 12,555

Total members’ accounts and liabilities 582,835 4,007 586,842

NET ASSETS/LIABILITIES ACQUIRED $ 16,370 $ (60,094) $ (43,724)

Note: Cost approximates fair value for short-term items.

e following statement of net assets reects the values assigned to USAFCU’s net assets by each major asset and liability caption as of the acquisition

date, October 1, 2010: