Navy Federal Credit Union 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NAVY FEDERAL CREDIT UNION30

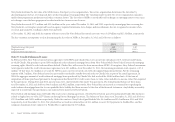

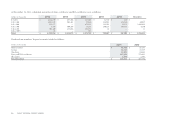

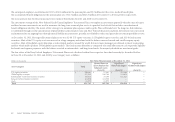

e following table sets forth the funded status of the pension and retiree medical benet plans:

Pension Retiree Medical

(dollars in thousands) 2011 2010 2011 2010

Funded status, end of year

Fair value of plan assets $ 833,785 $ 737,501 $ — $ —

Benet obligations 788,572 638,014 42,562 36,264

Funded status $ 45,213 $ 99,487 $ (42,562) $ (36,264)

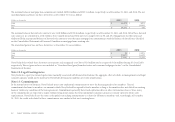

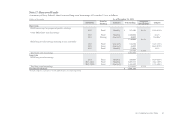

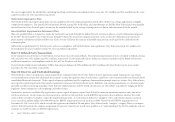

e weighted-average assumptions used to determine the projected benet obligation for the pension and retiree medical benet were:

Pension Retiree Medical

2011 2010 2011 2010

Discount rate 4.95% 5.80% 4.95% 5.80%

Rate of compensation increase 3.50% 3.50% N/A N/A

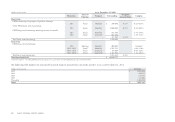

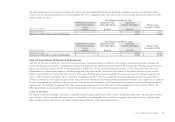

e following table sets forth the net periodic benet cost, contributions received and benets paid for the benet plans:

Pension Retiree Medical

(dollars in thousands) 2011 2010 2011 2010

Benet cost $ 21,600 $ 29,778 $ 4,441 $ 4,488

Cost of special/contractual termination benets 21,125 — 777 —

Employer contribution 99,600 45,000 1,341 1,302

Plan participants’ contributions —— 734 733

Benets paid 22,808 19,580 2,095 2,092

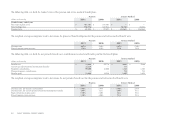

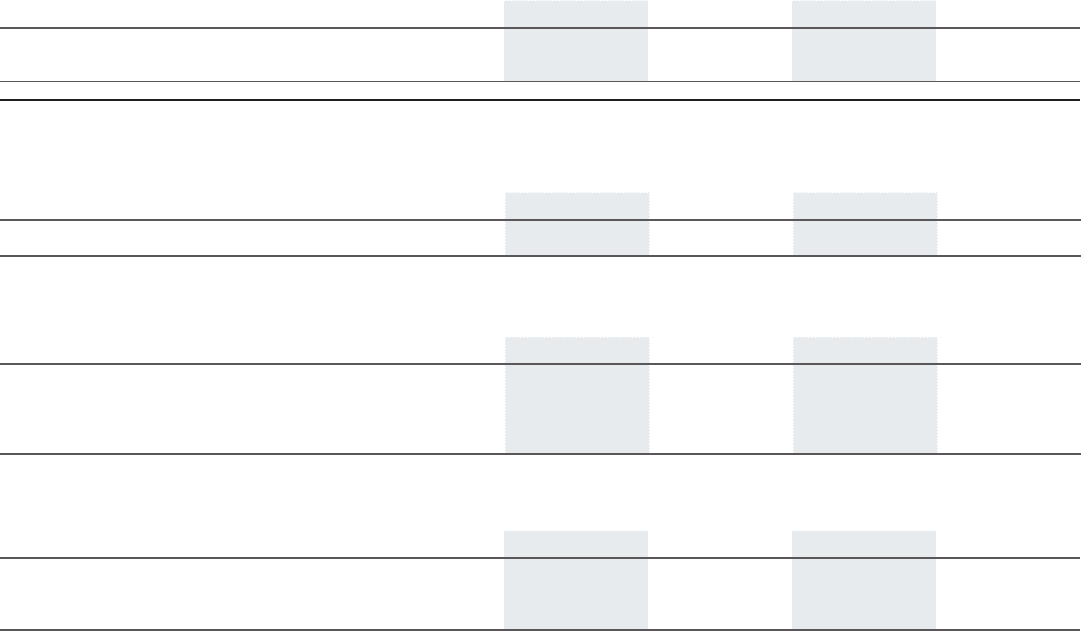

e weighted-average assumptions used to determine the net periodic benet cost for the pension and retiree medical benet were:

Pension Retiree Medical

2011 2010 2011 2010

Discount rate: for benet cost/(income) 5.80% 5.95% 5.80% 5.95%

Discount rate: for cost of special/contractual termination benets 4.95% N/A 4.95% N/A

Expected return on plan assets 7.50% 7.60% N/A N/A

Rate of compensation increase 3.50% 4.00% N/A N/A