Motorola 2001 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2001 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4MOTOROLA, INC.

4. Growth through innovative products, software applications, customer relationships.

We’re providing our customers with the solutions they demand: a portfolio of

24 exciting new wireless telephone products; driver information systems, such as

the OnStar®system; new digital cable set-top products; next-generation wireless

technology; silicon-to-software solutions.

5. Continuous reevaluation of our strategy as the high-tech environment changes.

Examples of this include the divestiture of businesses no longer key to our strategies;

acquisitions of companies that strengthen our strategic position; and the decision

to license our technologies more aggressively to other companies to generate

royalty income.

The changes we are making now are fundamentally different than the

changes we made in the past. We’ve taken the tough, necessary steps to improve

our cost structures, institute new efficiencies across the corporation, focus on

generating profit and positive cash flow, maintain a low break even point and

enhance our balance sheet.

2001 was the first year in the history of the cellular industry in which handset

sales declined. Despite this, our Personal Communications Sector (PCS) retained

the number-two worldwide market share, improved that market share from 15%

at the end of 2000 to 17% at the end of 2001 and returned to profitability in the

fourth quarter of 2001. We are the number-one handset provider in the rapidly grow-

ing China market. PCS expects further improvement in performance by driving:

•The implementation of our platform design strategy;

•Aggressive reductions in our product portfolio and parts complexity;

•Increased margins for new products; and

•Markedly improved relationships with operators.

In 2001, the wireless infrastructure industry also experienced its first year ever

of decline, dropping 23%. The focus of our Global Telecom Solutions Sector (GTSS)

is back to basics. As part of the drive toward operational excellence, the sector will

increasingly focus on providing margin-enhancing, value-added software and services

to its large installed base of customers. GTSS has won contracts and is deploying

next-generation wireless technology, such as GPRS, CDMA 1X and UMTS.

While the cable equipment industry saw a softening of demand in 2001,

the Broadband Communications Sector (BCS) retained a strong market share and

technology position. We believe the cable equipment market will resume growth

during the second half of 2002 due to significant opportunities outside of North

America. The European market in particular presents significant opportunity

over the next few years.

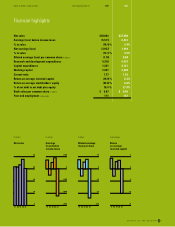

In 2001, we took tough but necessary

steps throughout the corporation to

improve our cost structure, institute

new efficiencies and enhance our bal-

ance sheet. Meanwhile, PCS improved

both its market share and profitability;

GTSS continued its drive to achieve oper-

ational excellence and develop more

value-added services for customers; and

BCS bolstered its leadership position

through acquisition.