Motorola 2001 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2001 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our company is emerging from a year of tremendous struggle and rebuilding,

a year of unacceptable performance for our stockholders, a year different and

more difficult than any other in our history.

Like others, we inopportunely chased the dot-com and telecom boom in 2000

and built up manufacturing capacity and a global cost structure for a $45 billion

revenue company going into 2001, having achieved $37.6 billion in revenue in

2000. Then came the reality of 2001. A telecom equipment downturn affecting both

wire-line and wireless. The worst semiconductor decline in history. Dot-com busts.

A U.S. recession. Appalling terrorist acts. Delays in the deployment of next-generation

(3G) wireless technology. A large customer default. Sales of only $30 billion. Major

and painful corporation-wide resizing. Regrettable financial charges.

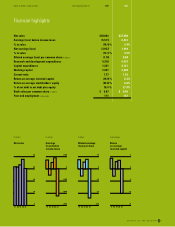

Sales decreased to $30.0 billion compared with $37.6 billion in 2000. We

incurred a net loss of $3.9 billion compared with net earnings of $1.3 billion the

prior year. The loss per share was $1.78 versus earnings of $.58 per share in 2000.

Included in the loss of 2001 were special items resulting in a net charge of

$3.3 billion after-tax, which represented approximately 80% of the total loss for

the year. A portion of these charges were related to cost-reduction actions taken

in 2001 as business activity weakened. These actions have been designed to

adjust our costs to global market conditions and, as the market recovers, to restore

a trend of improving profitability. In fact, the balance sheet at the close of 2001

was stronger than at the close of the previous year. Full financial data can be

found in the proxy statement.

We have been moving aggressively to reverse the impact of 2001 and return

to profitability. Our goal is to be a great stock again. We intend to achieve superior

and consistent operating performance through market share gains based on frequent

new product cycles and new market opportunities. The business strategies we are

following are robust and will, we believe, lead us to profitability. We instituted a

5-point plan to build shareholder value, and we’re delivering on that plan:

1. An experienced management team complemented by new talent.

We have instituted a world-class leadership supply system to ensure the right

managers in the right jobs at the right time.

2. Stabilized balance sheet and financial flexibility.

We generated positive operational cash flow of more than $1.9 billion,

reduced net debt by $4 billion and improved working capital.

3. Reduced costs/manufacturing capacity.

We announced a significant workforce reduction, and a reduction in the

number of manufacturing plants. We began 2001 with 147,000 employees

and employed 111,000 at year-end.

MOTOROLA, INC. 3

To our stockholders and other friends

We are determined to become a great

stock again. Our 5-point plan to rebuild

value for our investors includes an

emphasis on a strengthened manage-

ment team; a stabilized balance sheet

and improved financial flexibility;

cost and capacity reduction; growth

driven by innovation; and continuous

reevaluation of our strategies to

ensure alignment with the direction

of a dynamic high-tech environment.

Christopher B. Galvin

Chairman of the Board and

Chief Executive Officer

(right)

Edward D. Breen

President and

Chief Operating Officer

(left)