Motorola 2001 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2001 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MOTOROLA, INC. AND SUBSIDIARIES 31

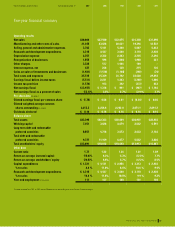

Five-year financial summary

Operating results

Net sales $30,004 $37,580 $33,075 $31,340 $31,498

Manufacturing and other costs of sales ÷21,445 ÷23,628 20,631 19,396 18,532

Selling, general and administrative expenses ÷3,703 ÷5,141 5,220 5,807 5,443

Research and development expenditures 4,318 ÷4,437 3,560 3,118 2,930

Depreciation expense ÷2,357 ÷2,352 2,243 2,255 2,394

Reorganization of businesses ÷1,858 ÷596 (226) 1,980 327

Other charges ÷3,328 ÷517 1,406 109 –

Interest expense, net ÷437 ÷248 138 215 136

Gains on sales of investments and businesses ÷(1,931) ÷(1,570) (1,180)) (260) (70)

Total costs and expenses ÷35,515 ÷35,349 31,792 32,620 29,692

Earnings (loss) before income taxes ÷(5,511) ÷2,231 1,283 (1,280) 1,806

Income tax provision ÷(1,574) ÷913 392 (373) 642

Net earnings (loss) $«(3,937) $««1,318 $«««÷891 $««««(907) $««1,164

Net earnings (loss) as a percent of sales ÷(13.1) % ÷3.5% 2.7% (2.9) % 3.7%

Per share data (in dollars)

Diluted earnings (loss) per common share $«««(1.78) $««««0.58 $««««0.41 $«««(0.44) $««««0.56

Diluted weighted average common

shares outstanding (in millions) ÷2,213.3 ÷2,256.6 2,202.0 2,071.1 2,091.2

Dividends declared1$÷««0.16 $««÷0.16 $««÷0.16 $««÷0.16 $««÷0.16

Balance sheet

Total assets $33,398 $42,343 $40,489 $30,951 $28,954

Working capital ÷7,451 ÷3,628 4,679 2,532 4,597

Long-term debt and redeemable

preferred securities ÷8,857 ÷4,778 3,573 2,633 2,144

Total debt and redeemable

preferred securities ÷9,727 ÷11,169 6,077 5,542 3,426

Total stockholders’ equity $13,691 $18,612 $18,693 $13,913 $14,487

Other data

Current ratio ÷1.77 ÷1.22 1.36 1.21 1.49

Return on average invested capital (18.0) % 6.3% 5.3% (5.4) % 7.7%

Return on average stockholders’ equity (24.8) %÷ 6.6% 5.7% (6.5) % 8.5%

Capital expenditures $««1,321 $««4,131 $««2,856 $««3,313 $««2,954

% to sales ÷4.4 % 11.0% 8.6% 10.6 % 9.4%

Research and development expenditures $««4,318 $««4,437 $««3,560 $««3,118 $««2,930

% to sales ÷14.4 % ÷11.8% ÷10.8% 9.9 % 9.3%

Year-end employment (in thousands) ÷111 ÷147 128 141 158

1Dividends declared from 1997 to 1999 were on Motorola shares outstanding prior to the General Instrument merger.

Dollars in millions, except as noted Years ended December 31 2001 2000 1999 1998 1997