Marks and Spencer 2002 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2002 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

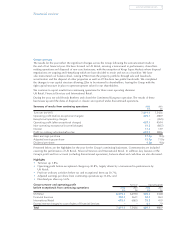

Financial review

The results from continuing operations include sales and operating profits from Kings Super Markets as the intended

disposal has not been completed. During the year, Kings Super Markets contributed £328.7m to turnover (last year

£313.1m) and £12.6m to operating profits (last year £11.9m).

Turnover for the retained International Retail business (Republic of Ireland, franchises and Hong Kong) decreased by

2.3% to £364.7m.

Operating profits for the retained businesses were down 31.0% at £20.7m. Within this, there was an encouraging

performance in the Republic of Ireland but some of our franchises partners experienced difficult trading conditions,

although franchise sales improved in the final quarter. Our business in Hong Kong, which we have decided to retain

and run as if it were a franchise, also traded below last year’s level in a weak economy and incurred approximately

£5m in restructuring and abortive sale costs.

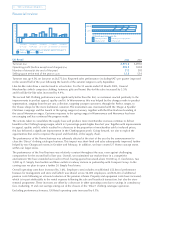

Discontinued operations

The Group announced in March 2001 that it intended to divest or close non-core or loss making activities including

Marks and Spencer Direct, stores in Continental Europe, Brooks Brothers and Kings Super Markets in the US and

to sell the Hong Kong subsidiary to a franchise partner. All of these have been achieved with the exception of the

sale of Kings Super Markets which is currently under negotiation and Hong Kong which has been retained as a

subsidiary, but is run as a franchise.

The results of Brooks Brothers and the Continental European operation up until the dates of disposal or closure

are reported under discontinued operations.

The cost to date of exiting Continental European operations is £136.8m, including trading losses of £42.5m.

The provision we set up at 31 March 2001 has been utilised against these costs and we have released £10.0m

as we now expect the total cost of closure to be less than originally anticipated.

Brooks Brothers was sold for £157.1m. The disposal gave rise to a book loss of £376.7m after a charge of £368.2m

for goodwill which was previously written off to reserves when Brooks Brothers was acquired. Excluding goodwill,

the net loss on disposal was £8.5m subject to finalisation of the sale process.

Asset disposals

The sale and leaseback of 78 smaller stores raised £344.1m (net of costs) and generated a profit of £50.0m which

is included in the overall profit on disposal of fixed assets of £41.2m. The disposal of other properties has raised

£111.8m (net of costs).

Interest

Net interest income increased to £17.6m from £13.9m last year, as a result of higher average retail cash balances, which

benefited from the proceeds of the disposal of businesses and properties, pending the repayment to shareholders.

Interest payments on intra-group and external borrowings for the Financial Services business are charged to that

business as cost of sales. The operating profit for Financial Services is shown in the segmental analysis (see note 3).

The total interest cost incurred by Financial Services was £103.7m (last year £115.3m). In the consolidated financial

statements, the excess of intra-group interest over third-party interest payable, has been added back in the segmental

analysis to arrive at total operating profit. The intra-group interest added back this year of £6.4m arose in the first

half of the year when the interest charged to cost of sales of Financial Services was greater than the interest payable

for that period.

Taxation

The pre-exceptional tax charge for the year was £195.7m, giving an effective tax rate of 29.6% (excluding the effect

of exceptional items) compared to 32.9% last year. The decrease in the rate is attributable to losses in the prior year

in respect of Continental European businesses for which no tax credit was available (trading losses for this year were

provided for at the previous year end).

These rates also reflect the adoption of the new accounting standard on deferred tax which has reduced profit after

tax by £3.3m (last year £6.8m) from £156.7m to £153.4m and increased the effective rate of tax by 0.5 percentage

points (last year 1.4 percentage points).

6Marks and Spencer Group p.l.c.