Marks and Spencer 2002 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2002 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Remuneration report

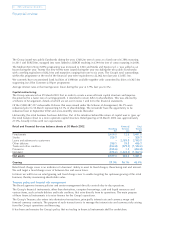

4 Directors’ pension information (continued) Increase in Increase in

transfer pension

value earned

in excess of in excess of

Years of inflation1inflation1Accrued Accrued

service at during the during the entitlement entitlement

30 March year ended year ended at at

Age at 2002 30 March 30 March 30 March 31 March

30 March or date of 2002 2002 200222001

2002 retirement £000 £000 £000 £000

Luc Vandevelde351–––––

Roger Holmes4,5 42 1 22 3 41

Alan McWalter4,5 48 2 25 2 53

David Norgrove 54 14 198 14 86 71

Laurel Powers-Freeling444 n/a 7 1 1n/a

Alison Reed645 19 176 19 75 n/a

Retired director

Robert Colvill761 16 – – 152 140

1Inflation has been assumed to be equivalent to the actual rate of price inflation which was 1.7% for the year to 30 September 2001.

This measurement date accords with the Listing Rules.

2The pension entitlement shown above is that which would be paid on retirement based on service to 30 March 2002 or date of

retirement from the Board if earlier.

3Luc Vandevelde does not participate in the Company Pension Scheme (see section 1, footnote 9).

4Roger Holmes, Alan McWalter and Laurel Powers-Freeling are subject to the pension earnings ‘cap’ (£95,400 at 30 March 2002) which is

reviewed annually by the Government.

5The pensions for Roger Holmes and Alan McWalter are based on a uniform accrual of two-thirds of the pension earnings ‘cap’ less the

pension which they have accrued from membership of previous employers’ pension schemes (see section 1, footnote 9).

6Pension figures are from 11 July 2001 when Alison Reed was appointed director.

7Pension figures are to 31 December 2001 when Robert Colvill ceased to be a director. Having reached the normal retirement age for

senior management, his accrued entitlement has increased over last year because (i) the pension, having been deferred has, in line with

normal practice, been increased by a late retirement factor and (ii) an increase has been applied in line with the pension increase for all

pensioners (see also section 1, footnote 7).

8The pension entitlement shown excludes any additional pension purchased by the member’s Additional Voluntary Contributions.

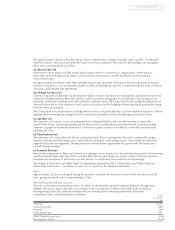

Employees joining the Company after 1 April 2002 will, on completion of one year’s service, be invited to join the

new, contributory Retirement Plan. The Plan is a defined contribution arrangement, where employees may choose

to contribute between 3-6% of their salary, and the Company will contribute between 6-12%. The employee will

be free to choose, from a range of investment vehicles, where the total contribution will be invested. The Company’s

defined benefit pension scheme was therefore closed to new members on 31 March 2002.

During the one year waiting period before joining the Plan, the employees will be covered for death in service by

a capital payment of twice salary, increasing to four times salary from the date of joining the Plan.

18 Marks and Spencer Group p.l.c.