Marks and Spencer 2002 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2002 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial review

Group summary

The results for the year reflect the significant changes across the Group following the announcement made at

the end of last financial year. We have focused on UK Retail, securing a turnaround in performance, closed loss

making operations and disposed of non-core businesses, with the exception of Kings Super Markets where disposal

negotiations are ongoing and Hong Kong which we have decided to retain and run as a franchise. We have

also restructured our balance sheet, raising £794m from the property portfolio through sale and leaseback,

securitisation and the disposal of other properties as well as £719m from two public Eurobonds. We completed

the changes to our capital structure allowing £2bn to be returned to shareholders, leaving the Group with the

right capital structure in place to generate greater value for our shareholders.

We continue to report results from continuing operations for three main operating divisions:

UK Retail, Financial Services and International Retail.

During the year, we sold Brooks Brothers and closed the Continental European operation. The results of these

businesses up until the dates of disposal or closure are reported under discontinued operations.

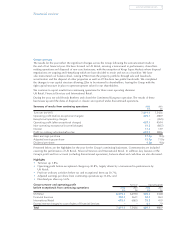

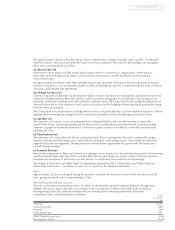

Summary of results from continuing operations 2002 2001

£m £m

Turnover (ex VAT) 7,619.4 7,342.6

Operating profit (before exceptional charges) 629.1 480.9

Exceptional operating charges –(26.5)

Operating profit (after exceptional charges) 629.1 454.4

Non-operating exceptional income/(charges) 41.2 (84.7)

Interest 17.6 13.9

Profit on ordinary activities before tax 687.9 383.6

Basic earnings per share 17.4p 8.3p

Adjusted earnings per share 15.9p 11.9p

Dividend per share 9.5p 9.0p

Presented below are the highlights for the year for the Group’s continuing businesses. Commentaries are included

covering the performance of UK Retail, Financial Services and International Retail. In addition, key features of the

Group’s profit and loss account (including discontinued operations), balance sheet and cash flow are also discussed.

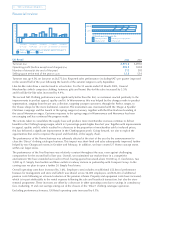

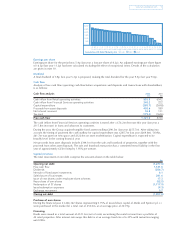

Highlights

•Turnover up 3.8%;

•Operating profit before exceptional charges up 30.8%, largely driven by a turnaround in performance by

UK Retail;

•Profit on ordinary activities before tax and exceptional items up 30.7%;

•Adjusted earnings per share from continuing operations up 33.6%; and

•Dividend per share up 5.6%.

Group turnover and operating profit Turnover Operating profit

before exceptionals from continuing operations 2002 2001 2002 2001

£m £m £m £m

UK Retail 6,575.2 6,293.0 505.2 334.8

Financial Services 350.8 363.1 84.2 96.3

International Retail 693.4 686.5 33.3 41.9

Excess interest charged to cost of sales of Financial Services ––6.4 7.9

Total 7,619.4 7,342.6 629.1 480.9

www.marksandspencer.com 3