Marks and Spencer 2002 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2002 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

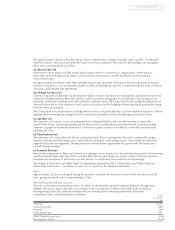

5 Payments to former directors

Details of payments made under the Early Retirement Plan and other payments made to former directors during the

year are: Paid in Paid in

year 2001

£000 £000

Early retirement pensions1(payable until)

James Benfield (22 April 2009) 70 68

Lord Stone of Blackheath (7 September 2002) 93 91

Derek Hayes (19 November 2008) 65 63

Chris Littmoden (28 September 2003) 88 85

Keith Oates (3 July 2002) 174 170

Unfunded pensions

Clinton Silver288 86

Lord Sieff of Brimpton n/a 61

Other

Robert Colvill3177 n/a

Chris Littmoden487 –

Sir David Sieff513 n/a

1Under the Early Retirement Plan the Remuneration Committee could, at its discretion, offer an unfunded Early Retirement Pension,

separate from the Company pension, which was payable from the date of retirement to age 60. With effect from 31 March 2000, the

Early Retirement Plan was withdrawn but payments continue for awards made before this date.

2The pension scheme entitlement for Clinton Silver is supplemented by an additional, unfunded pension paid by the Company.

3Robert Colvill retired from the Board on 31 December 2001 but remained as an employee until 31 March 2002 to complete the

restructuring announced in March 2001. The above payment comprises salary, profit share, benefits and bonus for that three-month

period (see section 1, footnote 7). He continues as non-executive Chairman of Marks & Spencer Financial Services as long as is

necessary to facilitate a smooth management transition on an annual fee of £45,000.

4As an ex-patriate director Chris Littmoden was entitled to have local tax obligations paid for by the Company. Since he left the

Company, the local tax authorities have informed us that an additional settlement was due in relation to the period 1995 to 1997

inclusive. The amount shown above includes an element of interest due and was settled by the Company during the year.

5Sir David Sieff continued to use his company car throughout the financial year.

6 Long-term benefits

All the share schemes of Marks and Spencer p.l.c. were adopted by Marks and Spencer Group p.l.c. as part of the

capital reorganisation in 2002.

The Company operates two types of share option schemes:

(i) SAYE Scheme

A Save As You Earn (SAYE) Option Scheme approved by shareholders in 1981 and renewed by shareholders in

1987 and 1997. The Scheme is open to all employees, including executive directors, who have completed one

year’s service and who open an approved savings contract. Inland Revenue rules limit the maximum amount

which can be saved to £250 per month. When the savings contract is started options are granted to acquire the

number of shares that the total savings will buy when the savings contract matures; options cannot normally be

exercised until a minimum of three years has elapsed.

(ii) Executive Share Option Scheme, approved by shareholders in 2000

The current Executive Share Option Scheme is open to all senior management. Annual awards of up to 150% of

basic salary may be offered based on performance and, for exceptional performance, grants of up to 300% of

basic salary may be awarded. The performance targets for the current Scheme are:

•earnings per share growth of at least inflation plus an average of 3% per annum for 50% of each grant,

measured from a fixed base of 14.5p or current EPS if higher;

•earnings per share growth of inflation plus an average of 4% per annum for the other 50% of each grant,

measured from a fixed base of 16.5p or current EPS if higher.

Since the 1996 Finance Act, grants of Inland Revenue Approved options have been limited to £30,000. Grants in

excess of this limit, will be unapproved options, which confer no tax advantage on the participants.

Earlier Schemes

The Company has operated Executive Option Schemes for over 20 years following shareholder approval for the first

scheme in 1977. The Remuneration Committee has imposed performance criteria for the exercise of all options

granted since 1996 and the performance targets for earlier schemes are described below:

1997 Scheme

The first grants under this scheme were in June 1998 and no options have been granted since June 2000.

Options are subject to the following performance targets on exercise:

•Tier 1 Options: earnings per share growth over three years of at least inflation plus an average of 3% per annum;

•Tier 2 Options: earnings per share growth over five years which would place the Company in the upper

quartile of the FTSE 100 companies.

www.marksandspencer.com 19