Marks and Spencer 2002 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2002 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

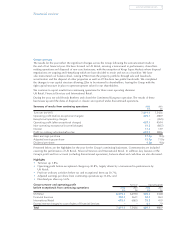

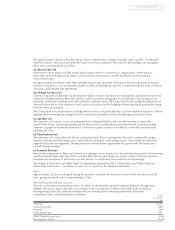

Financial Services 2002 2001

£m £m

Turnover 350.8 363.1

Operating profit 84.2 96.3

Operating profit from Financial Services decreased by £12.1m to £84.2m. Within this, the operating profit from

Financial Services retailing activities was £73.2m (last year £81.5m). The balance of the operating profit is

attributable to the captive insurance company which was affected by negative investment returns for the year

as a whole due to falls in the underlying markets.

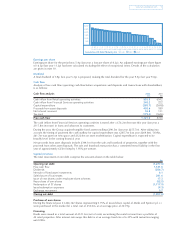

Account Personal Savings Life and

Scale of current business Cards Lending Products Pensions

Number of accounts/policy holders (000s)

2002 5,089 515 223 89

2001 5,009 548 174 80

Customer outstandings/funds under management (£m)

2002 653 1,530 1,140 n/a

2001 634 1,625 1,042 n/a

The proportion of retail sales made on the Chargecard has stabilised at approximately 20%. The number of active

Chargecard accounts decreased during the year, but the average outstanding balance per customer increased by 7%.

Average customer borrowings have been broadly level year on year which, together with an improved net interest

margin, has led to an increase in net income.

In a very competitive environment personal loan advances have fallen. During the year, we reviewed the bad debt

policy and amended our approach to providing for bad debts. This resulted in a revised write-off policy which,

together with an increase on the proportion of balances in arrears and a strengthening of provisions in line with

other providers, has led to an increase in bad debt charges of £11.9m (across all credit products) compared to

last year.

In other areas the number of new life and pension policies has fallen year-on-year in a competitive market and

personal lines insurance and mortgage protection products have not grown to sufficient scale.

During the year, we have looked at ways of more effectively leveraging the synergies between our retail and

financial services businesses. We have held two discount days in stores for our Chargecard customers which were

well received. Later this year we intend to pilot a combined credit and loyalty card in two regions of the UK, as part

of a plan to strengthen and extend the relationship with our customers. It is expected that the impact of the pilot will

add approximately £35m to Financial Services operating costs in the coming year. This includes the cost of the

pilot, together with necessary infrastructure costs. However, we expect to reduce our ongoing operating costs by

some £10m.

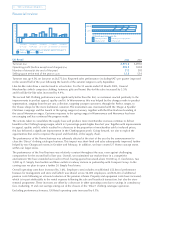

International Retail 2002 2001

Turnover (£m)

Retained businesses 364.7 373.4

Kings Super Markets 328.7 313.1

693.4 686.5

Operating profit (£m)

Retained businesses 20.7 30.0

Kings Super Markets 12.6 11.9

33.3 41.9

Number of stores (at the end of the year)

Owned 42 41

Franchise 132 125

Selling space at the end of the year (000 sq ft)

Owned 955 954

Franchise 1,095 1,018

www.marksandspencer.com 5