Marks and Spencer 2002 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2002 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

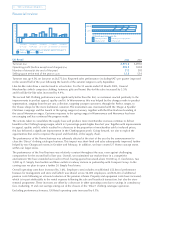

Financial review

The Group issued two public Eurobonds during the year, £368.2m (net of costs) at a fixed rate of 6.38% maturing

in 2011 and EUR550m, swapped into rates linked to £LIBOR resulting in £344.0m (net of costs) maturing in 2006.

The Medium Term Note (MTN) programme was increased to £3bn and Marks and Spencer p.l.c. was added as an

Issuer during the year. Twenty five new MTNs were issued during the year (excluding the two public Eurobonds)

with a sterling equivalent of £822.0m and maturities ranging from one to six years. The Group’s total outstandings

within this programme at the end of the financial year were equivalent to £2,062.6m (last year £1,085.1m).

We currently have uncommitted bank facilities of £498.6m available together with committed facilities of £425.0m

supporting our £1bn Commercial Paper programme.

Average interest rates on borrowings were lower during the year at 5.9% (last year 6.5%).

Capital restructuring

The Group announced on 29 March 2001 that in order to create a more efficient capital structure and improve

the potential for a faster rate of earnings growth, it intended to return £2bn to shareholders. This was effected by

a Scheme of Arrangement, details of which are set out in notes 1 and 24 to the financial statements.

Of the 2,848,387,227 redeemable B shares that were issued under the Scheme of Arrangement, 86.2% were

redeemed prior to 30 March representing 54.1% of shareholdings. The remainder have the opportunity to be

redeemed next in September 2002 and at six-monthly intervals thereafter.

Historically, the retail business has been debt free. Part of the intention behind the return of capital was to ‘gear up’

the retail balance sheet to a more optimum capital structure. Retail gearing at 30 March 2002 was approximately

27.0%, broadly in line with our expectations.

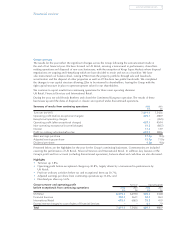

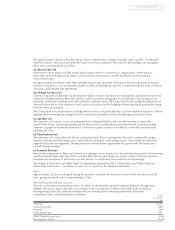

Retail and Financial Services balance sheets at 30 March 2002 Financial Total

Retailing Services Group

£m £m £m

Fixed assets 3,419.0 12.5 3,431.5

Stocks 325.3 –325.3

Loans and advances to customers –2,183.0 2,183.0

Other debtors 358.1 78.2 436.3

Trade and other creditors (904.8) (279.2) (1,184.0)

Provisions (205.6) 1.8 (203.8)

Net debt (475.0) (1,432.0) (1,907.0)

Net assets 2,517.0 564.3 3,081.3

Gearing 27.0% 76.1% 46.9%

Retail fixed charge cover is an indicator of a business’ ability to meet its fixed charges, those being rent and interest.

We will target a fixed charge cover of between five and seven times.

In future we will focus on retail gearing and fixed charge cover to enable targeting the optimum gearing of the retail

business, thereby maximising shareholder value.

Treasury policy and financial risk management

The Board approves treasury policies and senior management directly controls day-to-day operations.

The Group’s financial instruments, other than derivatives, comprise borrowings, cash and liquid resources and

various items, such as trade debtors and trade creditors, that arise directly from its operations. The main purpose

of these financial instruments is to raise finance for the Group’s operations.

The Group’s Treasury also enters into derivatives transactions, principally interest rate and currency swaps and

forward currency contracts. The purpose of such transactions is to manage the interest rate and currency risks arising

from the Group’s operations and financing.

It has been and remains the Group’s policy that no trading in financial instruments shall be undertaken.

8Marks and Spencer Group p.l.c.