Marks and Spencer 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

things are looking up!

Annual report and financial statements 2002

Table of contents

-

Page 1

Annual report and financial statements 2002 things are looking up! -

Page 2

... cost profits and losses Consolidated statement of total recognised gains and losses Balance sheets Consolidated cash flow information Notes to the financial statements Group financial record The full Annual Report and Accounts with downloadable files are available online on the Marks & Spencer... -

Page 3

... that had made Marks & Spencer great in the past. To succeed, we needed clarity of purpose and no distractions. The second element of the plan was therefore to stop all activities which were non-core or making a loss. Thirdly, we needed the right capital structure to make our balance sheet more ef... -

Page 4

...clothing and speciality food by translating our scale and authority into superior quality, value and appeal; • Build on our unique customer relationships through new products and services, particularly in Home and Financial Services; • Shape our store locations, formats and product offer to meet... -

Page 5

...capital structure in place to generate greater value for our shareholders. We continue to report results from continuing operations for three main operating divisions: UK Retail, Financial Services and International Retail. During the year, we sold Brooks Brothers and closed the Continental European... -

Page 6

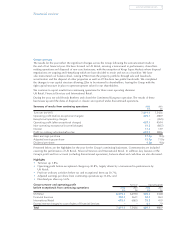

...coming year we plan to open a further 20 Simply Food stores. Overall operating costs have increased by 3.6%. Employee costs includes an additional £52.8m of performance bonuses for management and store staff which was shared across 56,000 employees, and £26.0m of additional pension costs following... -

Page 7

... as a whole due to falls in the underlying markets. Scale of current business Number of accounts/policy holders (000s) 2002 2001 Customer outstandings/funds under management (£m) 2002 2001 Account Cards Personal Lending Savings Products Life and Pensions 5,089 5,009 653 634 515 548 1,530 1,625... -

Page 8

... divest or close non-core or loss making activities including Marks and Spencer Direct, stores in Continental Europe, Brooks Brothers and Kings Super Markets in the US and to sell the Hong Kong subsidiary to a franchise partner. All of these have been achieved with the exception of the sale of Kings... -

Page 9

...ï¬nancial year, 21,446,162 shares (representing 0.75% of issued share capital of Marks and Spencer p.l.c.) were purchased in the market for a total cost of £52.0m, at an average price of 241.9p. Financing Bonds were issued in a total amount of £321.5m (net of costs) securitising the rental income... -

Page 10

...38% maturing in 2011 and EUR550m, swapped into rates linked to £LIBOR resulting in £344.0m (net of costs) maturing in 2006. The Medium Term Note (MTN) programme was increased to £3bn and Marks and Spencer p.l.c. was added as an Issuer during the year. Twenty ï¬ve new MTNs were issued during the... -

Page 11

... is managed by using a number of banks and allocating each a credit limit according to credit rating criteria. These limits are reviewed regularly by senior management. Dealing mandates and derivative agreements are agreed with the banks prior to deals being arranged. (e) Financial Services Interest... -

Page 12

... in the corporate bond rate (used to discount the liabilities) from 6.0% to 5.9% with the balance due largely to a lower than expected value of assets in the fund. The FRS 17 net pension liability has no impact on pension funding and as a consequence has no impact on the Group's current or future... -

Page 13

... responsibilities, primarily reviewing the reporting of ï¬nancial and non-ï¬nancial information to shareholders, the systems of internal control and risk management, and the audit process. It comprises ï¬ve non-executive directors, is chaired by Kevin Lomax and meets at least three times annually... -

Page 14

.... Corporate Social Responsibility ('CSR') Committee: provides the Board with an overview of the social, environmental and ethical impacts of the Group's activities. It is chaired by Luc Vandevelde, is comprised of main Board members and senior management and meets at least three times annually... -

Page 15

... has put in place an organisational structure with formally deï¬ned lines of responsibility and delegation of authority. There are also established procedures for planning, capital expenditure, information and reporting systems, and for monitoring the Group's businesses and their performance. These... -

Page 16

... share ownership in recent years, and currently 42,700 employees hold approximately 31 million shares in their own right and 31,000 employees hold options on 78 million shares under the SAYE scheme. Salaries and beneï¬ts Salaries and beneï¬ts for executive directors are reviewed annually. Salaries... -

Page 17

... ï¬ve years of appointment (whichever is the later) should hold shares whose market value at that time is equivalent to or greater than their then current gross annual base salary. New directors Alison Reed, an existing member of senior management, was appointed to the Board as Finance Director on... -

Page 18

... accommodate her working pattern (two days in London, three days in Chester - the location of our Financial Services operation). A taxable beneï¬t arises which is met by the Company. 10 This year's annual bonus for executive directors has been awarded at a level of 100% of base salary as ï¬nancial... -

Page 19

... shares under 2000 Executive Share Option Scheme with a market value at the date of employment of four times base salary (see section 6 - Long-term beneï¬ts). 3 Termination payments As disclosed in last year's Annual Report, a total of £2,742,000 was paid to directors who retired during last year... -

Page 20

... be invested. The Company's deï¬ned beneï¬t pension scheme was therefore closed to new members on 31 March 2002. During the one year waiting period before joining the Plan, the employees will be covered for death in service by a capital payment of twice salary, increasing to four times salary from... -

Page 21

... Retirement Plan was withdrawn but payments continue for awards made before this date. 2 The pension scheme entitlement for Clinton Silver is supplemented by an additional, unfunded pension paid by the Company. 3 Robert Colvill retired from the Board on 31 December 2001 but remained as an employee... -

Page 22

...No other director exercised Executive Share Options or SAYE contracts in the year under review. The market price of the shares at the end of the ï¬nancial year was 385.25p; the highest and lowest share prices during the ï¬nancial year (for either Marks and Spencer p.l.c. or Marks and Spencer Group... -

Page 23

... the end of the ï¬nancial year and one month prior to the notice of the Annual General Meeting. The Register of Directors' Interests (which is open to shareholders' inspection) contains full details of directors' shareholdings and options to subscribe for shares. No director had any interest in any... -

Page 24

...Spencer, Brooks Brothers (until 28 December 2001) and Kings Super Markets brand names. Financial Services consists of the operations of the Group's retail Financial Services companies, which provide account cards, personal loans, unit trust management, life assurance, personal insurance and pensions... -

Page 25

... the European Community. Directors and senior management regularly visit stores and discuss, with employees, matters of current interest and concern to the business. We have long-established Employees' Proï¬t Sharing and Save As You Earn Share Option Schemes, membership of which is service-related... -

Page 26

... Spencer Group p.l.c. Directors' report The main trading company's (Marks and Spencer p.l.c.) policy concerning the payment of its trade creditors is as follows: • General merchandise is automatically paid for 11 working days from the end of the week of delivery; • Foods are paid for 13 working... -

Page 27

... Board, the Listing Rules of the Financial Services Authority. We report to you our opinion as to whether the ï¬nancial statements give a true and fair view and are properly prepared in accordance with the United Kingdom Companies Act. We also report to you if, in our opinion, the directors' report... -

Page 28

...attributable to shareholders Exchange differences on foreign currency translation Unrealised surplus/(deï¬cit) on revaluation of investment properties Total recognised gains and losses relating to the period Prior year adjustment Total recognised gains and losses since last annual report †25 25... -

Page 29

www.marksandspencer.com 27 Balance sheets Group 31 March 2001 As restated†£m Company 30 March 2002 £m Notes 30 March 2002 £m Fixed assets Tangible assets: Land and buildings Fit out, ï¬xtures, ï¬ttings and equipment Assets in the course of construction 13 2,166.9 1,187.3 27.0 14 2,735... -

Page 30

...Cash ï¬,ow statement Cash inï¬,ow from operating activities Returns on investments and servicing of ï¬nance Interest received Interest paid Dividends paid to minorities Net cash inï¬,ow from returns on investments and servicing of ï¬nance Taxation UK corporation tax paid Overseas tax paid Cash out... -

Page 31

...deferred tax. Details of the effect of this change in accounting policy are set out in note 7. In addition, the Group has adopted the following ï¬nancial reporting standards in these ï¬nancial statements for the ï¬rst time: i) FRS 17 'Retirement Beneï¬ts'. The Group is not required to adopt this... -

Page 32

30 Marks and Spencer Group p.l.c. Notes to the ï¬nancial statements 2. Accounting policies continued Current asset investments Current asset investments are stated at market value. All proï¬ts and losses from such investments are included in net interest income or in Financial Services turnover ... -

Page 33

...ï¬t and loss account. Foreign currencies The results of international subsidiaries are translated at the weighted average of monthly exchange rates for sales and proï¬ts. The balance sheets of overseas subsidiaries are translated at year-end exchange rates. The resulting exchange differences are... -

Page 34

... to cost of sales of Financial Services was greater than the interest payable for that period. 3 UK Retail turnover including VAT comprises clothing, footwear and gifts £3,773.4m (last year £3,649.5m); home £373.3m (last year £355.8m) and foods £3,093.5m (last year £2,925.9m). VAT on UK Retail... -

Page 35

... cost of £16.5m disclosed in note 5A above, this gave rise to total closure costs for the 'Direct' catalogue business of £35.5m. 2 Other asset disposals mainly relate to the disposal of UK stores. C Provision for loss on operations to be discontinued Net closure costs Goodwill previously credited... -

Page 36

...Marks and Spencer Group p.l.c. Notes to the ï¬nancial statements 5. Exceptional items continued D Loss on sale/termination of operations The loss on sale/termination of operations in the current year is analysed as follows: Continental Europe £m Brooks Brothers £m Total £m Net closure costs... -

Page 37

... 0.0p (0.2)p (0.2)p 11.4p (0.2)p 11.2p In the current year, the effect of this change in accounting policy has been to increase the total tax charge for the period by £3.3m. Balance sheet 31 March 2001 - as reported Implementation of FRS 19 31 March 2001 - as restated Deferred tax Shareholders... -

Page 38

...operations1 operations £m £m 2001 Total £m Wages and salaries UK proï¬t sharing (see note 11C) Social security costs Pension costs (see note 11A) Employee welfare and other personnel costs Employee costs2 Classiï¬ed as: Employee costs (see note 4) Manufacturing cost of sales 1 2 799.7 12.6 48... -

Page 39

... increase in salaries Discount rate and rate of return on investments % 2.5 2.5 4.0 6.0 This actuarial valuation revealed a shortfall of £134m in the market value of the assets of the UK Scheme of £3,102m compared to the actuarial liability for pension beneï¬ts. This represents a funding level... -

Page 40

... year 43,741) eligible employees. These shares are purchased in the market: 3,066,891 ordinary shares were purchased by the Proï¬t Sharing Trustees in respect of the 2000/2001 allocation. D United Kingdom Employees' Save As You Earn Share Option Scheme Under the terms of the Scheme, the Board may... -

Page 41

....com 39 11. Employees continued E Executive Share Option Schemes Under the terms of the current Scheme, approved by shareholders in 2000, the Board may offer options to purchase ordinary shares in the Company to executive directors and senior employees at the market price on a date to... -

Page 42

40 Marks and Spencer Group p.l.c. Notes to the ï¬nancial statements 12. Directors A Emoluments Emoluments of directors of the Company are summarised below. Further details are given in the Remuneration Report on pages 14 to 20. 2002 £000 2001 £000 Aggregate emoluments Termination payments 5,... -

Page 43

... 3 Investments include listed securities held by a subsidiary. The difference between their book value and market value is negligible. 4 Own shares include 810,835 ordinary shares (last year 3,525,198) in the Company held by the Marks and Spencer p.l.c. Qualifying Employee Share Ownership Trust (see... -

Page 44

... Card Services Limited Marks and Spencer Retail Financial Services Holdings Limited Marks and Spencer Financial Services Limited Marks and Spencer Unit Trust Management Limited Marks and Spencer Savings and Investments Limited Marks and Spencer Life Assurance Limited MS Insurance Limited St Michael... -

Page 45

...: amounts falling due within one year 2002 £m Group 2001 £m Company 2002 £m Bank loans, overdrafts and commercial paper Medium term notes (see note 21B) Securitised loan notes Trade creditors Amounts owed to Group undertakings Taxation Social security and other taxes Other creditors1 Accruals... -

Page 46

...last year 6.8%) and the weighted average time for which the rate is ï¬xed is 15.2 years (last year 2.3 years). B Maturity of ï¬nancial liabilities 2002 £m Group 2001 £m Repayable within one year: Bank loans, overdrafts and commercial paper Medium term notes Securitised loan notes B shares Other... -

Page 47

...closely approximate book values. 2 Fixed asset investments comprise listed securities held by a subsidiary which are stated at market value. 3 Interest rate swaps and forward foreign currency contracts have been marked to market to produce a fair value ï¬gure. 4 FTSE 100 put options provide no loss... -

Page 48

...company was Marks and Spencer p.l.c. As explained in note 1, the Scheme of Arrangement whereby Marks and Spencer Group p.l.c. became the holding company of Marks and Spencer p.l.c. has been accounted for as a merger. The comparative ï¬gures for called up share capital are those of Marks and Spencer... -

Page 49

...a market value of £0.1m. Of the shares held by the QUEST, 2,558,578 were allocated to employees, including executive directors, in satisfaction of options exercised under the Marks and Spencer United Kingdom Employees' Save As You Earn Share Option Scheme. The Group received £2.5m (last year £nil... -

Page 50

48 Marks and Spencer Group p.l.c. Notes to the ï¬nancial statements 25. Shareholders' funds 0111150 Group Share capital Ordinary Non-equity shares B shares £m £m Share Capital premium redemption Revaluation account reserve reserve £m £m £m Other reserve £m Proï¬t and loss account £m ... -

Page 51

... of own shares Goodwill transferred to proï¬t and loss account on sale/closure of businesses Net reduction in shareholders' funds Opening shareholders' funds as previously stated Prior year adjustment (see note 7) Opening shareholders' funds as restated Closing shareholders' funds 153.0 (238... -

Page 52

... of listed investments Net (purchase)/sale of unlisted investments Net sale of unlisted investments on sale of business Net decrease in short-term deposits Cash (outï¬,ow)/inï¬,ow from (increase)/decrease in liquid resources C Financing (Decrease)/increase in bank loans, overdrafts and commercial... -

Page 53

... 3.2 32. Foreign exchange rates The principal foreign exchange rates used in the ï¬nancial statements are as follows (local currency equivalent of £1): Sales average rate 2002 2001 Proï¬t average rate 2002 2001 Balance sheet rate 2002 2001 Euro US dollar Hong Kong dollar Japanese yen 1.62 1.43... -

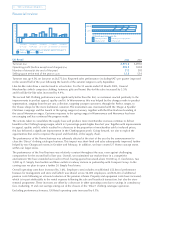

Page 54

... taxation Taxation on ordinary activities Minority interests Proï¬t attributable to shareholders Dividends (Loss)/proï¬t for the period Balance sheet Intangible ï¬xed assets Tangible ï¬xed assets Fixed asset investments Current assets Total assets Creditors due within one year Total assets less... -

Page 55

... activities Returns on investments and servicing of finance Taxation Capital expenditure and financial investment Acquisitions and disposals Equity dividends paid Cash inflow/(outflow) before management of liquid resources and financing Management of liquid resources Financing Increase/(decrease... -

Page 56

THE QUEEN'S AWARD FOR ENTERPRISE INNOVATION 2000 Design and production: Pauffley Printing: St Ives, Westerham Press Cover printed on Revive Silk paper made from 75% post-consumer recycled fibre and 25% chlorine-free bleached pulp. Text printed on ...