Macy's 2005 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2005 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

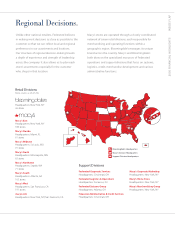

Effective February 1, 2006, we realigned the company’s stores

into eight retail operating divisions – seven Macy’s and one

Bloomingdale’s. Two new Macy’s divisions, St. Louis-based

Macy’s Midwest and Minneapolis-based Macy’s North,

were created in areas of the country where the presence

of the Macy’s brand will expand significantly in fall 2006.

Concurrently, five existing Macy’s divisions – Macy’s East,

Macy’s Florida, Macy’s Northwest, Macy’s South (formerly

Macy’s Central) and Macy’s West – were expanded to

incorporate new stores and geographic markets serving

millions of new Macy’s customers.

Through the integration process, we were able to identify and

retain many of the very best people from the May Company

organization. This includes store management and associates,

as well as May Company corporate and division executives in

merchandising, operations and specialized support functions.

We will be making dramatic changes to the assortments

in former May Company locations as we tailor our offering

door-by-door. This includes introducing Macy’s private brands

throughout all of the former May Company stores in fall 2006

and offering more exclusive and differentiated merchandise

from market vendors.

We are optimistic about our strategy to improve our stores

to provide both a better shopping experience for customers

and enhanced financial results for shareholders.

We’ve already begun the process of investing to “reinvent”

stores acquired from May Company. Over the next several

years, our plan is to reinvent stores accounting for 70 percent

of the sales volume of former May Company locations. In all,

over the 2006-2008 period, we expect to spend as much as

$4 billion on new stores, store improvements, systems and

e-commerce infrastructure. This includes a capital budget

of $1.6 billion in 2006.

Cost synergies remain an important component of the

May Company integration. We are on track to achieve our

initial estimates to realize approximately $175 million in

cost synergies in 2006 and at least $450 million in annual

cost synergies in 2007 and beyond.

A Commitment to Marketing

A key benefit of the May Company acquisition and Macy’s

brand conversion is our ability to market and advertise

Macy’s on a truly nationwide basis for the first time as we

move to a common promotional calendar. Macy’s stores

will be located in virtually every major geographic area

of the United States, supported by an enhanced online

shopping experience on macys.com.

We believe we have an extraordinary opportunity to

transcend the traditional realm of retail store marketing

and to establish Macy’s as a leading American consumer

brand that stands for fashion and affordable luxury.

Fostering Success at Bloomingdale’s

Although much of the spotlight related to the May Company

integration has focused on Macy’s, it’s also important to

stress the outstanding performance and strategic progress

at Bloomingdale’s, the nation’s only nationwide, full-line,

upscale department store.

Bloomingdale’s was among Federated’s best performing

divisions in 2005 and continues to be recognized for its

originality, innovation and fashion leadership. This brand’s

allure was demonstrated in 2005 when Bloomingdale’s

completed and unveiled The New View, a major remodel

of the third floor at its 59th Street flagship in New York City.

Bloomingdale’s will be growing again in 2006 and 2007

with the conversion of four former May Company locations

in Southern California, Boston and suburban Washington,

D.C., as well as the opening of a spectacular new West Coast

flagship store in San Francisco.

An Exciting Road Ahead

We remain extremely optimistic and excited about the road

ahead for our company as we capitalize on the opportunities

in Macy’s and Bloomingdale’s as national brands. While

2006 will be a year of integration and transition, we expect

significant improvement in 2007. Our goal is to accelerate

same-store sales to at least 3 percent per year, and to

improve EBITDA and cash flow. By the 2008-2009 period,

we expect to reach an EBITDA rate of 14-15 percent, our

historical peak levels of profitability, adjusted for the impact

of the sale of credit portfolios.

We have no delusions that everything will go perfectly

in the next year or two. Bringing together Federated and

May Company is a very complex process involving large and

multi-dimensional businesses. But we have a solid plan to

handle what comes, as well as an experienced and motivated

management team and organization that understands we

have a once-in-a-lifetime opportunity to create something

truly special on the American retailing scene.

Thank you for your support in this process and for believing

in Federated as we re-shape our future.

NATIONWIDE BRANDS. REGIONAL DECISIONS. CUSTOMERS FIRST.