Macy's 2005 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2005 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

page two

“Federated not only is larger today,

but we’re also more focused, more creative and more attuned to serving

the needs of our core customers, market by market.”

TERRY J. LUNDGREN

Chairman, President &

Chief Executive Officer

By virtually any measure, 2005 will be remembered as an

extraordinary year in the history of our company:

• We initiated and completed the acquisition of The

May Department Stores Company in a move that nearly

doubled the size of Federated. The acquisition included

nearly 500 outstanding store locations operated under

regional nameplates, including Famous-Barr, Filene’s, Foley’s,

Hecht’s, Kaufmann’s, Lord & Taylor, L.S. Ayres, Marshall Field’s,

Meier & Frank, Robinsons-May, Strawbridge’s and The Jones

Store, as well as a group of bridal and formalwear specialty

stores across the country.

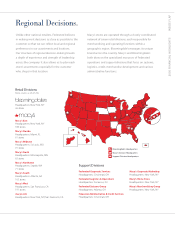

• We refocused our business on two exceptional national brands

– Macy’s and Bloomingdale’s. More than 400 May Company

stores will be converted to these nameplates in September

2006, and about 80 duplicate locations are being divested.

We also announced plans to divest Lord & Taylor and the Bridal

Group in 2006. Through the conversions, Macy’s will grow to

more than 800 locations and Bloomingdale’s will add at least

four new locations.

• We also entered into a strategic alliance with Citigroup by

selling Federated’s proprietary and co-branded Visa credit

card receivables to Citigroup. The sale involves multiple

transactions to be completed by the third quarter of 2006.

Included are Federated and May Company proprietary and

Visa receivables.

• We achieved measurable progress on our four strategic

priorities – assortments, price simplification, improving the

shopping experience and marketing. Movement on each

priority is described in more detail on pages 4-9 of this report.

Federated not only is larger today, but we’re also more focused,

more creative and more attuned to serving the needs of our

core customers, market by market. We are an industry leader

with an opportunity to reshape how fashion is delivered to the

American consumer.

Clearly, we are in the process of creating something that

does not exist – a premier fashion retailer with strong national

brands and regional buying and decision-making that’s right

for the customers of each individual store. This is how we

put customers first, and how we will maximize value to

our shareholders.

May Company Integration

Integrating two retailers of the size and scope of Federated

and May Company is a significant undertaking. Fortunately,

Federated will benefit from the company’s experience in

successfully integrating other acquisitions over the past dozen

years, including Macy’s, Broadway Stores and Liberty House.

Dear Fellow Shareholder: