Macy's 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Federated entered into a strategic alliance with

Citigroup to buy Federated’s proprietary and

co-branded Visa credit card receivables. Under terms

of the agreement, Citigroup is purchasing (in multiple

separate transactions in 2005 and 2006) all credit

receivables of Federated and May Company for an

upfront premium of approximately 11.5 percent. In

total, these transactions are estimated to produce

after-tax proceeds of approximately $4.6 billion.

• Federated announced plans to invest approximately

$130 million in capital over the next two years in infra-

structure improvements and service enhancements to

support continued growth of its direct-to-consumer

businesses, including macys.com, bloomingdales.com,

Bloomingdale’s By Mail, macysweddingchannel.com

and bloomingdalesweddingchannel.com.

Among the company’s highlights in 2005:

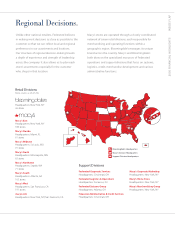

• Following an announcement in February, Federated

acquired The May Department Stores Company in

August in a transaction valued at approximately

$11 billion plus approximately $6 billion in assumed

debt. The company announced plans to convert

about 400 May Company locations to the Macy’s or

Bloomingdale’s nameplate in 2006, strengthening

the reach of both national retailing brands. Another

80 duplicate May Company and Macy’s locations, as

well as Federated’s Bridal Group and Lord & Taylor

divisions, will be divested.

• In March, Federated converted its regional store

nameplates – Burdines, The Bon Marché, Goldsmith’s,

Lazarus and Rich’s – to Macy’s following a period of

hyphenation. This brand conversion coincided with the

launch of Macy’s Star Rewards customer loyalty program.

Financial Highlights

Federated Department Stores, Inc. is one of America’s premier national retailers, operating about

850 stores in 45 states, the District of Columbia, Guam and Puerto Rico. All stores will operate as Macy’s

or Bloomingdale’s by the end of 2006. The company also operates macys.com, bloomingdales.com and

Bloomingdale’s By Mail. Federated’s diverse workforce includes more than 200,000 employees.

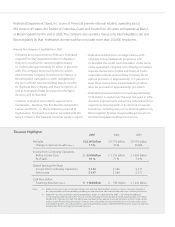

2005 2004 2003

Net Sales $22.390 billion $15.776 billion $15.412 billion

Change in same-store sales (Note 1) 1.3 % 2.6 % (0.9)%

Income from Continuing Operations

Before Income Taxes $ 2.044 billion $ 1.116 billion $ 1.084 billion

% of Sales 9.1 % 7.1 % 7.0 %

Diluted Earnings Per Share

Income from Continuing Operations $ 6.32 $ 3.86 $ 3.71

Net Income $ 6.47 $ 3.86 $ 3.71

Cash Flow Before

Financing Activities (Note 2) $ 1.182 billion $ 780 million $ 1.028 billion

Notes: (1) Represents the year-to-year percentage change in net sales from Bloomingdale’s and Macy’s stores in operation throughout

the year presented and the immediately preceding year and all Internet sales and mail order sales from continuing businesses.

(2) Represents net cash provided by continuing operating activities of $1,950 million for 2005, $1,507 million for 2004 and

$1,776 million for 2003 reduced by the net cash used by continuing investing activities of $2,506 million for 2005, $727 million

for 2004 and $748 million for 2003. The 2005 amount has been further adjusted to exclude the effects of $5,321 million of cash

used to acquire The May Department Stores Company and $3,583 million of cash provided by the sale of credit card accounts

and related receivables. Net cash provided by continuing operating activities in 2003 benefited from lower income tax payments

resulting from the use of Fingerhut net operating losses.