Macy's 2000 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2000 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We also opened t hree new furniture st ores in

2000 and undert ook a number of significant store

remodels in key market s. Nine new department

st ores and t w o f ree- st anding furniture st ores are

on t he horizon f or 2001. In t he area of t echnology,

our in- st ore syst ems and back- of - t he- house

operat ional support infrast ruct ure also lead t he

indust ry, which w e believe gives us a strat egic

competitive advant age w hen it comes to

capit alizing on f ut ure growth opport unit ies.

One of the most attract ive of t hese grow t h

opport unities w e t hink lies in capt uring

t he pot ent ial inherent in eff ective mult i- channel

int egration – a seamless w eaving t ogether of

st ores, cat alogs and e- commerce sit es int o a ret ail

fabric that covers a broad range of cust omer

needs and preferences. Although some of t he

luster just ifiably has worn off t he world’s view

of e- commerce in the last year, Federat ed remains

commit t ed t o effectively int egrating t he bricks

of our st ores wit h the clicks of our e- commerce

websit es. It is a mat t er of cust omer relat ionship

management , and t his is w here w e see

t he f ut ure headed for successful retailers.

While t he numbers being produced by our

Int ernet businesses still are immat erial, we feel

good about t he progress t hat is being made.

Our principal e- commerce sit es last year

generat ed $156 million in sales – up 150% from

t he prior year. In 2001, we expect t o see cont inued

dramatic growth in Internet sales as we further

nurt ure t hese brand- ext ending businesses.

As w ith anyt hing new, how ever, it inevit ably w ill

t ake awhile before we get t he st it ching in t his

new mult i- channel fabric exact ly right. St ill, we

know t hat being an indust ry leader means t aking

chances and being willing t o learn from whatever

mist akes are made along t he way. So given t he

choice, Federat ed w ould rather t ake some prudent

risks than choose t o do not hing – because as

we see it , doing not hing t ends to guarant ee t hat

not hing is what you’ll get in ret urn.

A Picture of 2001

Our goals for t he current year are t o be great at

t he f undamentals of ret ailing, and as such they

are not much changed from prior years.

We w ill cont inue t o plan and execut e t he

business wit h t he object ive of maximizing

earnings per share growth while increasing return

on invest ment . We int end t o do t his by focusing

on increasing operat ing income, depart ment st ore

earnings and cash f low, as w ell as by t aking

advant age of st rategic growth opport unit ies t hat

may emerge.

While we ant icipat e a 2% comp- st ore sales

increase in our depart ment st ores t his year,

reflect ing an economy t hat most observers

expect t o be sluggish int o t he second half of

t he year, our longer t erm goal is t o achieve

comp- st ore sales increases averaging about 3%.

While our department st ore EBITDA rate

(earnings before int erest, t axes, depreciat ion

and amort ization) now is approaching t he

highest in our indust ry – and, as such, will be

more diff icult t o grow in t he coming years –

we st ill see some modest opportunit y for

improvement . And w e are commit t ed t o

improving our return on invest ment and

generat ing significant cash f low.

2

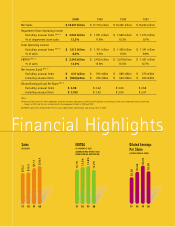

97 98 99 00

9.7%

10 .3 %

11 . 8 %

12 .2%

Department Store

Operating Income

AS A PERCENT OF SALES

(EXCLUDES UNUSUAL ITEMS)

Our goals for the current year are to be

great at the fundamentals of retailing, and

as such they are not much changed ...