Macy's 2000 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2000 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dear Fellow Shareholder:

The year 2000 for Federat ed was challenging

and disappoint ing. While t he depart ment st ore

segment perf ormed accept ably versus our

expect at ions – and very w ell compared to t he

retail sector as a w hole – it w as not enough t o

justif y being sat isfied wit h our overall result s.

The Fingerhut credit delinquency problem t hat

surfaced mid- year caused Federat ed’s t ot al

earnings perf ormance to be w ell below st andard.

While we know that t here inevit ably will be ups

and downs for any company, our goal clearly is t o

avoid such problems and t o capit alize on t he

dist inct ive assets t hat should enable Federated t o

produce superior result s over t he longer t erm.

Wit h this in mind, w e believe t he big pict ure f or

Federat ed is very good.

Our depart ment stores, w hich const it ut e 90%

of our business and comprise some of t he best

brands and t he best people in the indust ry,

managed t o outperform our peers in comp- st ore

sales growth in 2000, despit e an economic

climate t hat grew increasingly difficult as t he

year progressed. Depart ment st ore operat ing

income, before one- t ime charges, also grew last

year – t o 12.2%, up from 11.8% in 1999. This

was part icularly grat ifying since we were coming

of f the best year in t he company’s hist ory.

We believe our exclusive privat e brands and

labels – backed by a merchandising organizat ion

unparalleled in t he indust ry – are a crucial

component of t he success of our depart ment

st ores. Posit ive cust omer response t o our superior

mix of merchandise of ferings, including t he

import ant presence of prominent national brands

from t he market place, can help Federat ed’s

depart ment st ores t o consist ent ly produce

operat ing profit s equal t o or better t han t he

world’s best ret ailers.

Federat ed also cont inues t o be a st rong cash-

flow generat or. We believe t hat cash flow is an

import ant measure of performance and success

for any company, but in a consolidat ing retail

sect or it is even more of a st rategic advantage.

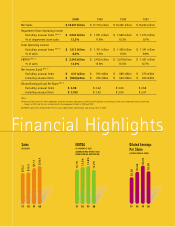

In 2000, t he company produced cash f low of

$481 million, compared t o $370 million in t he

prior year, before financing and t he cost of t he

Fingerhut acquisition in 1999. Since much of the

Fingerhut issue resulted in a non- cash drain, and

t he subsequent dow nsizing of Fingerhut reduced

working capit al, we act ually wound up exceeding

our original cash- flow plans for t he year,

performing very well on t his import ant subject .

Last year, Federat ed used approximat ely $600

million of excess cash t o repurchase 17.6 million

shares of t he company’s common stock. In t he

fut ure, we expect t o cont inue t o use excess cash

for st ock buybacks, as well as for strategic

acquisit ions and ot her appropriat e growth

opport unities t hat may arise.

Underlying t he st rengt h of our depart ment st ore

segment is a commit ment t o invest ing in new

st ores and store remodels, as well as in developing

and deploying st at e- of- t he- art ret ail technology.

Federat ed opened nine new depart ment st ores in

2000, including an excit ing new M acy’s in Puert o

Rico – our first out side of the cont inent al U.S.

To Shareholders

Letter

1