Loreal 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(At December 31st, 2012)

(1) Non-recurring items include mainly capital gains and losses on long-term asset disposals, impairment of long-term assets, restructuring costs and elements relating to

identified operational incomes and expenses, non-recurring and significant regarding the consolidated performance. (2) Diluted net earnings per share excluding non-

recurring items, after non-controlling interests. (3) Dividend proposed to the Annual General Meeting of April 26th, 2013. (4) On the number of shares at December 31st, 2012,

i.e. 608,810,827 shares. (5) Dividend distribution rate based on diluted net profit excluding non-recurring items per share. (6) Based on the dividend proposed to the Annual

General Meeting of April 26th, 2013.

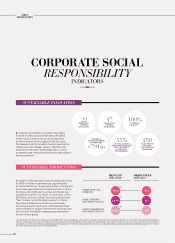

❚ Profits and cash flow have grown very strongly, reaching

record levels, and confirming the power of L’Oréal’s business

model. Gross profit increased by +9.5%, reaching 70.7% of

sales. Operating profit, at 3,697 million euros, has increased

by +12.3%, reflecting a significant improvement in profitability

compared with 2011. Net earnings per share, at 4.91 euros,

increased by +13.6%. Net profit after non-controlling interests

amounted to 2,868 million euros. Advertising and promotional

expenses remained at a high level; reaching 30.2% of sales.

Efficiency in this area increased, benefitting from new

methods of communications as well as the opportunities

provided by digital media.

❚ The balance sheet structure is very solid. The reinforcement

of shareholders’ equity compared with end-2011 is mainly

the result of profit allocated to reserves and the net

increase in value of the Sanofi shares, valued at market

price. After dividend payment and acquisitions

(mainly CADUM and URBAN DECAY), the group recorded

a net cash surplus.

❚ By suggesting a +15% increase

in dividend per share to €2.30 (3),

the Board of Directors has

clearly expressed its confidence

in the group’s future.

This increase in dividend means

a further increase in the pay-out

ratio, which comes out this year

to 46.8%(6), demonstrating

L’Oréal’s commitment to

a dynamic policy in terms

of shareholder returns.

STRONG GROWTH IN PROFITS

A SOLID BALANCE SHEET

A STRONG VALUE CREATION

NET PROFIT AFTER

NON-CONTROLLING

INTERESTS

(€ millions)

NET PROFIT EXCLUDING NON-

RECURRING ITEMS AFTER NON-

CONTROLLING INTERESTS(1)

(€ millions)

2010 2011 2012

NET EARNINGS

PER SHARE(2)

(in euros)

2010 2011 2012

OPERATING PROFIT

(€ millions)

20122010 2011

+17.6%

2010 2011 2012

+26.4%

NET CASH FLOW:

AT 2.58 BILLON

EUROS

63.86

MARKET

CAPITALISATION(4)

(IN BILLIONS OF EUROS)

4.3%

CAPITAL

EXPENDITURE

OF SALES

104.90

SHARE PRICE

NET CASH

SURPLUS OF

1,575

MILLION EUROS

DIVIDEND(3)

PER SHARE

2.30

NET EARNINGS(2)

PER SHARE

4.91

3,697

3,293

3,057 2,868

2,438

2,240

4.91

4.32

4.01

2,972

2,583

2,371

Dividend distribution rate 2007-2012

as % of profit (5)

DIVIDEND PER SHARE

+15.0%

41.1% 41.3% 43.9% 44.9% 46.3%

46.8%(6)

1.38 1.44 1.50

1.80 2.00

2007 2008 2009 2010 2 011 2012

2.30

89