Kroger 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

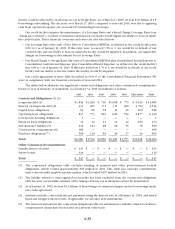

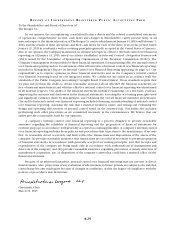

A-32

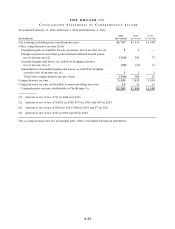

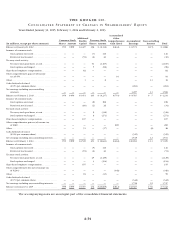

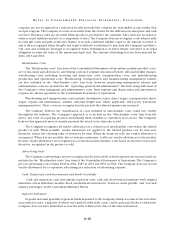

THE KROGER CO.

C O N S O L I D A T E D S T A T E M E N T S O F C O M P R E H E N S I V E I N C O M E

Years Ended January 31, 2015, February 1, 2014 and February 2, 2013

(In millions)

2014

(52 weeks)

2013

(52 weeks)

2012

(53 weeks)

Net earnings including noncontrolling interests . . . . . . . . . . . . . . . . . . . . . $ 1,747 $ 1,531 $ 1,508

Other comprehensive income (loss)

Unrealized gain on available for sale securities, net of income tax (1) . . . . 5 5 —

Change in pension and other postretirement defined benefit plans,

net of income tax (2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (329) 295 75

Unrealized gains and losses on cash flow hedging activities,

net of income tax (3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (25) (12) 13

Amortization of unrealized gains and losses on cash flow hedging

activities, net of income tax (4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 3

Total other comprehensive income (loss) . . . . . . . . . . . . . . . . . . . . . . . . (348) 289 91

Comprehensive income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,399 1,820 1,599

Comprehensive income attributable to noncontrolling interests . . . . . . . . . 19 12 11

Comprehensive income attributable to The Kroger Co.. . . . . . . . . . . . . . . $1,380 $1,808 $1,588

(1) Amount is net of tax of $3 in 2014 and 2013.

(2) Amount is net of tax of $(193) in 2014, $173 in 2013 and $45 in 2012.

(3) Amount is net of tax of $(14) in 2014, $(8) in 2013 and $7 in 2012.

(4) Amount is net of tax of $1 in 2013 and $2 in 2012.

The accompanying notes are an integral part of the consolidated financial statements.