Kroger 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-35

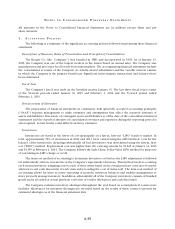

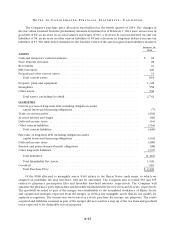

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S

All amounts in the Notes to Consolidated Financial Statements are in millions except share and per

share amounts.

1 . A C C O U N T I N G P O L I C I E S

The following is a summary of the significant accounting policies followed in preparing these financial

statements.

Description of Business, Basis of Presentation and Principles of Consolidation

The Kroger Co. (the “Company”) was founded in 1883 and incorporated in 1902. As of January 31,

2015, the Company was one of the largest retailers in the nation based on annual sales. The Company also

manufactures and processes food for sale by its supermarkets. The accompanying financial statements include

the consolidated accounts of the Company, its wholly-owned subsidiaries and the variable interest entities

in which the Company is the primary beneficiary. Significant intercompany transactions and balances have

been eliminated.

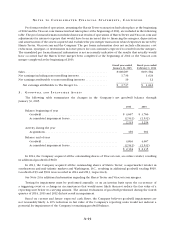

Fiscal Year

The Company’s fiscal year ends on the Saturday nearest January 31. The last three fiscal years consist

of the 52-week periods ended January 31, 2015 and February 1, 2014 and the 53-week period ended

February 2, 2013.

Pervasiveness of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles

(“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of

assets and liabilities. Disclosure of contingent assets and liabilities as of the date of the consolidated financial

statements and the reported amounts of consolidated revenues and expenses during the reporting period is

also required. Actual results could differ from those estimates.

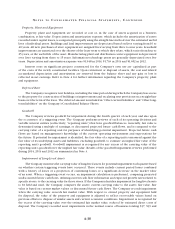

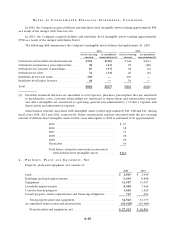

Inventories

Inventories are stated at the lower of cost (principally on a last-in, first-out “LIFO” basis) or market. In

total, approximately 95% of inventories in 2014 and 2013 were valued using the LIFO method. Cost for the

balance of the inventories, including substantially all fuel inventories, was determined using the first-in, first-

out (“FIFO”) method. Replacement cost was higher than the carrying amount by $1,245 at January 31, 2015

and $1,150 at February 1, 2014. The Company follows the Link-Chain, Dollar-Value LIFO method for purposes

of calculating its LIFO charge or credit.

The item-cost method of accounting to determine inventory cost before the LIFO adjustment is followed

for substantially all store inventories at the Company’s supermarket divisions. This method involves counting

each item in inventory, assigning costs to each of these items based on the actual purchase costs (net of vendor

allowances and cash discounts) of each item and recording the cost of items sold. The item-cost method of

accounting allows for more accurate reporting of periodic inventory balances and enables management to

more precisely manage inventory. In addition, substantially all of the Company’s inventory consists of finished

goods and is recorded at actual purchase costs (net of vendor allowances and cash discounts).

The Company evaluates inventory shortages throughout the year based on actual physical counts in its

facilities. Allowances for inventory shortages are recorded based on the results of these counts to provide for

estimated shortages as of the financial statement date.