Kroger 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-23

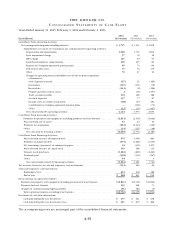

LI Q U I D I T Y A N D C A P I T A L R E S O U R C E S

Cash Flow Information

Net cash provided by operating activities

We generated $4.2 billion of cash from operations in 2014, compared to $3.6 billion in 2013 and

$3.0 billion in 2012. The cash provided by operating activities came from net earnings including non-

controlling interests adjusted primarily for non-cash expenses of depreciation and amortization, the LIFO

charge and changes in working capital. The increase in net cash provided by operating activities in 2014,

compared to 2013, resulted primarily due to an increase in net earnings including non-controlling interests,

which include the results of Harris Teeter, an increase in non-cash items, a reduction in contributions to

Company-sponsored pension plans and changes in working capital. The increase in non-cash items in 2014,

as compared to 2013, was primarily due to increases in depreciation and amortization expense and the

LIFO charge.

Cash provided (used) by operating activities for changes in working capital was ($49) million in 2014,

compared to $63 million in 2013 and ($211) million in 2012. The increase in cash used by operating activities

for changes in working capital in 2014, compared to 2013, was primarily due to an increase in cash used for

receivables and a decrease in cash provided by trade accounts payables, partially offset by an increase in cash

provided by accrued expenses.

The increase in net cash provided by operating activities in 2013, compared to 2012, resulted primarily

due to changes in working capital and long-term liabilities. The increase in cash provided by operating

activities for changes in working capital in 2013, compared to 2012, was primarily due to a decrease in cash

used for deposits in-transit, prepaid expenses and receivables. The use of cash for the payment of long-term

liabilities decreased in 2013, as compared to 2012, primarily due to our funding of the remaining unfunded

actuarial accrued liability for the UFCW Consolidated Pension Plan in 2012.

The amount of cash paid for income taxes increased in 2014, compared to 2013, primarily due to an

increase in net earnings including non-controlling interests. The amount of cash paid for income taxes

increased in 2013, compared to 2012, primarily due to additional deductions taken in 2012 related to the

funding of our pension contributions and union health benefits.

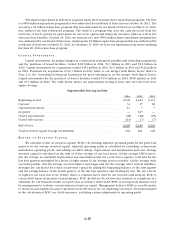

Net cash used by investing activities

Cash used by investing activities was $3.1 billion in 2014, compared to $4.8 billion in 2013 and

$2.2 billion in 2012. The amount of cash used by investing activities decreased in 2014, compared to 2013, due

to decreased payments for acquisitions, offset primarily by increased payments for capital investments. The

amount of cash used by investing activities increased in 2013, compared to 2012, due to increased payments

for capital investments and acquisitions. Capital investments, including payments for lease buyouts and

excluding acquisitions, were $2.8 billion in 2014, $2.3 billion in 2013 and $2.1 billion in 2012. Acquisitions

were $252 million in 2014, $2.3 billion in 2013 and $122 million in 2012. The decrease in payments for

acquisitions in 2014, compared to 2013, and the increase in payments for acquisitions in 2013, compared to

2012, was primarily due to our merger with Harris Teeter in 2013. Refer to the “Capital Investments” section

for an overview of our supermarket storing activity during the last three years.

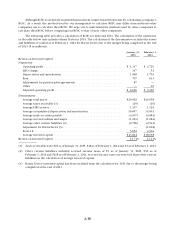

Net cash provided (used) by financing activities

Financing activities provided (used) cash of ($1.2) billion in 2014, $1.4 billion in 2013 and ($721) million

in 2012. The increase in the amount of cash used for financing activities in 2014, compared to 2013, was

primarily related to decreased proceeds from the issuance of long-term debt and increased treasury stock

purchases, offset partially by decreased payments on long-term debt. The increase in cash provided by

financing activities in 2013, compared to 2012, was primarily related to increased proceeds from the issuance

of long-term debt, primarily to finance our merger with Harris Teeter, and a reduction in payments on long-

term debt and treasury stock purchases, offset partially by net payments on our commercial paper program.

Proceeds from the issuance of long-term debt were $576 million in 2014, $3.5 billion in 2013 and $863 million

in 2012. Net borrowings (payments) provided from our commercial paper program were $25 million in 2014,