Intel 1999 Annual Report Download - page 46

Download and view the complete annual report

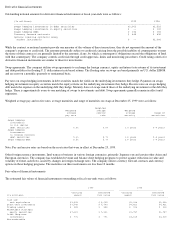

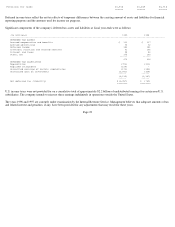

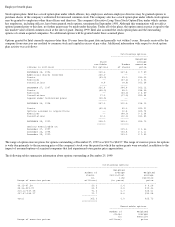

Please find page 46 of the 1999 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.These options will expire if not exercised at specific dates through December 2009. Option exercise prices for options exercised during the

three-year period ended December 25, 1999 ranged from $0.15 to $61.41.

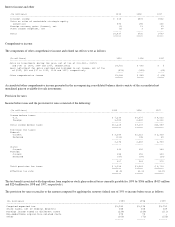

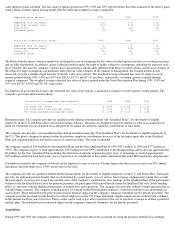

Stock Participation Plan. Under this plan, eligible employees may purchase shares of Intel's common stock at 85% of fair market value at

specific, predetermined dates. Of the 472 million shares authorized to be issued under the plan, 74.3 million shares remained available for

issuance at December 25, 1999. Employees purchased 5.4 million shares in 1999 (6.3 million in 1998 and 9.0 million in 1997) for $241 million

($229 million and $191 million in 1998 and 1997, respectively).

Pro forma information. The company has elected to follow APB Opinion No. 25, "Accounting for Stock Issued to Employees," in accounting

for its employee stock options because, as discussed below, the alternative fair value accounting provided for under SFAS No. 123,

"Accounting for Stock-Based Compensation," requires the use of option valuation models that were not developed for use in valuing employee

stock options. Under APB No. 25, because the exercise price of the company's employee stock options equals the market price of the

underlying stock on the date of grant, no compensation expense is recognized in the company's financial statements.

Pro forma information regarding net income and earnings per share is required by SFAS No. 123. This information is required to be determined

as if the company had accounted for its employee stock options (including shares issued under the Stock Participation Plan, collectively called

"options") granted subsequent to December 31, 1994 under the fair

Page 24

------------------------------------------------------------------------------------------------

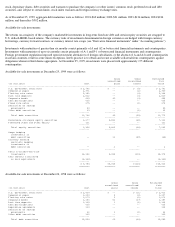

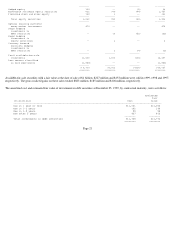

$0.15-$7.58 59.2 $ 4.29

$8.66-$15.09 28.4 $ 9.11

$15.12-$37.45 12.3 $25.87

$37.47-$84.97 3.3 $43.04

------

Total 103.2 $ 9.42

======